Sign Up for SpotGamma And Get TRACE Today

To celebrate the launch of TRACE, take advantage of this limited time discount and save $1,196/year with SpotGamma's most comprehensive and powerful "Alpha" plan for 40% off your first year!

Offer valid thru September 29, 2024 at midnight!

40% Off!!!

ACCESS TRACE NOW

Normally $2,988/yr

Billed annually ($1,792/year)

Here's what's included inside SpotGamma's full suite of "Alpha" trading tools:

Founder's Notes with Expert Commentary

Unique Support & Resistance Levels

Daily Trading Ranges

Index Charts with Key Levels

Subscriber Q&A with SpotGamma Founder

Online Office Hours for Traders of All Levels

Delta, Vanna, & Gamma Models

0DTE Volume / Open Interest Indicator

Monthly OPEX Analysis

Trading Platform Integrations

Discord Membership

Equity Hub

HIRO

Volatility Dashboard

TRACE!!!

For Our Friends at Excess Returns!

All new tool from SpotGamma Reveals...

How to unveil support, resistance, & volatility like NEVER before in the S&P 500

LAUNCH EVENT:

Tuesday, September 24, 2024

11:00 AM EDT (~90mins)

FREE TO ATTEND! EXCELLENT GIVEAWAYS! CASE STUDIES!

With Brent Kochuba!

Founder, SpotGamma

Tired of chasing the market or staring at random chart patterns?

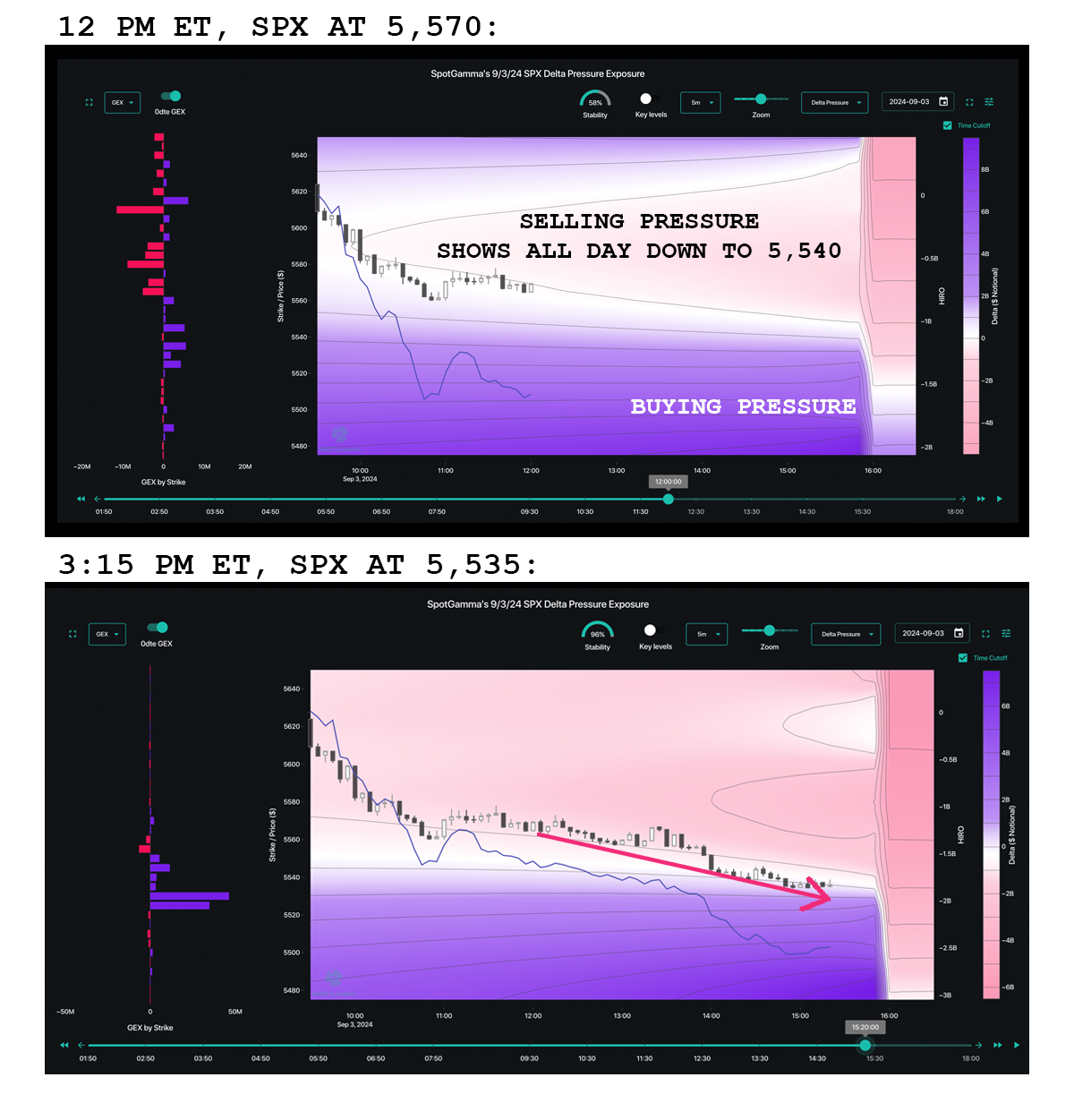

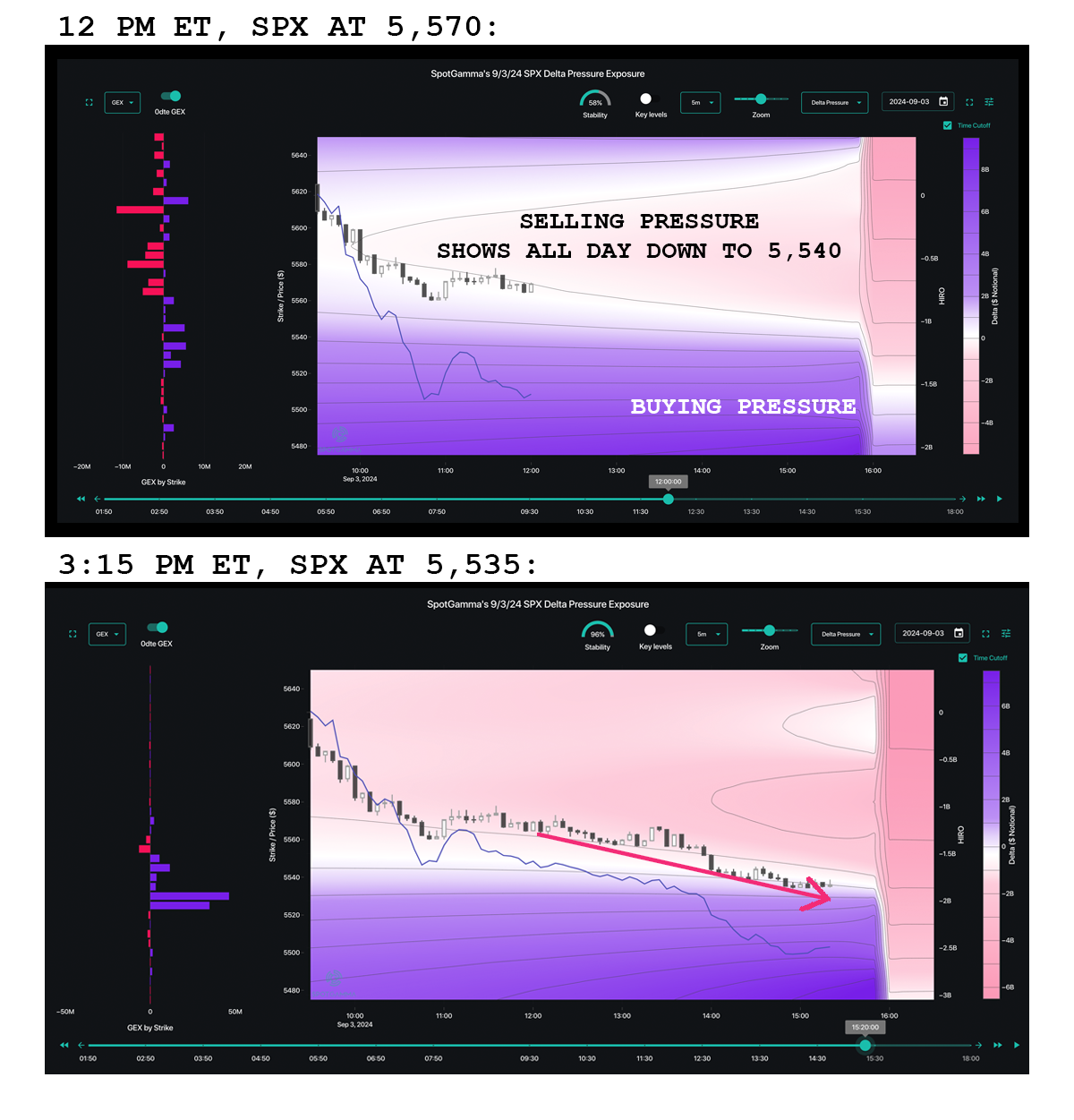

SpotGamma’s newest tool, TRACE, is the best way to see real-time zones of support, resistance, and volatility for the largest market in the US - the S&P 500. How does TRACE do this? By tracking OPTIONS POSITIONS.

Let us show you how to see these moves in real time every day, regardless of how radical or quiet the market may be.

TRACE provides live heatmaps that track dealer and market maker positions, highlighting zones of support and resistance, plotting GEX by strike and 0DTE updates every trading day.

The tool offers three distinct lenses: Gamma, Delta, and Charm helping traders identify areas of buying/selling pressure, volatility, and pinning potential.

Unlike other tools, TRACE is powered by SpotGamma's proprietary options model, giving traders accurate, data-driven insights without relying on assumptions about market behaviors.

Is TRACE right for me?

Futures Traders

Capitalize on real-time market movements and adapt quickly to volatility.

Options Traders

Get precise insights into dealer hedging behavior to see support, resistance, and pinning levels.

Day Traders

Operate in fast-paced 0DTE environments where real-time data is essential for making informed decisions.

Institutions

Access advanced analytics and a comprehensive view of market dynamics, outperforming other single-focus tools.

TRACE gives you the POWER

When your preferred trading apps are not just neat utilities, but an integral part of your trading framework, trust is everything. Particularly when the pundits and talking heads can't figure out what's really behind market moves...

You can't get these insights anywhere else (and certainly not without a $100k+ price tag to run it) so come on down to TRACE The Market to see what YOU can do with all this power.

About SpotGamma

Our team has spent decades working at investment banks, market makers, and hedge funds developing expertise around how options drive stocks. Brent Kochuba founded SpotGamma in 2020 to provide retail traders with an edge by unveiling how and when options are driving stocks and futures. SpotGamma models all US options flows to generate proprietary expert analysis and actionable indicators for our global trading community.

Lots of places have said lots of nice things about us:

Sign Up for SpotGamma And Get TRACE Today

To celebrate the launch of TRACE, take advantage of this limited time discount and save $1,494/year with SpotGamma's most comprehensive and powerful "Alpha" plan for 50% off your first year!

Offer valid thru September 29, 2024 at midnight!

50% Off!!!

Expires 9/29 at midnight!

ACCESS TRACE NOW

Normally $2,988/yr

Billed annually ($1,494/year)

Here's what's included inside SpotGamma's full suite of "Alpha" trading tools:

Founder's Notes with Expert Commentary

Unique Support & Resistance Levels

Daily Trading Ranges

Index Charts with Key Levels

Subscriber Q&A with SpotGamma Founder

Online Office Hours for Traders of All Levels

Delta, Vanna, & Gamma Models

0DTE Volume / Open Interest Indicator

Monthly OPEX Analysis

Trading Platform Integrations

Discord Membership

Equity Hub

HIRO

Volatility Dashboard

TRACE!!!

© Copyright 2024. SpotGamma.

And if you've read this far, you should really sign up.