The GME squeeze is struggling a bit today as the stock is off $96 (30%) to $225. We think this could be the result of put buying in the stock.

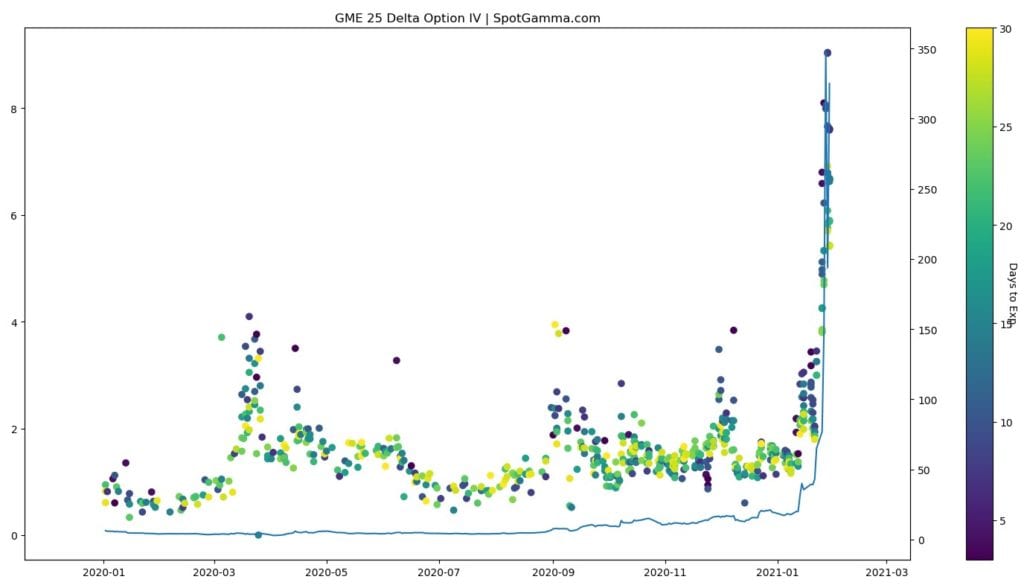

Option implied volatility has surged recently, sending the price of call options massively higher. You can see this reflected in the graph below. For example at the open we noted the 320 call (at the money), expiring in 5 days was $125. That is $12,500 of notional value, and this prices out most market participants. Compounding this are brokerage halts in the trading name, making options more risky due to the time decay factor.

If retail cannot purchase options they lose their ability to “weaponize gamma”. This is because call options are essentially a mechanism of leverage because each call contract purchased may result in dealers buying stock. A few hundred dollars spend on a call could result in thousands of dollars notionally of stock purchases.

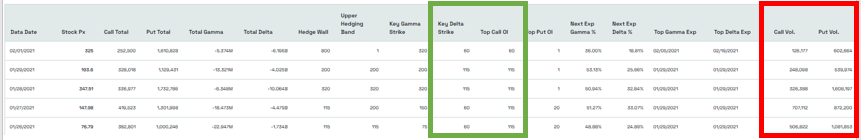

From a delta perspective the bulk of options are at $60 strike calls as you can see in the green box below. This infers that the greatest source of delta hedging flow for dealers are these deep in the money calls which may require they hold long stock as a hedge.

The “Total Delta” column below is the maximum estimated exposure for options dealers (its likely less than this estimated figure, out of scope for this post). Since this figure is negative, it means that dealers options positions make them directionally exposed to a move higher in GME. To hedge this they may buy GME stock until their delta exposure is closer to zero.

As you can see in red, put volume has consistently outpaced call volume as seen in red. Additionally the total open interest position reflects Call open interest less than Put open interest (see “Call/Put Total” columns). If our delta metric is correct, dealers are having to hold long stock delta and each new wave of put buying allows them to sell that long stock they are holding. As that pushes the stock lower, they delta required to hedge the deep in the money calls declines, too. This “gamma trap” becomes a feedback loop as dealers sell stock, and new puts are added allowing them to sell more stock. We think this may be some of what is driving the stock lower, despite determined buyers in the retail public.

If their delta position was long it would require dealers to short the stock, an activity that was difficult last week the supply of shares to short dwindled.