SpotGamma's OPEX Hub

Options are a major market influence - particularly during OPEX week!

Enter your email below to get our Special OPEX Spec Sheet, detailing single stock OPEX impact

See What Matters Most Ahead of Options Expiration

🔑 Get exclusive OPEX analysis with key stocks to watch and insights on the trades with the biggest opportunity.

Each month, SpotGamma analysis helps our subscribers get ahead of OPEX and see which names to pay attention to.

Our analysis allows traders to adjust strategies, take profits, hedge positions, and prepare for potential buying opportunities.

Sign up for our FREE insights and receive:

Let us show you which stocks to watch!

At SpotGamma, we focus on the near term impact that options flows have on the major US indices and individual stocks. We bring in data from the largest options feed and top tier financial exchanges to best analyze and deliver unique levels and analysis around these options positions.

Nothing we provide is investment advice.

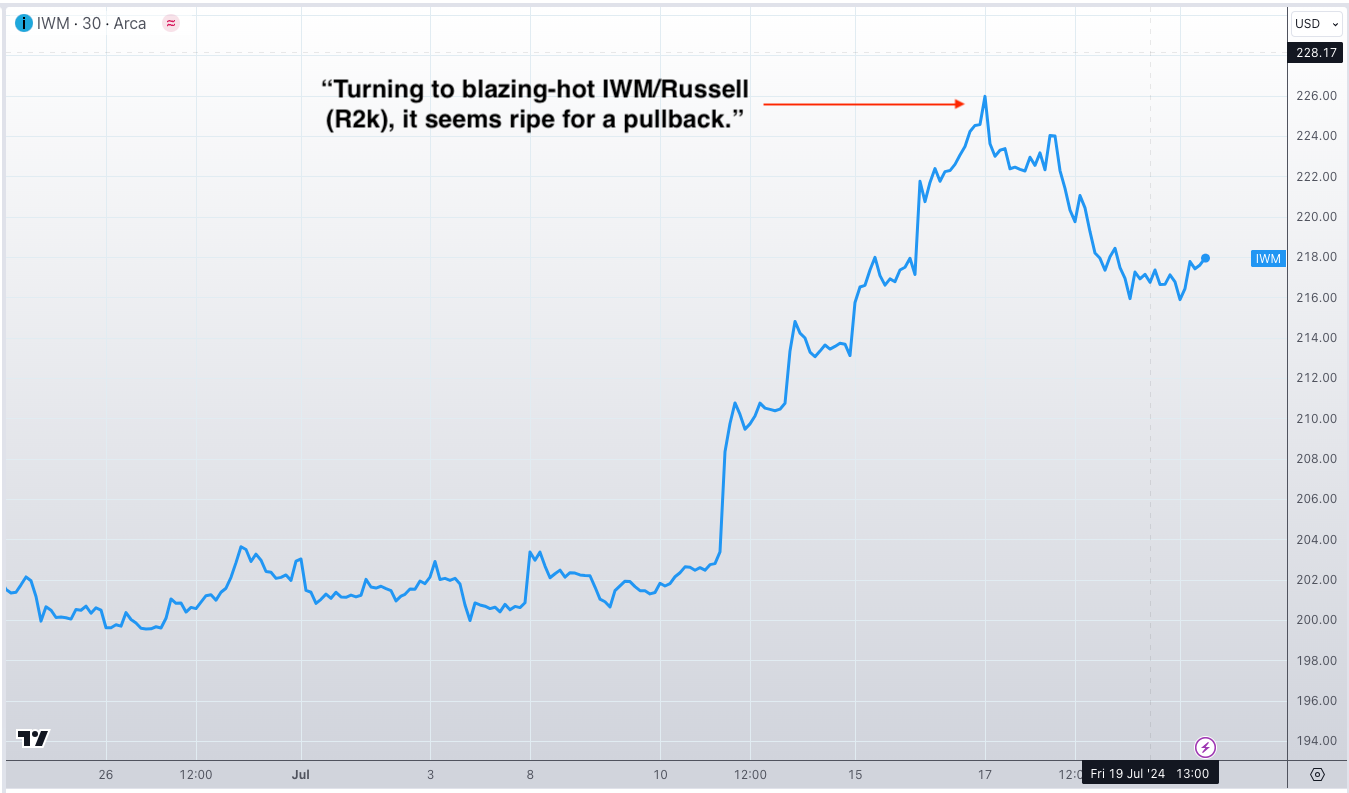

Top Stocks to Watch into Monthly OPEX

Get access to the stock insights now!

Download the list now!

Don't wait! Get these insights FREE as we head into options expiration.