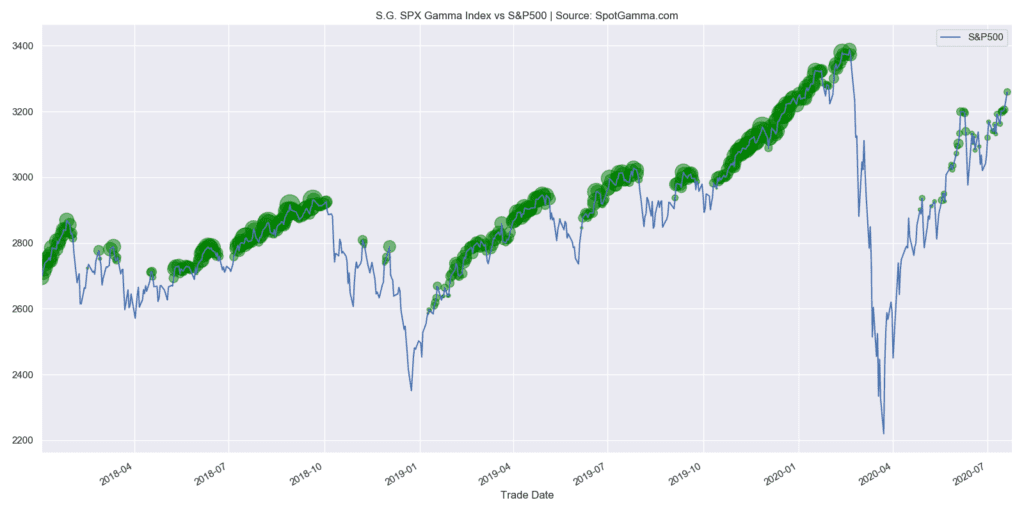

One of the things that has left us curious about the recent rally in SPX has been the lack of call positions. These call positions bring positive gamma to markets, which help to support the SPX. Our model suggests that in positive gamma markets options dealers are buying declines, and selling rallies therein “suppressing” volatility. This also infers that this flow may help prevent larger drawdowns and keep a decline in VIX/implied volatility levels.

Here we have plotted positive gamma levels as bubbles and you can see that the recent rally is producing much smaller and less consistent levels of positive gamma compared to recent rallies.

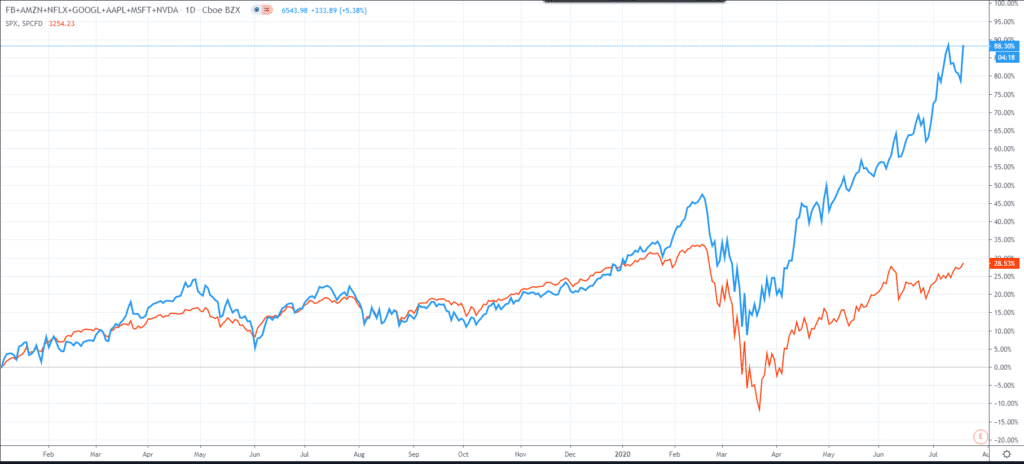

We have a few ideas about why this is, the primary of which is that most participants are focused on the “FANG” stocks. As they outperform the market it may be a disincentive for owning SPX upside.