Today we want to provide an example of how we use the gamma data to setup a trade. Here we are using the SPX options data but using SPY to express our viewpoint that the SPX will stick to the 2800 area today. Note: This is a very basic trade and meant to convey general concepts. There are dozens of ways in which one could optimize the strategy and execution.

Our plan is to sell a 280 straddle in SPY as we see the SPY/SPX sticking to the 280/2800 level today. In addition to selling the straddle we plan trade SPY around the 280 level as we see opportunity.

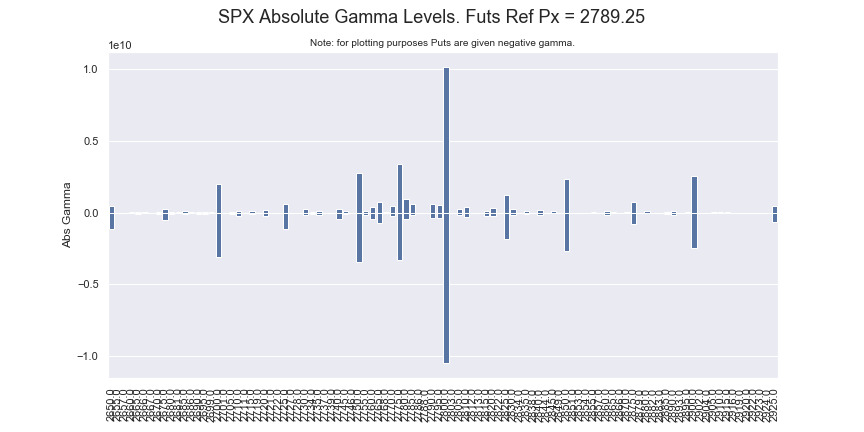

2800 has been the “sticky” level for several days now with the close of the last two days within 3 handles of 2800. You can see from our chart below that 2800 has by far the most gamma associated with it. We refer to this as the largest “absolute gamma strike”. Daily volume at 2800 has been large and we believe that helps to keep the market pinned to 2800, too.

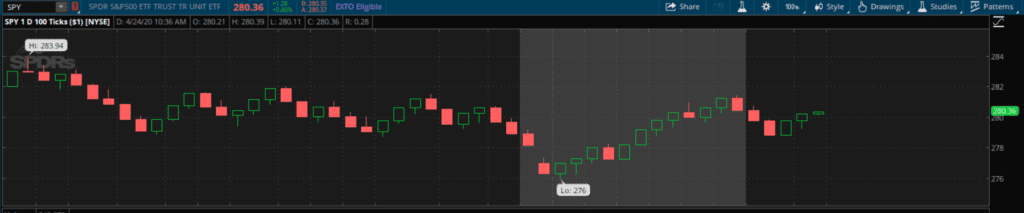

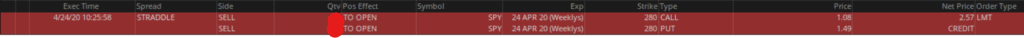

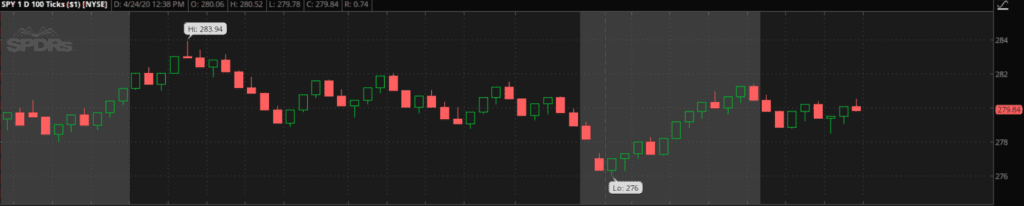

Here is the SPY leading up to our trade, along with a confirmation of the straddle trade. These contracts expire today and our “breakeven” in SPY is 280 ± $2.50.

For a variety of reasons I am looking to close this trade in the early afternoon, primarily I do not want to be short “cheap gamma” into the Friday close and my personal family/quarantine situation means I can’t watch the market too closely in the afternoon. To that point I would argue that one should maybe hold the options into the close, or at least into the last hour.

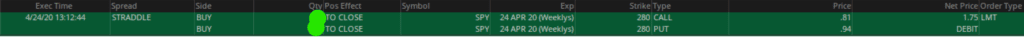

We elected to close the trade in the early afternoon for $1.75 and a profit of about 30%. Again, a very strong case could be made holding for longer, but the point of this exercise was to generate some trade ideas around gamma levels.

We hope that this exercise shed some light on what we think are tradeable opportunities around gamma levels. This trade could have easily been altered easily to adjust for a bullish or bearish tilt, and or an extended duration. To that end many futures traders elect to swing trade or scalp around these levels, too.