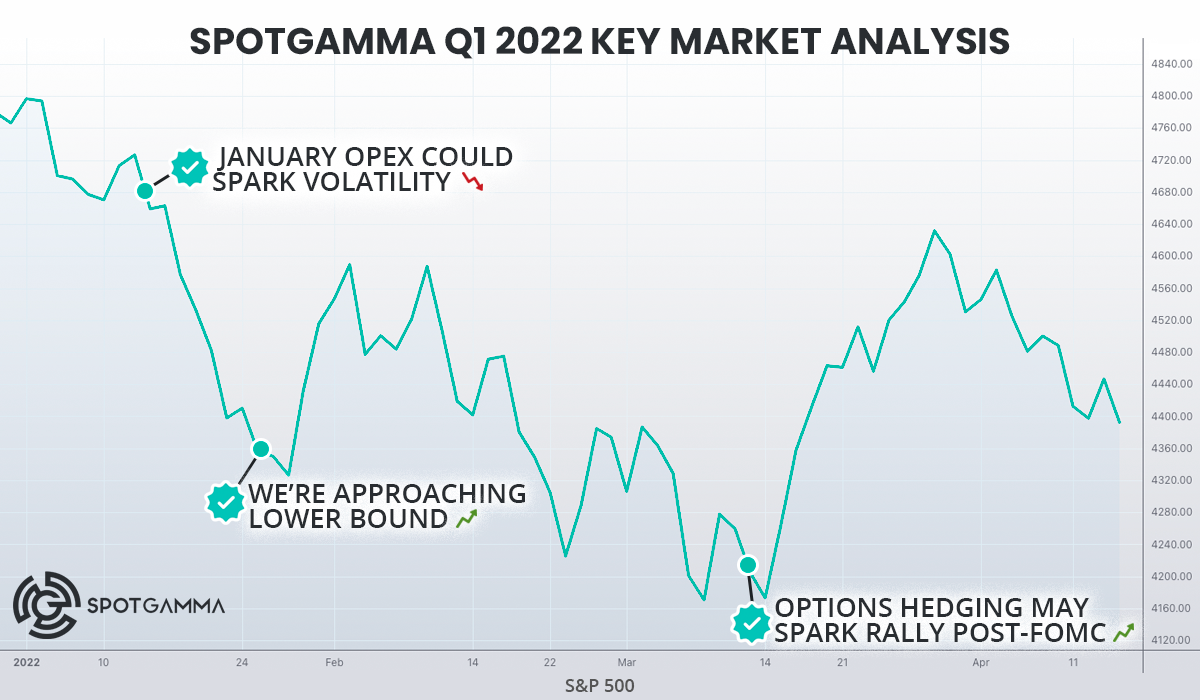

looking for clear, insightful analysis on what's really driving markets?

Where options flow the markets go

Meet SpotGamma, where we use our proprietary options flow data to help you read and understand the patterns driving today's markets

Daily Options Flow Analysis

Unique Levels on US Indices

Key Levels on 3,500+ US Stocks

Real-Time Charts & Indicators

Options Education Courses

Directional Guidance

Everyday Traders and World-Class Experts Love Using SpotGamma

See for yourself...

"I signed up for the monthly plan last night, and my trade this morning just paid for an upgrade to the annual plan. I'm all in!"

- Nick F.

"Beyond a shadow of a doubt your AM and PM Founder's Note has the greatest value to me in determining how I trade the day. SpotGamma has increased my ability to trade with a much higher level of success."

-Philip W.

"Cannot tell you guys enough how you have changed the way I trade…and I don’t use 90% of your tools! Service is worth 10x the cost!"

- Christopher R.

So, Why Options Flows?

Trying to forecast stock market movement without paying attention to the impact of options flows is like trying to build a sandcastle on the beach with a blindfold over your eyes.

That's Where Options Flow and "Positional Analysis" Comes In.

Positional analysis is like a "financial lifeguard" pointing out all the best spots to build so you can stay informed of what's really going on in the markets, and make informed trading decisions.

Positional Analysis is the Secret to Your Trading Edge

Hedge funds have known about the power of the options market for years, but only recently did access to this institutional data become available to the public.

🤷♂️ Without Positional Analysis

😎 With Positional Analysis

SpotGamma lets You access the same proprietary real-time options flow data that the pros use

"Whenever I trade without looking at the options flow first - I regret it!"

founder's

note

Key Levels & Commentary

Proprietary levels equip traders with actionable trading intelligence

equity

hub

3,500+ Stocks & Indices

Evaluate stock entry points based on options analysis

hiro

INDICATOR

Real-Time Indicator

See options trades impact the markets down to the second

VOLATILITy

DASHBOARD

Implied Volatility

Real-time algorithm powers a 360* view into market volatility

Try SpotGamma Today For Free and Begin To See What The Professionals See

Trusted By Top Institutions

Frequently Asked Questions

What is included in each SpotGamma subscription level?

SpotGamma has three plans available for subscribers: Standard, Pro, and Alpha. All plans come with access to the SpotGamma Dashboard, twice-daily Founder's Notes from Brent and the SpotGamma team, subscriber Q&As, and unique key levels for the major US Indices. The Pro plan gives you access to Equity Hub, with key levels for over 3,500 stocks and ETFs, and Alpha gets you access to HIRO, our real-time options indicator, as well as the Volatility Dashboard.

Does SpotGamma help with 0DTE trades?

0DTE is a term used to describe options which expire in a very short amount of time. Here's a whole page full of articles and analysis on 0DTE options.

I already trade on my own platform, what integrations does SpotGamma have?

SpotGamma key levels integrate seamlessly with the following futures trading platforms: Bookmap CloudNotes, NinjaTrader, Jigsaw, eSignal, Sierra Chart, TradingView, ThinkorSwim, and EdgePro.

What are the SpotGamma proprietary key levels?

To get a snapshot of all SpotGamma key levels, head to the helpful and comprehensive Support Center where we cover all things SpotGamma levels.