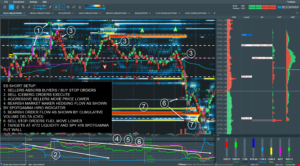

The following is a guest post from Doug Pless. When I plan to trade futures, I begin my morning preparation by reading the SpotGamma AM Founder’s Note. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX and SPY. I also look up […]

Options Vanna

Trade Analysis: ES Futures (13 September 2021)

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels, the SpotGamma Imp. 1 Day Move, the SpotGamma Gamma Index, and Gamma Notional for SPX […]

Trading NQ Futures Using Vanna and HIRO

The following is a guest post from Doug Pless. As I have discussed in previous articles, I begin my morning preparation by reading the SpotGamma AM Report when I plan to trade futures. For ES futures, I note gamma levels and key metrics for SPX and SPY. For NQ futures, I note Gamma Notional, and […]

Todays Option Vanna Rally

We’ve written about some of the major risk signals showing over the last several days/weeks, and those risks manifested in a 4-5% drawdown over the last few trading sessions. Todays bounce appears to be mainly off of the closing of short term put options trades (delta hedge unwind) along with a crush in implied volatility. […]

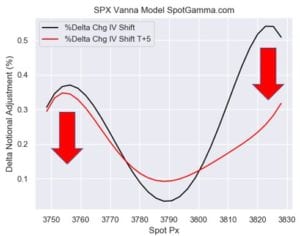

SPX Options Vanna Into the April Rally

The S&P500 has been surging the last several days, following several large options expirations at the end of March. With this we have seen a change in the forecast of our vanna model, which we use to forecast dealer buying or selling pressure. Vanna is the change in an options delta for a change in […]

SPX SPY Options Vanna

Options Vanna is the delta adjustment required for a change in implied volatility. When we model market makers options hedging activity, we adjust options implied volatility to understand how hedging flows might impact the stock markets. Market makers likely hedge SPX and SPY options with ES futures, so these hedges may have a large influence […]

SPX Options Vanna Rally

Recently we have been discussing with subscribers the elevated implied volatility in the S&P500 due to the 1/5 election events. The VIX is a decent measure of implied volatility in the S&P, and you can see that despite the market being at all time highs, the VIX was well off lows. Our feeling was that […]