Investors have turned to put options as a way to generate income. Strategically this can be a great strategy, but what does it mean when the MAJORITY of put options are SOLD instead of BOUGHT? In other words: the majority of traders are now using put options as income as opposed to insurance.

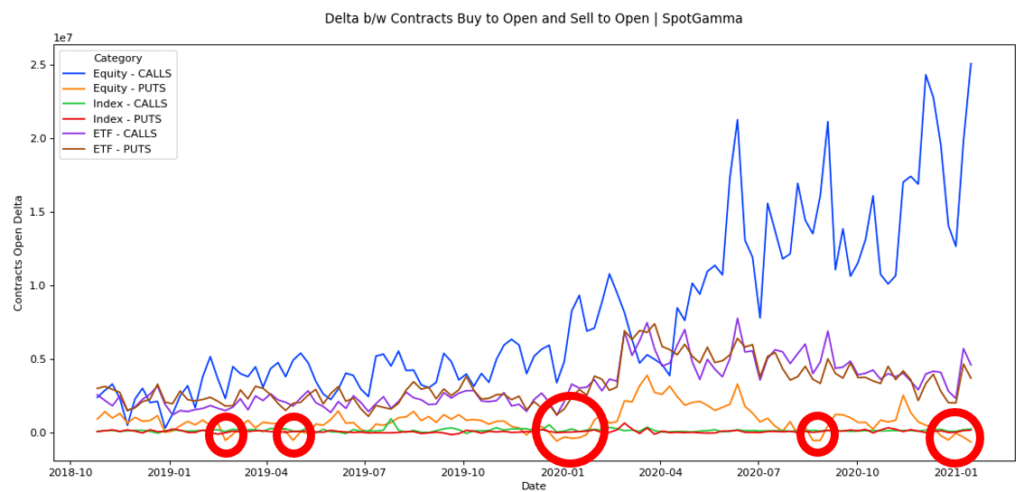

The circled areas in the chart below highlight the other times this has happened in the last ~2 years. Specifically this chart measures the amount of an option type that was bought to open against the number that were sold to open. Therefore because the gold line is below zero know that traders are options to sell puts to open MORE than buying them to open.

This implies that traders have little fear about a decline in markets, as selling a put option exposes a trader to large losses if the market declines. We think this is an indication of overconfidence, and exuberance in markets.

Checking these periods against a chart of SPY, we can see that the forward returns can be quite ominous.