Special Limited Time Offer EXCLUSIVELY for the Simpler Trading Community!

Choose the plan you want

50% off monthly plans for all new subscribers for a limited time only!

Standard

$44/mo

First month $17, then $89/mo

First month $44, then $89/mo

Pro

$64/mo

First month $64, then $129/mo

First month $25, then $129/mo

Alpha

$149/mo

First month $149, then $299/mo

First month $49, then $249/mo

Standard

Normally $89/mo

$67/mo

Billed annually at $801

(Saves $267/year)

Pro

Normally $129/mo

$97/mo

Billed annually at $1,161

(Saves $387/year)

Alpha

Normally $299/mo

$224/mo

Billed annually at $2,691

(Saves $897/year)

50% off the alpha plan

To celebrate the release of our new powerful lens to see the hidden forces driving the stock market, sign up for the Alpha plan for 50% off your first year!

new! directional + volatility signals

Compass

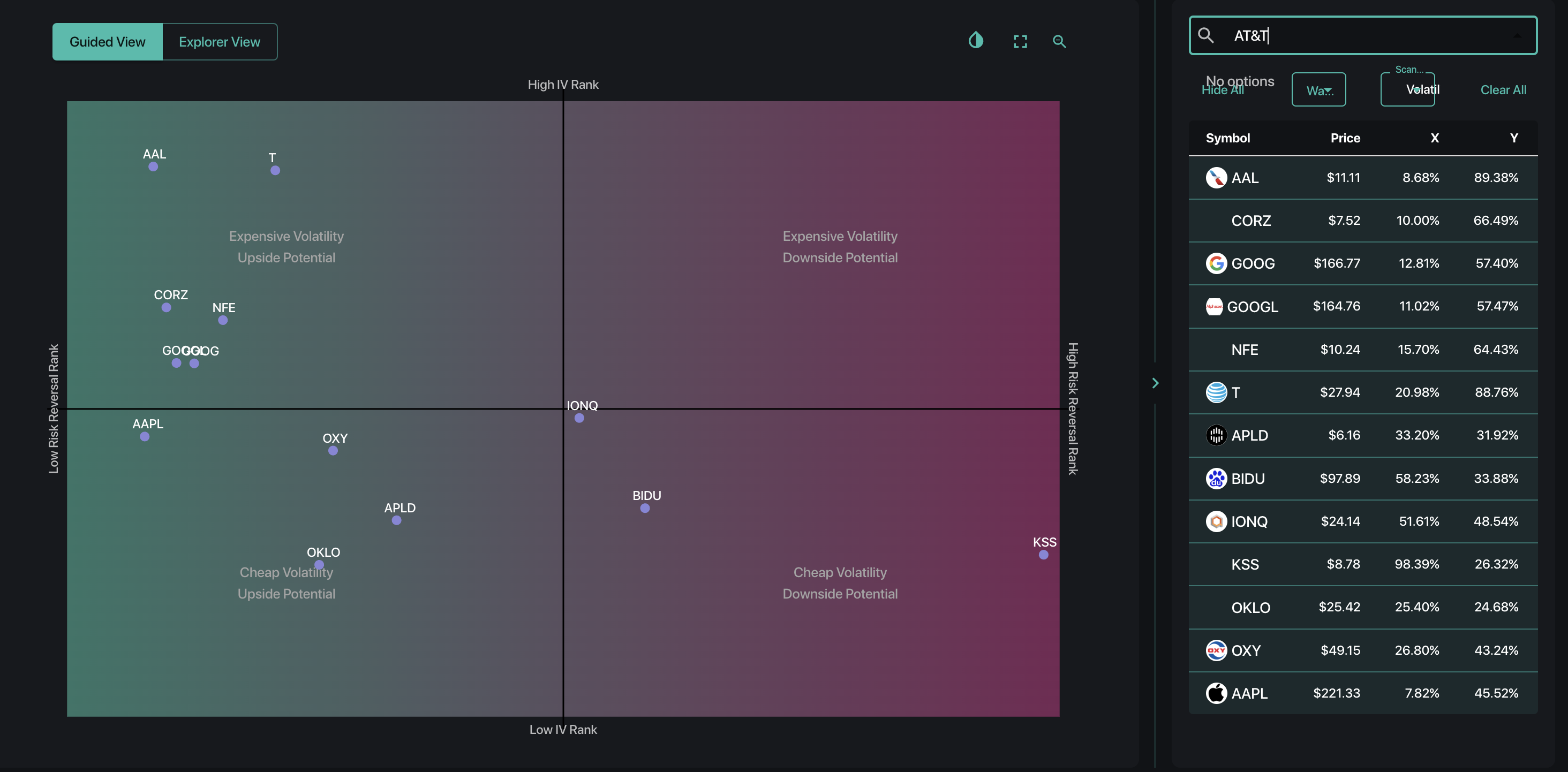

Compass is SpotGamma’s proprietary super scanner that enables you to discover new trade ideas and analyze the best ways to trade your favorite names. With Compass, you can plot multiple stocks across a 2-dimensional grid to assess both the volatility expectations and directional positioning for those names. Compass empowers you to see if the stocks you follow have relatively high or low implied volatility, with a bullish or bearish setup. Compass also allows for completely custom axes, plotting over a dozen different metrics on the grid.

HEATMAP THE S&P 500

TRACE

TRACE is a powerful tool designed to help you visualize how the options market exerts pressure on the SPX Index in real time. TRACE unveils where the SPX Index may find zones of support & resistance, areas of heightened volatility, and price consolidation throughout the trading day. Built off of SpotGamma’s proprietary Options Inventory Model, TRACE ingests all options traded across the US exchanges to display the dynamic influence of the greeks using three models: Gamma, Delta Pressure, and Charm Pressure. Additionally, TRACE features a strike plot showing gamma exposure and open interest across strikes, showing you the levels to watch for market movement.

Alpha

Normally $3,588/yr

$1,794/year

Billed annually at $1,794

(first year only, then $2,691 loyalty discount)

Where Options Flow The Markets Go