S&P 500 Stock Market Gamma Trading Levels Based on Options Open Interest

All About 0DTE Options

Try SpotGamma HIRO Indicator for Free

Real-time options data

See when options drive stocks

0DTE filter for short-term trades

Subscribe to the industry's #1 platform delivering daily expert analysis to unveil:

Proprietary market levels

Bullish or bearish stocks

Hidden trading risks

Key Takeaways - What are 0DTE Options?

Understanding 0DTE Options

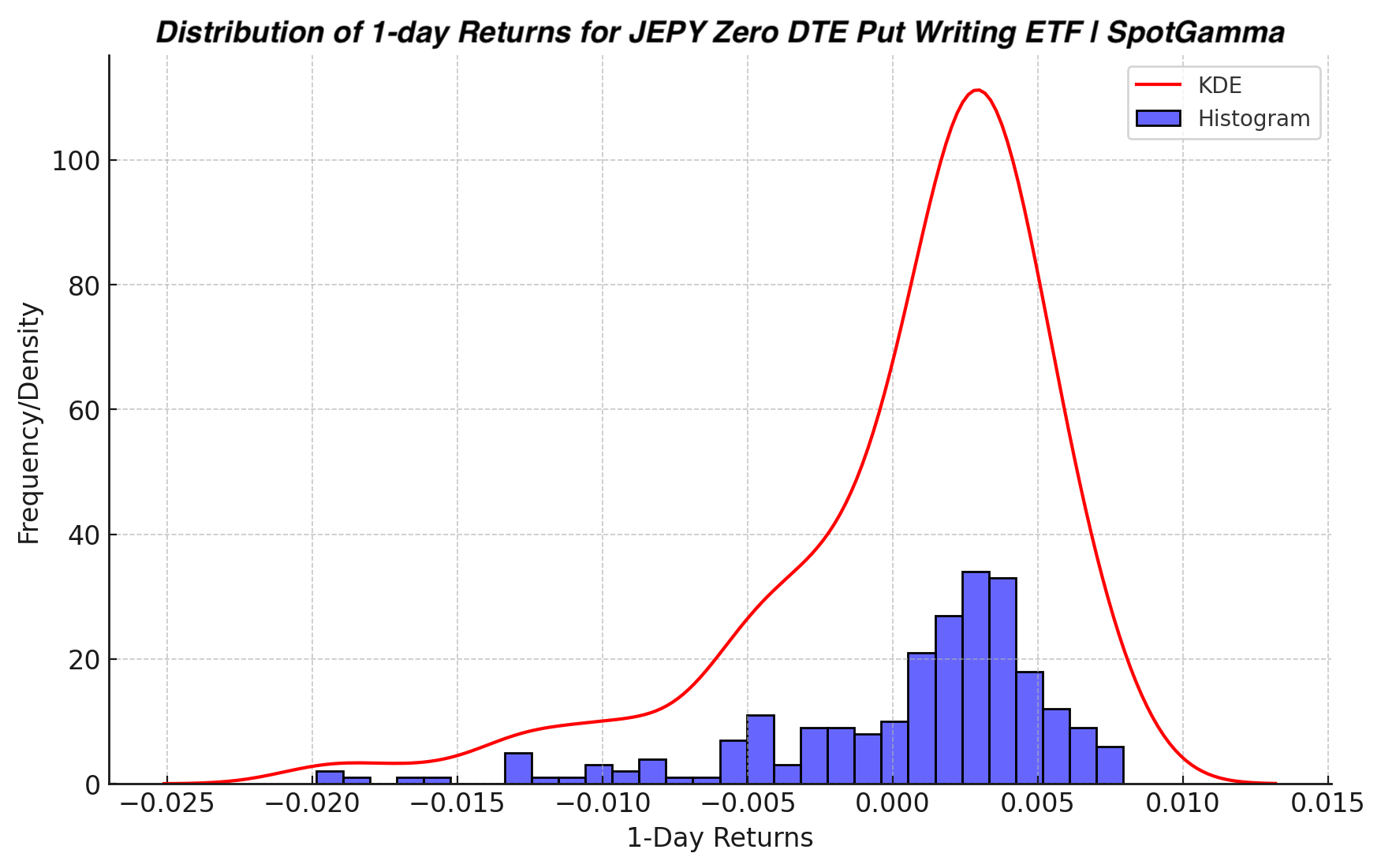

The term 0DTE stands for “Zero Days to Expiration,” which refers to options contracts that expire in a very short amount of time. These options can include longer-term options reaching their final trading day, or specific options designed to last only for one trading session. 0DTE options have grown increasingly popular in recent years, making up a significant portion of daily options trading volume.

Major indices and ETFs such as SPX, SPY, QQQ, and NDX offer daily options expirations, meaning 0DTE options expire that same trading day. In contrast, 0DTE options for large single stocks like NVDA, TSLA, AAPL, or GME typically refers to the next available Friday expiration, as these stocks do not have daily expirations.

The short duration of 0DTE options results in high gamma sensitivity, meaning their prices can change dramatically with small movements in the underlying stock. Additionally, 0DTE options exhibit high theta levels, which represent the rate of time decay in an option's price. As the expiration time approaches, this decay accelerates rapidly, making theta levels notably high.

Below is an up to date chart which displays the percentage of options volume that is 0DTE across the SPX, SPY, QQQ and NDX.

Access today's Founder's Note for FREE!

Expert commentary packed with proprietary key levels, major support and resistance targets, and market analysis on major 0DTE news.

By subscribing, you agree with our Privacy Policy and provide consent to receive updates from our company.

How Can You Monitor 0DTE Options Trading?

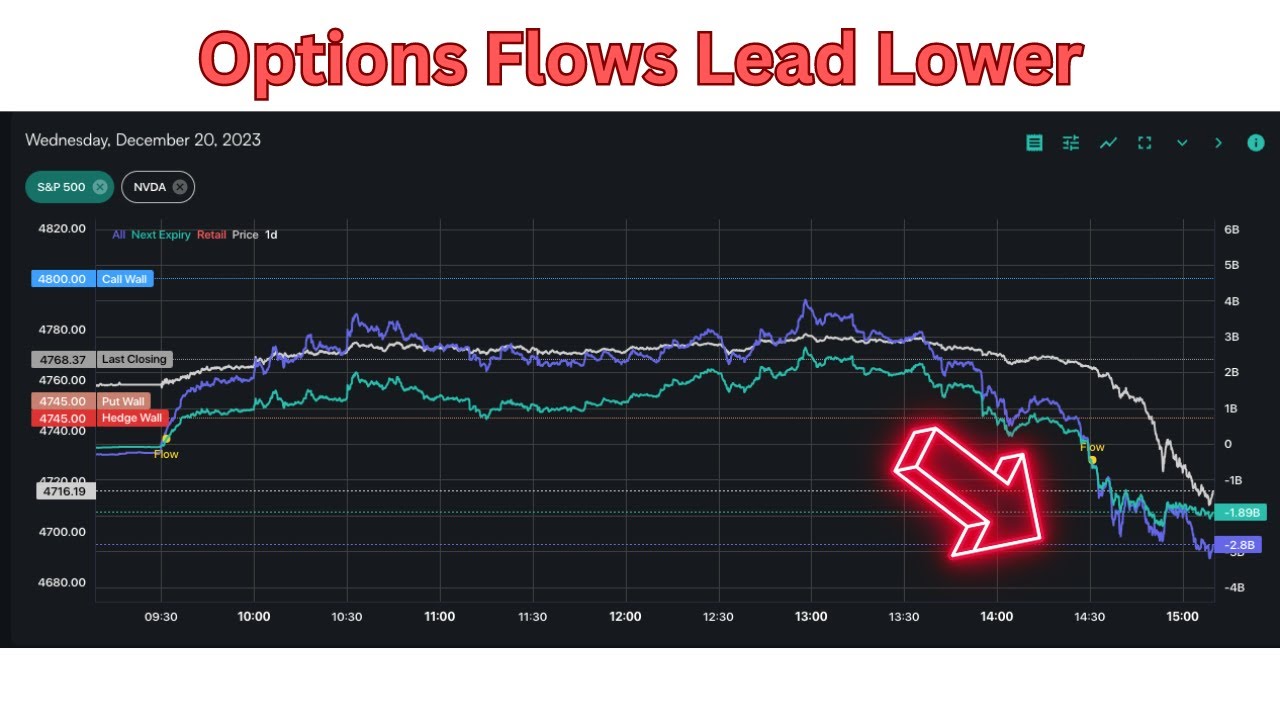

SpotGamma HIRO allows traders to monitor 0DTE, short dated options trading in real time. HIRO reveals exactly when and where our models detect large 0DTE options activity.

0DTE options volume is impactful because it has a high level gamma. Gamma is a way of measuring an options sensitivity to underlying price moves. Gamma can also be seen as a way to measure options market maker hedging requirements. As the price of the underlying stock shifts, some 0DTE options may have rapid, exponential changes in price. When this occurs, these options may require larger hedging flows which may result in market makers buying, or selling, large shares of stock.

What are the risks of 0DTE Options Trading?

Increased volatility is a significant characteristic of 0DTE options due to their high gamma sensitivity. This sensitivity can cause rapid price fluctuations, necessitating large hedging trades that amplify market volatility. Additionally, these options experience extremely high theta levels, leading to accelerated time decay as they approach expiration. The rapid erosion of value in these options can be particularly pronounced if the underlying asset doesn't move in the anticipated direction.

SpotGamma detailed the risks of 0DTE back in October of 2022, after we noticed that large, 0DTE call volume was driving markets higher, discussed in depth in the video below.

SpotGamma 0DTE Analysis Featured in Major Media

SpotGamma has been a leader in 0DTE, short dated options volume analysis. We have been quoted on the topic in such publications as the Wall Street Journal, Bloomberg, Reuters and MarketWatch.

If you're in the Media looking for 0DTE commentary or analysis, please get in touch with us at media@spotgamma.com.

Learn More About 0DTE with SpotGamma

Below is the most up-to-date content and analysis published by SpotGamma regarding 0DTE.

Access today's Founder's Note for FREE!

Expert commentary packed with proprietary key levels, major support and resistance targets, and market analysis.

By subscribing, you agree with our Privacy Policy and provide consent to receive updates from our company.

Subscribe to the industry's #1 platform delivering daily expert analysis to unveil:

Proprietary market levels

Bullish or bearish stocks

Hidden trading risks