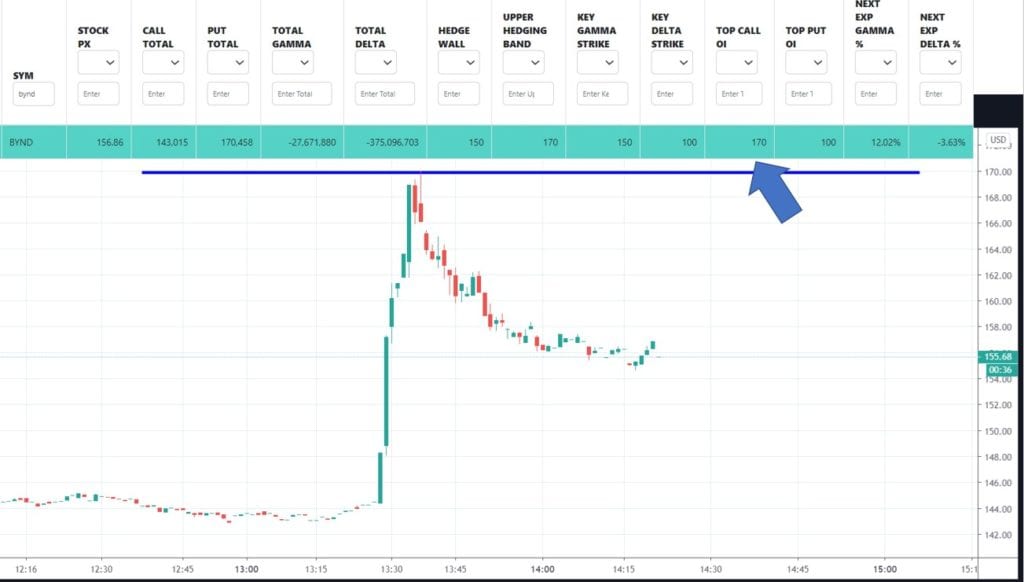

BYND has earnings today. But first news broke about a partnership with MCD. The headline algos ripped the stock, which stopped directly at the largest call options strike of 170.

To find more options based trading setups, go to our EquityHub.

S&P 500 Stock Market Gamma Trading Levels Based on Options Open Interest