The S&P500 has been surging the last several days, following several large options expirations at the end of March.

With this we have seen a change in the forecast of our vanna model, which we use to forecast dealer buying or selling pressure. Vanna is the change in an options delta for a change in implied volatility (IV). Our model adjusts both the S&P500 price and implied volatility to forecast the directional exposure of options dealers.

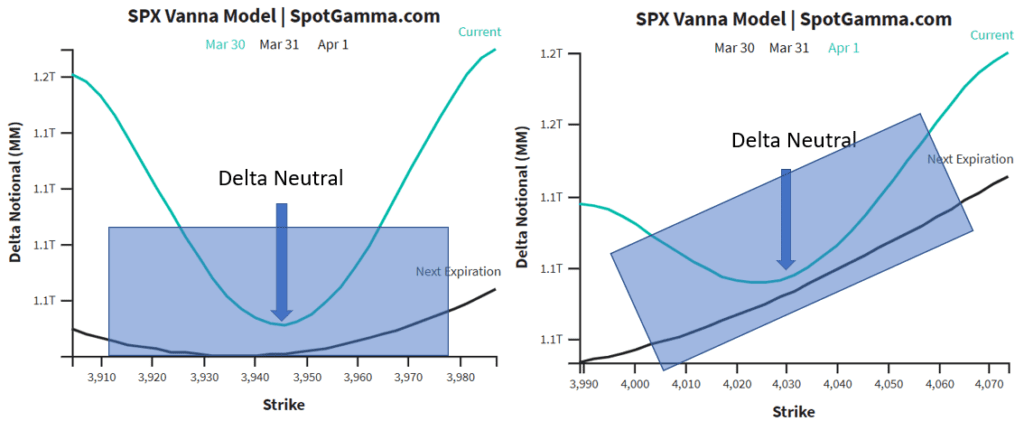

What’s plotted in our charts below is the notional exposure generated by the options position, and so in theory dealers will need to offset this exposure with ES futures hedges. We assume that dealers are “delta neutral” ie fully hedged at the start of each day, which is depicted with the blue arrow. As markets shift higher or lower dealers will need to adjust ES hedges accordingly.

As you can see in the figures, on March 30th (left) the dealers had a more or less neutral position for a given change higher or lower in the S&P. This is implied by the symmetrical nature of both the current (teal line) and future (black) delta exposure.

However, as the market ripped higher the estimated options exposure became much more skewed to long long side (April1 chart, right). In other words, the dealers options portfolio hypothetically gained much more long exposure. This is why both the current and future (next expiration) lines rise as we move to the right (higher SPX prices).

The implication here is that dealers will have to increasingly sell ES futures into these rising markets so that they can hedge this growing long options delta exposure.

We do not think this is enough of a force to cause a selloff in equity markets, but it does imply resistance is building around current S&P prices. Its important to note that this model is just one piece of our complete framework which includes factors like large options positioning and gamma adjustments.