TSLA announced earnings last night which beat expectations and the stock reacted… fairly normally. No insane pops or drops.

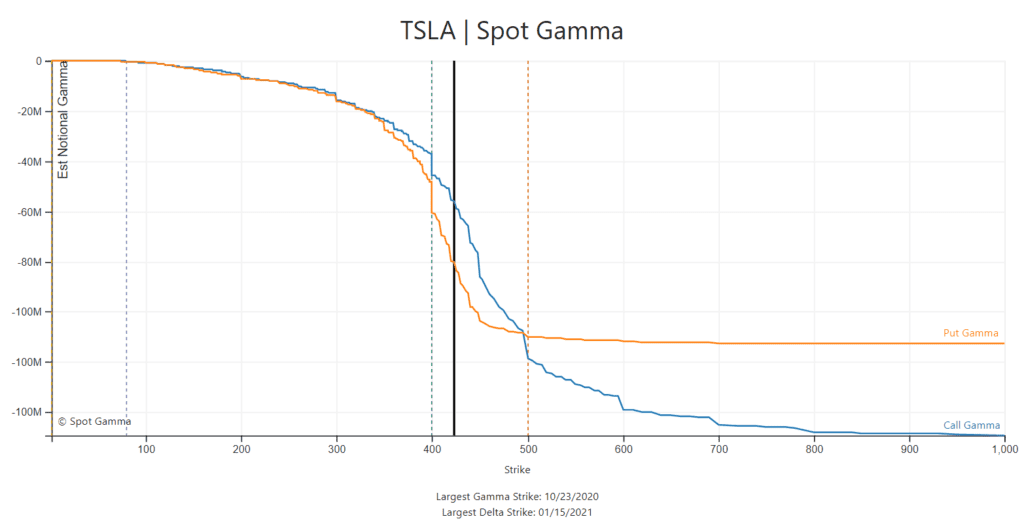

We think much of this tepid reaction is due to the relative lack of gamma compared to past earnings periods (see here). Below is a chart of the current gamma levels in TSLA, and you can see that the call gamma (blue) relative to put gamma (orange) is pretty even. This implies there is less dealer hedging needed for call options. Because we believe dealers are net short calls in TSLA this means they have less to buy as the stock goes up, which creates less upward pressure.

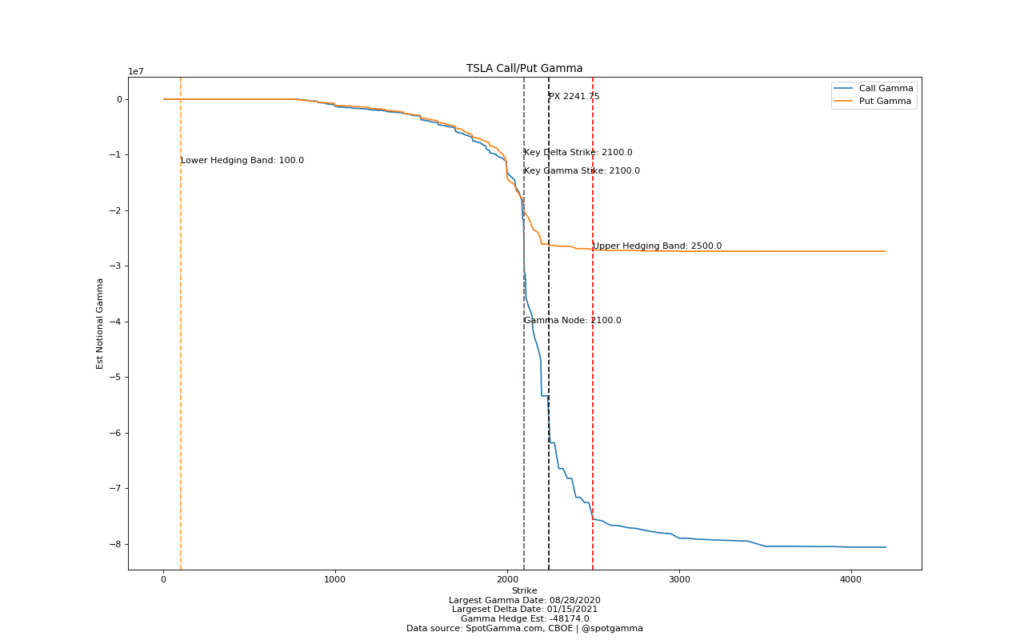

If you compare the gamma position above to the gamma from mid August (chart below) you can see that the call gamma is much more negative that put gamma. This infers that dealers are short a great deal more calls, and need to therefore have a lot more stock to buy as the stock goes higher.

They key point to this is that less options positions generally mean less options gamma. Less options gamma generally means less volatility.