Fundamentals are dead

— Christopher Cole (@vol_christopher) October 16, 2020

Flows are the only thing that matters today

Policymakers sought to stop a credit cycle with liquidity so people mistake liquidity for reality

Financial gravity suspended, but not indefinitely, “flow guru” trading wins big in short term, but not long run

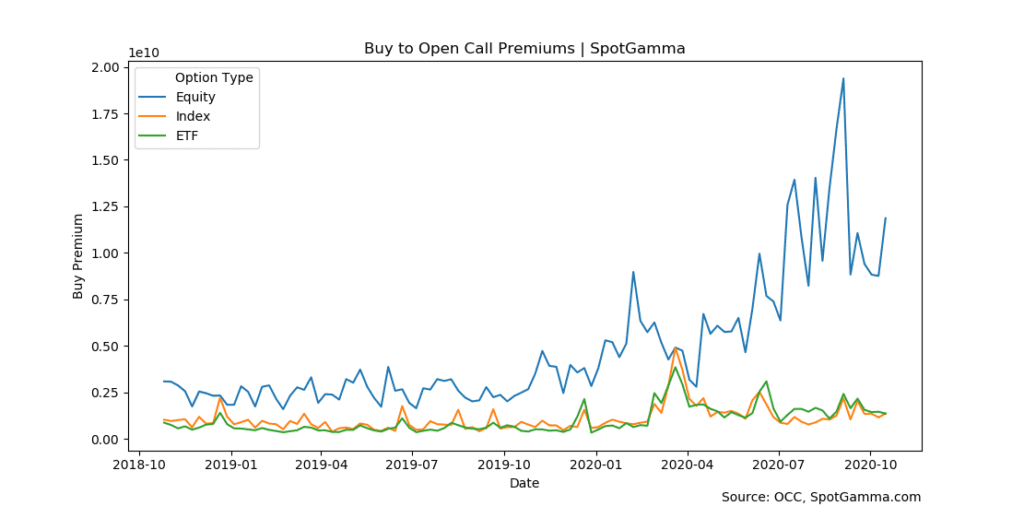

The 2020 markets have been remarkable for a myriad of reasons but for us there is nothing more remarkable than call option demand. This past week we highlighted huge call induced moves in AMZN & ZM, and this week we came across the data set featured below. This data measures “Customer” flow which is essentially retail and “buy side” trading.

As you can see the premium being spent on single stock call options is heavily outpacing that of ETF’s and Index. There was an initial call buying acceleration into Feb ’20 which at the time was record call volumes. However, following the March market collapse single stock demand soared both to news highs and in relation to ETF & Index.

The significant thing about these call volumes is that they likely force markets higher. This is because when call buyers purchase options it leaves dealers and market makers short calls. In order to hedge they must buy stocks both initially and as the market goes higher. This means that as stocks go up dealers and market makers must keep buying stock. As markets rise it may be more attractive for options speculators to buy more calls, which leads to more long hedges. This is what makes the tweet above from Atremis’ Christopher Cole so important – these call options flows can have a major impact on markets and traders are now shifting to trade these hedging flows.

Whats curious about this call buying is the lack of ETF/Index call volume despite the massive market rebound from March lows. Generally Index options are used by large entities due to higher notional values. It does appear that big players stepped in to buy “macro” index exposure into the March dip. Following that it appears that both retail and large institutions (like SoftBank) have preferred single stocks based on this surge in single stock call premiums.

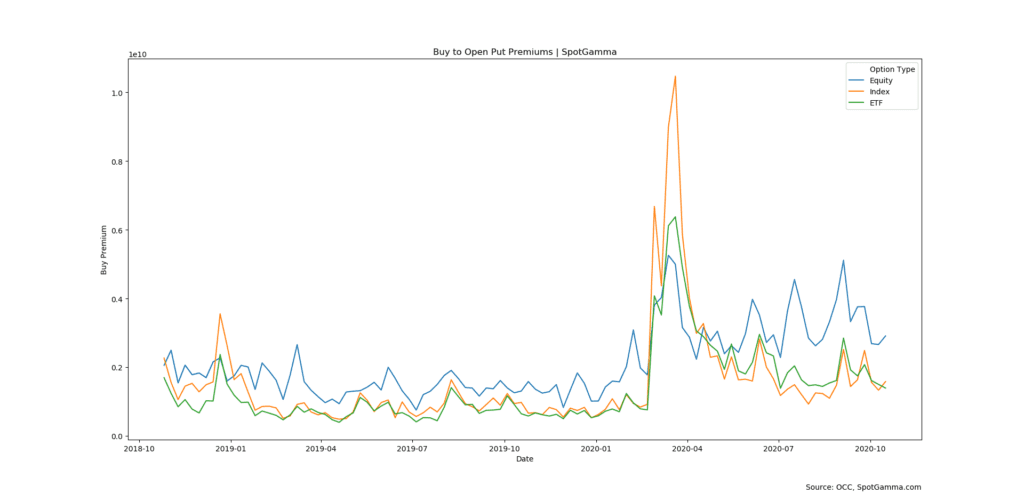

The put flows present some equally interesting data. You can see that single stock put premium is now a fraction of current call premiums. Whats really fascinating about the March selloff is how Index options premiums outpaced that of ETF & single stock. This is again likely due to large institutions seeking macro hedges to protect against further downside. It also appears those options were bought into the tail end of March, indicating a lot was spent on puts just as the market was rebounding.

We see little reason to think the call buying trends change materially. With just weeks to the election we’d note that several brokers have raised margin rates which may deter some buying into 11/3. There seems to be general consensus that a Blue Wave is coming, and along with that massive stimulus. Given the Pavlovian stimulus response call buyers may step up in force and push markets to new highs.

Conversely if we see any type of election issues markets may weaken. There are substantial put positions out in December of 2020, and our concern is that a weak market may lead option dealers to short futures to hedge those put positions. This could lead to a large sharp draw down similar to December of 2018. However, because those hedges are already in place we may not see a substantial put premium spike like we did in March of this year.