We’re seeing (and have been seeing) a major breakout in commodities. Metals, energy and commodities of all types are seeing large price increases. One of the stocks closely linked to commodities is FCX, Freeport-McMoran which primarily mines copper. As you can see below the stock has been on a tear, breaking out to highs not seen since 2012.

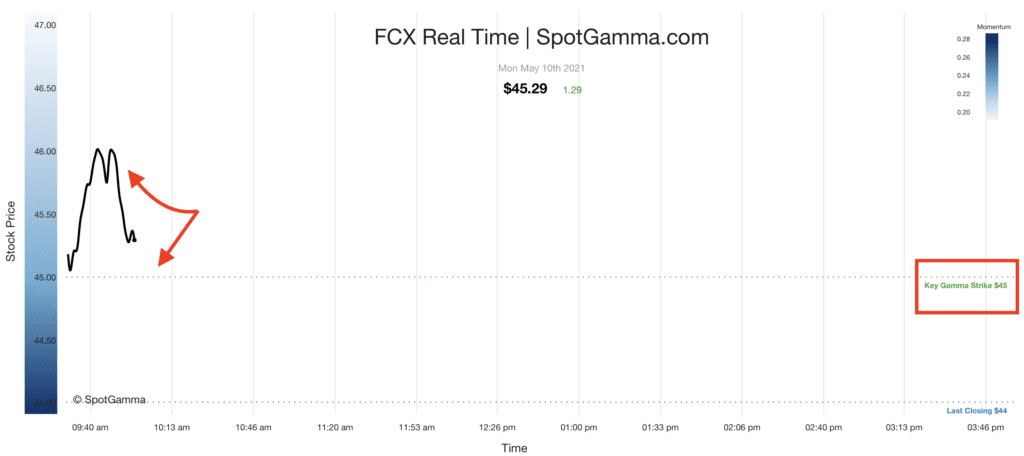

This morning (5/10/21) FCX gapped higher to $46 (+5%) only to fade back to the $45 level that is highlighted on both the chart above, and below. This $45 strike is where SpotGamma detects the highest level of options gamma in FCX. This is an important level as its an area which should attract a great deal of option hedging flows. This hedging can act as mechanism for support or pinning the stock to large options gamma areas.

Currently the bulk of options gamma does not expire for another 2 weeks, suggesting that $45 could be a significant level in FCX for another 10 days.

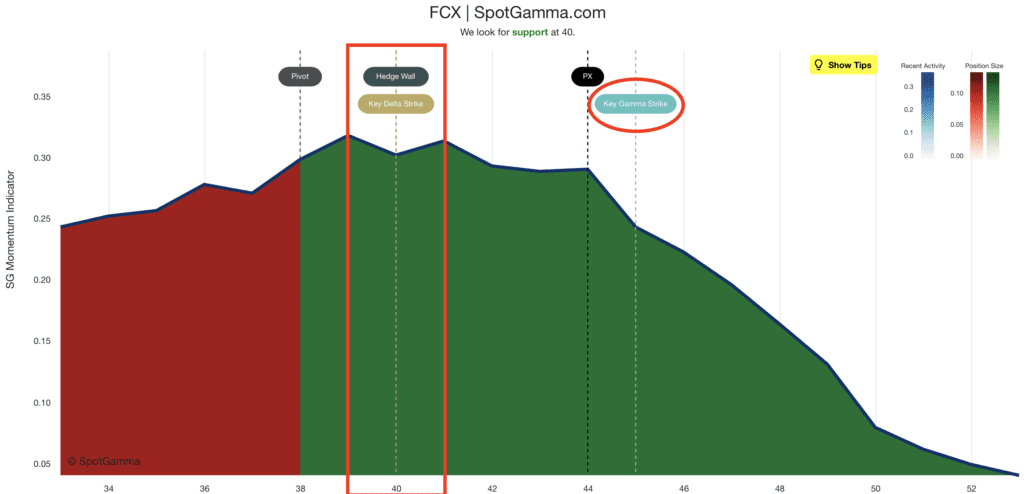

The second important level from an options perspective is the $40 strike. Our models indicate this line as a significant area of support as shown below (red box). The other thing noted in this chart is that the current price is embedded in an area of green. This implies that FCX is currently trading in an area of heavy call positions, and therefore as the price rises we may see dealer hedging that supports a move higher. This can create a “gamma squeeze” as dealers seek to “keep up” with the stocks movement.

What you also may notice is that the green area reduces as the price of FCX moves over $45 (red circle). This suggests that there is not a significant number of options in FCX past the $45 strike, and so call gamma reduces sharply. This may indicate that an options squeeze has helped propel this name higher. For gamma to continue to squeeze this name, traders will want to see call options added >=45 over the next few trading sessions.

Finally, we highlight our Dark Pool readings which infer that large funds are purchasing FCX. A reading over 45 is generally considered bullish, and you can see that both Fridays reading, as well as the 5 day average are >45.

Based on our EquityHub & Dark Pool data we see a strong case for FCX’s stock price to hold or increase. Into 5/21 we see large support at the $40 price area, and on any consolidation we think hedging flows should increase to “pin” this $40 level in the stock. If the high gamma strike rolls up from $45 to a new, higher strike, then we think FCX stock price will move higher with it.