S&P 500 Stock Market Gamma Trading Levels Based on Options Open Interest

SpotGamma Quarterly Report Card: Q1 2025

Never miss an options-driven move ever again.

Where options flow, the markets go.

Market Synopsis: Q1 2025

Q1’2025 saw nearly a 5% decline in the S&P 500 and weakness across broader markets led by weakness in the Mag7 tech companies, economic concerns, and looming tariff decisions. Starting in January, we noted some warning signs on January 6th, resulting in a 2% drop, before the market showed signs of stability and finished the month up nearly 3%. Then, in February, while markets were elevated mid-month, we warned about downside risk before the S&P 500 sharply declined by 3%. Finally in March, after markets broke by nearly 6%, we highlighted a floor on the S&P 500 at 5500 that held throughout the second half of the month. For SpotGamma users, these calls helped them stay positioned, reduce risk, and capitalize on market moves — especially during sharp drops and reversals.

Tradable events and SpotGamma guidance include:

SpotGamma Key Market Analysis

1/6 - weakness imminent

Weakness expected near term as there is little support under 6,000 on the S&P 500

“...as Futures indicate a test of SPX 6k, the ‘easy money’ rally has been made, as 6k marks resistance and a drain of vanna fuel.” That vanna fuel was noted to likely be tied to the end-of-year volatility. Additionally shared, “We also note that support underneath is very soft, and so a quick retest of <=5,900 could occur with some bad data.” The market dropped to 5,900 over the next two days before extending lower and retesting 5,800. Traders who acted on SpotGamma’s call had a chance to protect capital or position short into a high-probability pullback.

2/20 - risk off if spx <6.100

Beware S&P 500 components implied volatility at a low with worrying correlations

We warned right at the top of the note, in bold, that “We flip to risk-off/short delta if SPX trades <6,100.” We noted there is positive gamma overhead; however, below there is very little support, further reinforcing our commentary the previous morning on Feb 19th that this next week may indeed open a window of weakness. The market then had sharp declines of over 3% over the following week. This gave SpotGamma users early warning to pull back long exposure or lean short — well before the 3% drop played out.

3/14 - support in place, rally imminent

Stability in place with support at 5,500 and a path toward the 5,650-5,700 range

"...we continue to think a probe higher into 5,650 - 5,700 area is in the cards." The market then rallied to 5780 over the next 11 days. The reason we took this stance was because, “The SPX is showing net positive gamma strike support <5,500 from traders selling puts (dealers long).” We additionally noted that we were seeing put IV coming in and calls heading up, which supports the idea that… “5,500 will be an interim low into the end of March.” SpotGamma users had the data and confidence to lean into bullish setups as IV dropped and gamma support held — leading into a stable rebound.

1/17 - VIX EXPIRATION

VIX Expiration: Watch for a buoyant impact on equities

SPX had just gapped down after three down market days. In the morning, we pointed out how it was VIX expiration and that the most expected result would be a move up from there. The market closed higher for the next six market days. From our 01/17 AM note: “In regards to the VIX expiration, we've chronicled many instances in the past (see Dec note here) in which equity markets have found some buoyancy the day before, and morning of VIX expiration... Back to the VIX, this morning we see the VIX at 14.5, which is its highest reading since mid-November.”

2/1 - run to 5000

If 4900 is breached by the morning, a conditional run up to 5000 is likely

This was the morning after the biggest red day of the year. But based on structural reasons, we saw the most likely outcome to be a quick run up to 5000 if SPX was able to break 4900 by the next day. SPX closed at 4906, and then moved up for the next eight market days, breaching 5000 after six days. From our Feb 01 AM note: “We are unchanged from the map we laid out yesterday. Equity sellers came out, but volatility buyers did not. This suggests the reflexive stock dip buyers/equity vol sellers are now taking a shot…. Yesterday brought some sharp weakness to equities, but by and large options implied volatility did not move… Should that happen overnight [SPX reaching 4900] with solid tech earnings then we could see a quick final push to 5000.”

3/5 - higher prices next week

We anticipate higher prices next week because of overpriced event volatility

At this point, the larger trend was up but trader convictions were being tested with a gap down over the weekend. Due to rising implied volatility tied to future economic events, as indicated by our Term Structure tool, it was just the right amount of vanna fuel to expect a bullish boost for equities. This is ultimately what we saw over the next few market days, and for the remainder of the first quarter. From our March 05 AM note: “We think there is some event-vol premium around all of these points [PMI / Fed Speakers / State of the Union], and the odds-on bet is that they pass as non-events. Should that happen, the event vol premium (i.e. higher IV tied to the event(s)) gets drained away, which should provide a short term boost for equities.”

4/8 - CORRECTION AT 5200

SPX Stood At High Risk Of Volatility If Critical Support At 5200 Could Not Hold

After a seemingly unstoppable rally that opened up the year and sailed it up to 5250, we saw an acute amount of risk if 5200 broke as support because there was little underneath it to slow down prices below that: “We continue to use 5,200 as our barometer for risk, with relative safety seen >5,200, and high risk <5,200. […] Below 5,200 we must respect the specter of jumping volatility, which can force prices lower. 5,200 is the largest strike on the board, and likely to be the center of flows today and tomorrow.” What ended up happening is that, after a breach of 5200, a correction began the next day and continued for nine market days, dropping as low as 4953.

5/6 - 8-DAY UPSIDE MOVE

Low Implied Volatility And High Call Skew Paving The Way For An Upside Move

SPX was hovering above strong support at 5100 and call skew was heating up in a low implied volatility environment. In addition to stock baskets being bought heavily despite a volatile index, this led us to favor speculation of an upside move: “For this week we favor ‘drift higher’, with moderate resistance at 5,150 - 5,165, and more formidable resistance at the 5,200 Call Wall. Bulls have control while SPX >5,100… Here we plot Skew Rank vs IV Rank, with the most bullish positioning reflected by stocks in the top left of the chart. This tells us that volatility is low (IV Rank), and calls are being favored (Skew Rank). Bearish positions would show the red cloud toward the bottom right. As we think it’s a quiet week, we see no reason for single stock traders to back down from bidding.” The result was an eight-day market climb from 5142 to 5311.

6/4 - BULL RUN TO NEW ALL-TIME HIGHS

0DTE Rescues From Within Our Neutral Zone Were Setting The Market Up For A Strong And Responsive Bounce

After the price action was threatening another correction for 2024, we saw a pattern of market bounces clustered in the center of our neutral zone. These bounces had been strictly reinforced and bolstered by 0DTE rescues, identified by our HIRO option flow tool. “To this 0DTE point, you can see the options flow come in to buy the dip over the last two sessions in the HIRO chart below, as highlighted with red arrows. These are very large, material flows of ~$8bn notional on Friday, and ~$4bn yesterday. We'd also note that these bounces source from just under key support levels: 5,200 Friday and 5,250 yesterday…. Accordingly, should the S&P dip today, we'd be eyeing the key support levels of 5,250 and 5,200 for a strong, responsive bounce.” Later that day, SPX dipped to 5257, and then bounced into the steepest bull run of the year as we advanced into new all-time highs, running up to a close of 5487 over the next nine market days.

7/16 - vix to weaken market

The VIX expiration stands to weaken market levels with a slide down for 150 points

“These major levels remain in place for today, and we look for them to start to weaken from Wednesday's VIX OPEX to Friday's equity OPEX. The weakening of these levels allows for the S&P to shift out of this 5,600-5,665 range with the upcoming OPEX. Generally, we'd look for the range to hold until Friday, but with much less conviction due to positions beginning to shift with VIX exp, tomorrow… <5,600 we are "risk-off" and looking for at least a test of 5,550, but more like a test of 5,500. We are favoring this scenario into Friday and through early next week.” (This is also the day that negative market gamma began. SPX ended up closing down to test 5,500 that Friday, which was 150 points lower.)

8/6 - back to bullish after massive iv spike

After the biggest IV spike of the year, we flip back to a bullish risk-on stance because of put selling and newfound positive gamma

“We flip back to a bullish ‘risk on’ stance with a close back above 5,315. This is partly due to the onset of light positive gamma, backed by the assumed decline in implied vols (i.e. vanna fuel) that would come with a rally to 5,300.” What added to this observation was a sign of bullish flow activity from yesterday’s close. (The context is that the market just went through a heavy IV spike after three days of major selling from 5550 to about 5150. Within two days, the market closed above 5,315, establishing a major pivot back up to all time highs.)

9/13 - positive gamma return to push spx higher

The odds are for SPX to increase from here now that positive market gamma has been restored

Futures are again higher, with the SPX pushing up against the 5,600 zone… As positive gamma increases the SPX should go higher. This implies the market is more supported into higher S&P prices, as positive gamma contracts volatility, i.e. we are looking for sub 1% moves today. (Contextually, this upside call was at odds with a double top but SPX was still able to break out of it and end the quarter at all-time highs.)

10/9 - RALLY TO SUSTAIN PER IV DECLINE & NVDA RISE

A rally is being sustained by the decline of IV from geopolitical de-escalation and the rise of NVDA

“Helping bulls is the volatility complex. Over the last few days, we have seen at & near-the-money IV's contract a bit (allegedly due to lack of escalation in the Middle East). Shown below is 11/8 SPX Skew for this morning (teal) vs Monday's close (gray)… Lastly, we flag that NVDA continues to impress, as it’s now up 10% over the last 5 days. This is directly responsible for ~70bps of S&P500/QQQ performance, and indirectly a lot more (via other chip shares & ETFs). Should this outperformance continue, it’s going to force equities higher - regardless of any macro concerns ahead.” The outcome is that there was a rally this day, which continued for three more market days.

11/4 - HIGH OI + IV CARVE PATH TO THE UPSIDE

Heavy overhead open interest and elevated IV have carved out a plausible path to the upside

“Because the prevailing positions above 5,800 are calls, and positive dealer gamma, which inherently drives equity support. The gamma curve from our proprietary dealer positioning reflects positive gamma >5,800, with peak positive gamma near 5,900 (red dashed line = 5,750).

Further, a rally above 5,800 signals traders are "risk-on" following the election & FOMC, which should result in a volatility crush. That generates a vanna-thrust, which can drive equities higher. Accordingly, we look at 6,000 - 6,050 as an upside target, due to large open interest in that area. As noted many times, our preferred way to play a move higher is with tech calls.” The next day the market witnessed a staggering rally from there into new all-time highs, and within two days, a full month of market losses were recovered.

12/17 - VOL SPIKE IMMINENT PER SHORT IV POSITIONS

Short IV positions were judged to be too dangerous based on the imminent threat of a volatility spike

It is impossible to predict the exact timing of a volatility spike because it is the cascading of suddenly unfolding events as well as market panic. But when our volatility tools show that IV is well underneath its own 10th percentile, then we know that it is too dangerous to be shorting index volatility, and that it pays to be on alert for a volatility spike which can set a portfolio back months or years. We started issuing daily caution about this a week in advance while consolidating at all-time-highs in dangerously low index IV. From our morning note on 12/17: “If the SPX breaks <6,000 then we'd shift to ‘risk off’, and look for a jump in IV.” The next day there was the single largest open-to-close point crash in history for both SPX and NDX.

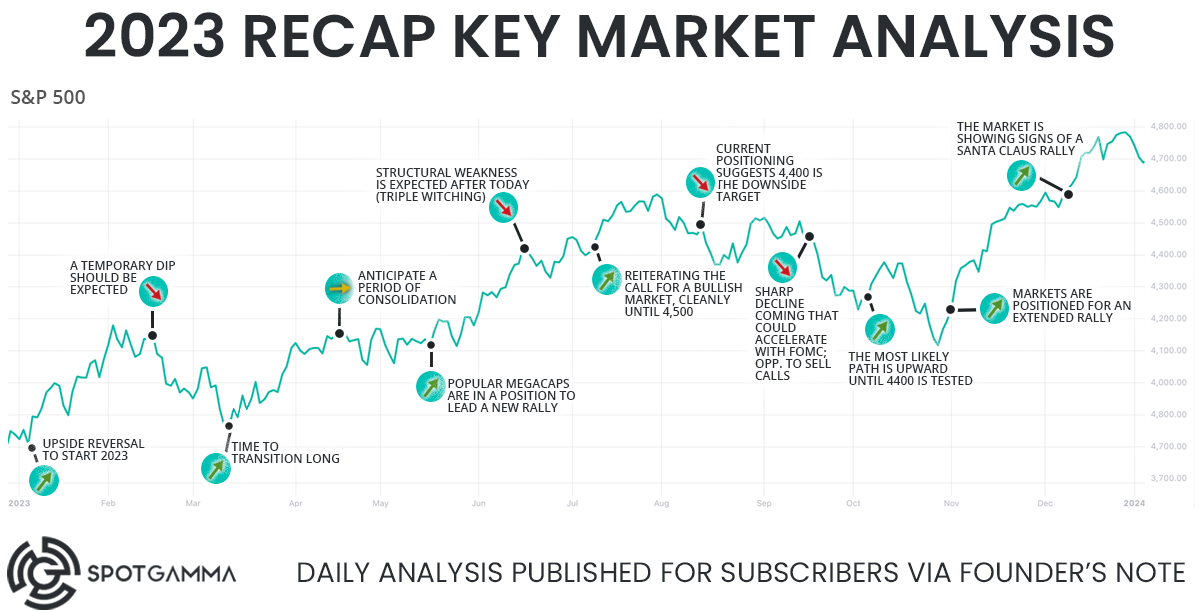

1/11 - upside reversal

SpotGamma Calls for an Upside Reversal to start 2023

"Recently we have been discussing the chance of a very strong January rally." The result was a 6% increase to the end of January. This interrupted a full year of bearish momentum from 2022, which closed near the low of the year.

2/15 - temporary dip

A Temporary Dip Should Be Expected

"We have seen a shift lower in the SPX Call Wall to 4150 SPX, which is a bearish signal." This bearish signal proved to be ideal timing. There was initially a fakeout at the open where it rose higher, but this was the last frothy day, and the market sold off for a full month until it hit the bottom for the year.

3/13 - go long

Time to Transition Long

"From the trading perspective, you cannot rule out overly-exaggerated rallies, and ultimately there is plenty of fuel to run this market back up into the 4000-4100 area." This day ended up marking a turning point as being the low point before a very strong and extended rally.

4/3 - consolidation coming

SpotGamma Anticipates a Period of Consolidation

“Because the Call Walls rolled higher our models are not officially "overbought", but we maintain our view of consolidation to start this week. This led to 5 weeks of trading in a narrow window before the next breakout.

5/17 - megacap rally

Popular Megacaps Are in a Position to Lead a New Rally

“The upside cap for SPX remains at the 4200 Call Wall, and we continue to favor the popular mega-cap tech names to express upside.” Next, these are the names which led the following strong market performance.

6/15 - Weakness expected

Structural Weakness is Expected After Today (Triple Witching)

“We have been looking for a window of weakness to open into and after this expiration… The argument for a pull back now is of course driven by today's expiration, which now sees a massive amount of call delta's set to expire which could in turn reduce upside momentum.” This resulted in a short term pull back in equities.

7/12 - BULLISH UNTIL 4,500

Reiterating The Call For A Bullish Market, Cleanly Until 4,500

“Zooming out, our best case upside scenario into next week is a tag of the 4,500 Call Wall… There are currently very few options positions >=4,500, and gamma should increase into next Wednesday which may tighten the trading ranges down in the 4,400 - 4,500 area. Those looking to express upside are likely better off in single stocks. To the downside we are still "risk neutral" <4,400, and think that 4,300 would be a challenge to break before 7/21 OPEX.” Looking back, this was the right side of the market to be on. It has been in consolidation, with three out of four of the past daily candles being red, but from this morning’s call and onward we saw thirteen out of fourteen of the next daily candles as green, and not one red candle on the path to the 4,500 Call Wall.

8/8 - TARGET 4,400

Current Positioning Suggests 4,400 Is The Downside Target

Current positioning suggests 4,400 would be a major low. “Framing this another way, our view over the last several sessions was that a break of 4,500 would lead to a rapid test of the 4,400 level, and an above average spike in volatility (aka higher vol-of-vol). While vol did perk up rather quickly, the probes below 4,500 were met with dip buyers…we see solid support at 4,450 & 4,400 which slows the decline.”

9/15 - sharp decline

A Sharp Decline Could Accelerate With FOMC; This Is An Opportunity To Sell Calls

“We do however feel that one risk here is that the SEP OPEX/VIX Exp is clearing out downside put positions, which may have been supporting equities for the last several weeks. As OPEX rolls off, you can see in the gamma model below that the downside positioning shifts "up and out" as the "elbow" of that model moves from ~4,400 to ~4,200. This implies that there are now fewer puts down below, which in this case may mean there is less to absorb an equity decline… If you recall into August markets moved ~5% lower, but it was a grind over several days/weeks with IV remaining rather contained. Due to OPEX positions expiring, should the FOMC upset markets it could result in faster downside with higher relative IVs… Today may also be an opportune time to sell some Tuesday calls or call spreads, particularly if there is another rally today which energizes those short-dated calls.”

10/5 - path upward

The most likely path is upward until 4400 is tested

Following market weakness in September, a heavy amount of negative Gamma had built up, and the market was positioned for an upward move at the start of October. Over the course of the next week, the SPX rallied from 4,250 to 4,400 where we projected the S&P 500 would meet resistance. From the 10/5 Founder's Note: “There is still a lot of negative Gamma + Vanna that could unleash a very sharp rally up into the 4,400 area. Should stocks recover 430 SPY, it reinforces the idea of a move to 4,400, as breaking that level likely triggers a release of pent-up volatility premium.”

11/1 - extended rally

Markets are positioned for an extended rally

Two days after the bottom of a three-month-long correction, we modeled a heavy amount of Vanna fuel to be in the market. In light of this and other considerations, we announced finding an edge for an extended bullish move carrying on for a minimum of three more weeks. From our 11/2 Founder's Note: “For today, we are looking for a directional move that plays out over the course of several sessions, vs the relative "pinning" of the last few sessions… We want to give edge to this bullish move extending into Nov OPEX, assuming our various key options levels move up to confirm. However, the fuel that ignites a rally here would be short covering - that is the crushing of IV and put values therein. Sharply lower IVs is the Vanna fuel that could move things rapidly higher, but then we would need to see longer dated call buyers enter to confirm that a move is set to extend."

12/6 - santa claus rally

The market is showing signs of a Santa Claus Rally

After a strong November, the market took a pause before readying itself for another leg higher. In early December, we observed heavy support forming in our models on the MAG7 components. Throughout 2023, the MAG7 has led the broader equity market higher, and the options complex proved ready to advance higher for the next six consecutive market days. From our 12/6 Founder's Note: “We're now seeing some evidence that the downside is stalling out, based on large options levels. Shown below are major levels for GOOGL, and we can see that the $130 area is the largest Gamma strike, and that is not changing despite being tested over the last few sessions. This, we think, shows major support. Further, it's January that contains the most Gamma, which implies that this $130 support area may not change in the short term. There is a similar phenomenon with the other Mag 7's - the exception being NVDA which has a lot more Gamma expiring on 12/8.”

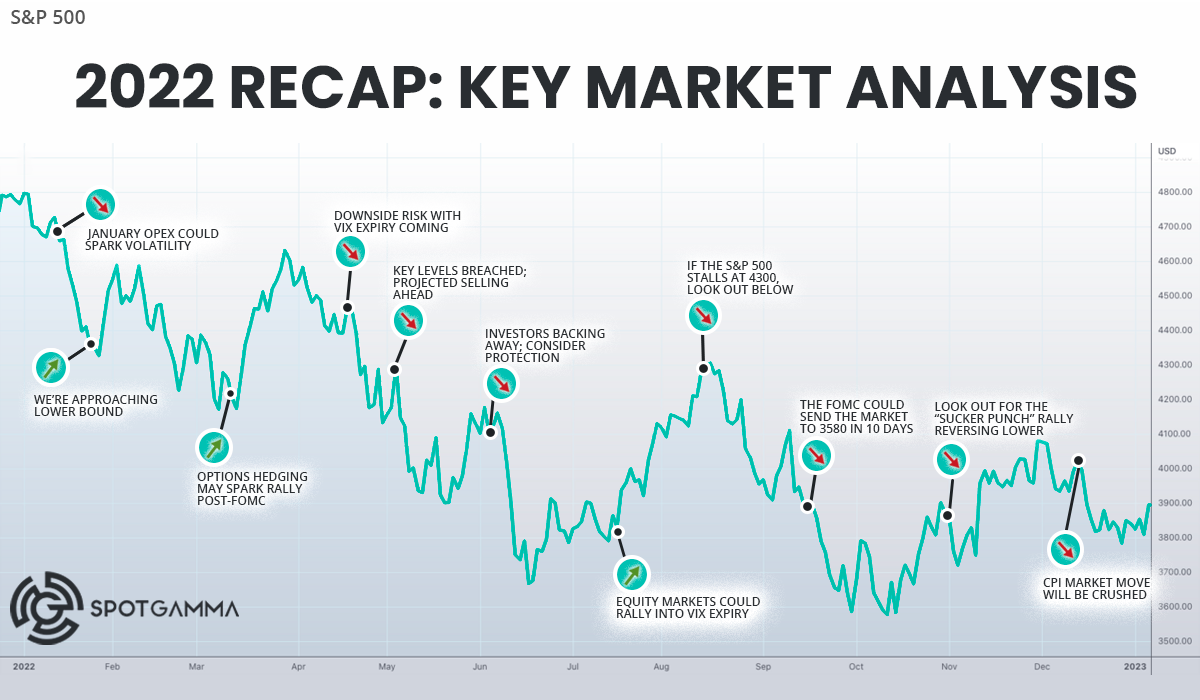

1/14 - JANUARY OPEX CRASH

SpotGamma Models Indicate Net Options Delta Expiration at Over $125 Billion

SpotGamma based its case on the expiration of deep in-the-money calls as a catalyst for volatility.

1/25 - THE LOWER BOUND

After Historic Stock Market Reversal, SpotGamma Calls Arrival at Lower Bound

After some extreme move in equities, SpotGamma called for the market hitting its lower bound. The put positions that were on, in a way, became fully hedged which may have resulted in a violent “snap back rally.”

3/11 - FOMC MARKET RALLY

Brent Calls for Market Rally Ahead of March OPEX on the Contrarian Investor Podcast

On the Contrarian Investor Podcast, Brent discussed how options hedging may impact stock prices, and why he thought markets may rally into the following week's options expiration, 3/18/22.

4/19 - VIX EXPIRY RALLY FADES

Options Expirations Remove Supportive Positions and Create Downside Risk

In our daily Founder’s AM Note, we alerted our subscribers that we see a likelihood for market weakness. Specifically, mean reversion back into 4400 is quite possible, and we give edge to that scenario as VIX expiry & S&P expiry removes supportive options positions. What followed was a -2% drop in SPX within 2 days, and -7.5% into month end.

5/4 - PROJECTed SELLING AHEAD

Look Out Below as the SG Vol Trigger Breached and the SG Call Wall Holds Strong

We alerted our subscribers that our proprietary metric, the SpotGamma Vol Trigger, moved lower as well as our resistance level dropped from 4400 to 4300. If the market failed to recover above the 4300 level, then we could see a quick test of 4000-4050. The market hit 4300 that day, then sold off -8.5%

7/19 - VIX EXPIRY RALLY

Equity Markets Could Rally into VIX Expiration

In our AM Founder’s Note, we alerted our subscribers in our “What to Watch” section that we could see strength as, “Equity Markets may jump into the Wednesday, July 20, 2022 VIX Expiration.” We then suggested that as, “Today is the last trading day before VIX expiration, and this day has been associated with strength in the recent months”, with our levels indicated a break above 3900 will then allow for the market to run higher. What followed was a near 3% move higher into the FOMC meeting the following week, exactly matching the SpotGamma expected 5-day move of 3.05%.

8/15 - large move downward likely

If The S&P 500 Stalls at 4300, Look Out Below

We alerted our subscribers that heading into the August 19th monthly options expiration, we expected to see $4300 on the SPX act as significant resistance. If this level cannot be breached to the upside, we would expect to see a large move downward. Next, the market dropped hard, and it only took 10 days to retest our $4000 SPX Put Wall level.

9/21 - post-fomc drop expected

The FOMC Can Send the Market to 3580 in Ten Days

On this day, traders were waiting for a major FOMC announcement at 2 PM ET. Our AM Founder’s Note projected that we could see a large move lower as we, “highlight 3580 as a major downside level into the end of the month." The FOMC spooked markets, and over the next ten days we saw the market drop to ~3580 at the end of September.

10/31 - "SUCKER PUNCH" RALLY REVERSAL

Look Out For the “Sucker Punch” Rally Reversing Lower

Markets had rallied on the back of short-dated (and even many same-day options). We warned that we had seen this before, and the markets were susceptible to a sharp short-term decline. The market dropped by 4pct over the rest of the week.

12/12 - Post-CPI Thrust to Fail

SpotGamma Beats Banks to the Forecast

SpotGamma's call that the CPI market move would be crushed was a unique one, and turned out to be spot on. As a result, a large bank (Goldman) shifted their view to match that of SpotGamma, heading into a giant options expiration.