S&P 500 Stock Market Gamma Trading Levels Based on Options Open Interest

How Option Flows Helped to Navigate the Small-Cap Madness

Monday

January

01

1999

Try SpotGamma HIRO Indicator for Free

Real-time options data

See when options drive stocks

0DTE filter for short-term trades

Key Takeaways

7/17/24: The Blazing-Hot Rally

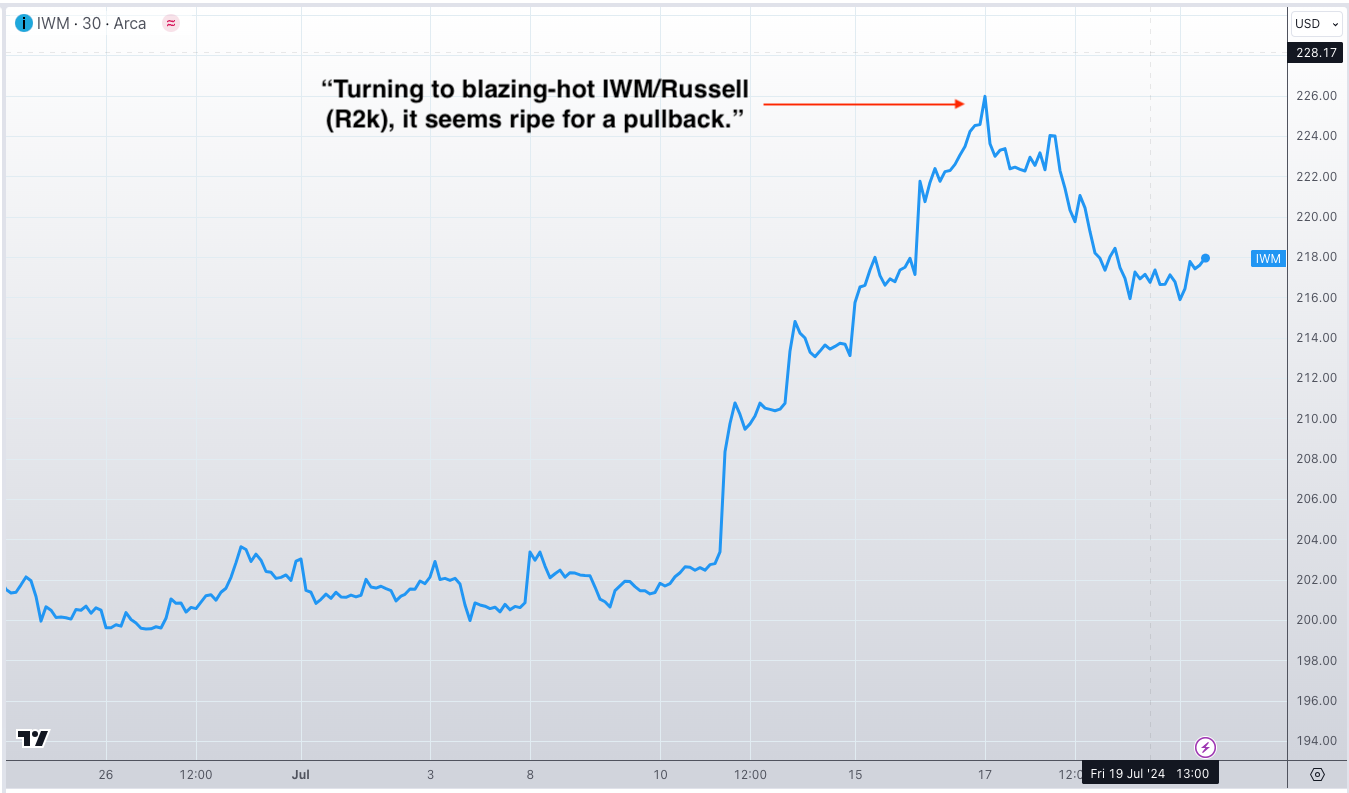

Imagine you're watching the market, and suddenly, IWM/Russell 2000 (R2k) surges +12% in just four days. It's the kind of move that grabs your attention. Our research team flagged this unprecedented rise, marking it as "the most overbought reading for any major US Index EVER."

Access today's Founder's Note for FREE!

Expert commentary packed with proprietary key levels, major support and resistance targets, and market analysis.

By subscribing, you agree with our Privacy Policy and provide consent to receive updates from our company.

Why This Matters

This wasn't just a historical anomaly; it was a critical signal. If you were trading or investing in IWM, knowing about this overbought condition could mean the difference between capitalizing on a pullback or getting caught in a market downturn.

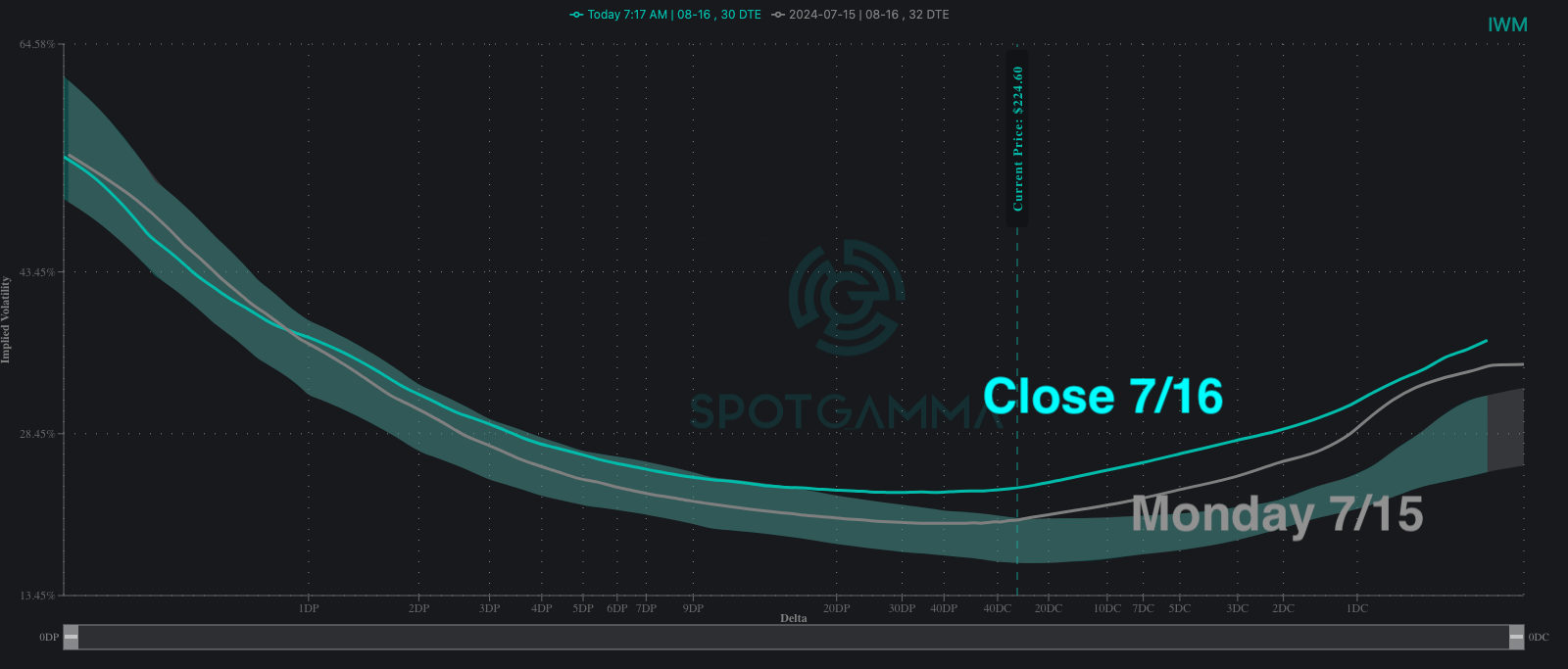

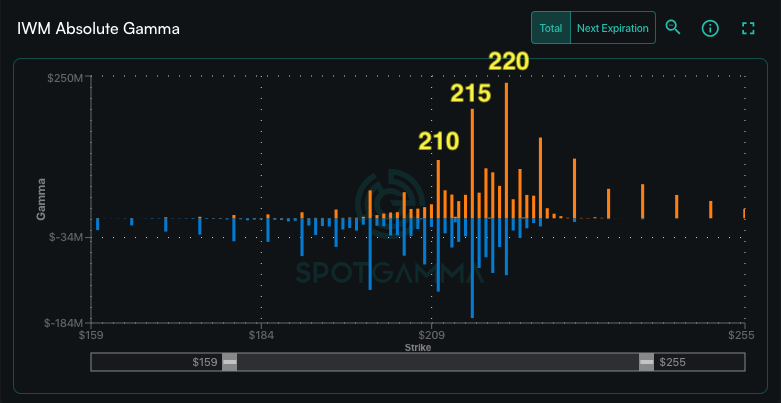

7/17/24: Record Call Volume

During the same week, we saw the largest ever call volume in IWM. Our analysts noted the steep skew and forecasted an OPEX-driven pullback into the 210 area. As we stated, "Options being bought add leverage/volatility, which magnify moves."

Why This Matters

Options buying can add leverage and volatility, magnifying market moves. By understanding this dynamic, you could anticipate and prepare for increased market turbulence.

7/18/24: The Prediction Holds

As the market opened the next day, our view remained firm: IWM was due for a significant pullback. We predicted that as the index struggled, long calls would lose value, leading to increased dealer selling pressure. We highlighted, "There are a lot of long calls in IWM, and as the index sputters those calls should quickly lose value. This suggests that dealer selling pressure should pick up."

Why This Matters

If you were holding positions in IWM, this information was crucial. It allowed you to adjust your strategy, either by taking profits, hedging your positions, or preparing for potential buying opportunities at lower levels.

7/18/24: Upside and Downside Projections

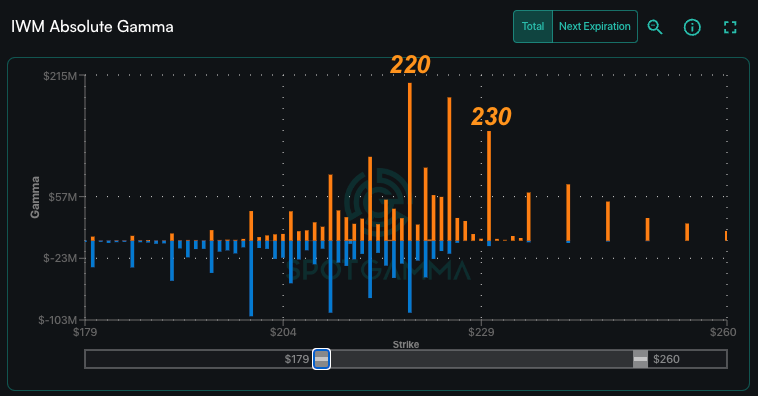

We didn't just predict the downside; we also outlined the upside exhaustion level at 230, based on the large drop in call gamma beyond this point. "If we are wrong on our call for downside, the upside 230 looks like the upside exhaustion level for next week."

Why This Matters

Knowing the limits of both the upside and downside allows for more strategic planning. Whether you were a day trader looking for quick profits or a long-term investor seeking stability, this insight was invaluable.

7/19/24: Market Reaction

As predicted, the small caps dropped by -2.7%, closing just below the key 220 level. We identified a range of 215-220 for IWM and continued to foresee a pullback to 210 into early next week. We reiterated, "We now see large positions at options-heavy 215 level, implying a range of 215-220 for IWM, today. We are still looking for a pullback to 210 into early next week based on the call skew needing to revert."

Why This Matters

Our call was accurate, and our subscribers were prepared. They navigated the market turbulence with confidence, knowing exactly what to expect.

Why Our Options-Based Research is Critical

Options Insights: The Hidden Signals

Many investors focus solely on the underlying stocks, but our research dives deeper. Options markets often provide critical signals that can forecast significant moves in the underlying securities. Here’s why our options-based research is indispensable:

1. Predicting Volatility: Options buying and selling can indicate future volatility. We observed, "Options being bought add leverage/volatility, which magnify moves." Understanding this helps you prepare for market swings.

2. Identifying Market Tops and Bottoms: Steep skews and record call volumes often precede market reversals. Our call on IWM highlighted, "the steep skew, and called for an OPEX-driven pullback."

3. Timing Market Moves: Options expiration (OPEX) can trigger significant market movements. We correctly anticipated the pullback, noting, "OPEX is a fantastic trigger for calls to be sold."

4. Quantifying Market Sentiment: Large options positions at specific strike prices provide insights into market sentiment and potential support/resistance levels. We pinpointed, "large positions at options-heavy 215 level, implying a range of 215-220 for IWM."

Benefits of Subscribing:

Don't Miss Out on the Next Big Call

Join our community of successful investors and gain the edge you need in today's volatile market. Subscribe now and start making smarter, more profitable trades.

Subscribe to the industry's #1 platform for daily expert analysis

Early access to market-moving insights

Detailed reports to help you understand market dynamics

Live access to expert analysts

Where options flow the markets go

Top Stocks To Watch Into OPEX 🔥

Options are a major market influence during OPEX week, but not just during OPEX week. Stick with SpotGamma to see what the professionals see.

Supercharge your trading strategy. Subscribe today.