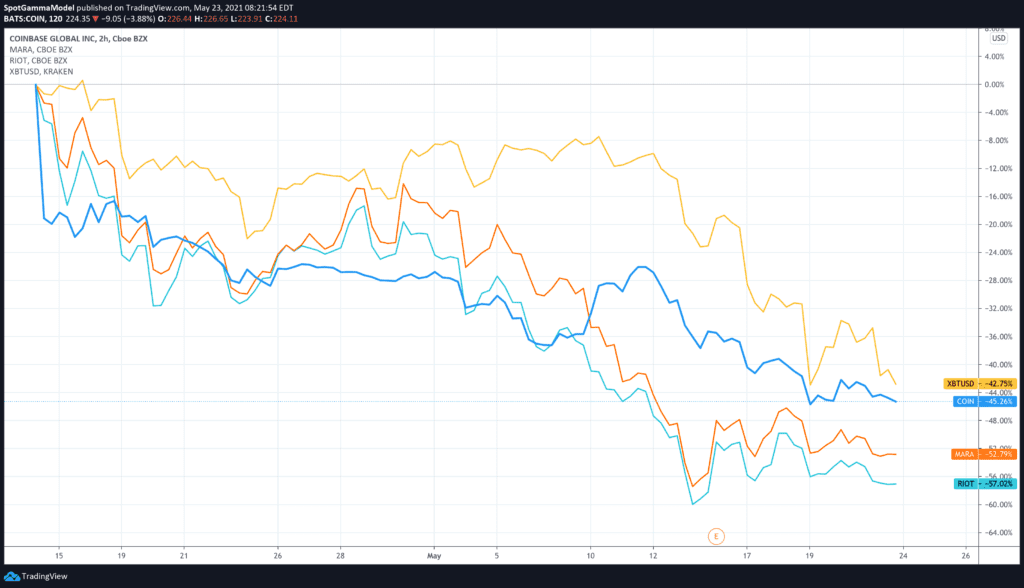

Coinbase is down -45% since its IPO (COIN), and along with that the price of Bitcoin and other cryptocurrencies has been horrible. Bitcoin alone is down 42% – but that is actually outpaced by popular crypto related stocks like: MARA (-52%), RIOT (-57%).

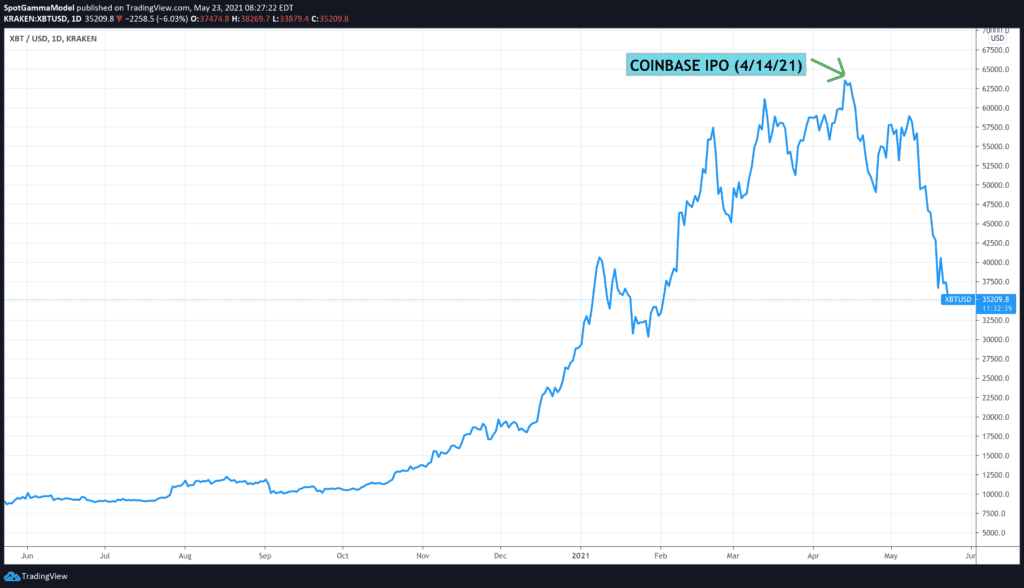

Its fascinating to note the COIN IPO (4/14/21) market the ~$64k Bitcoin price high to the day.

It appears that many traders may have been using call options in these crypto stocks, likely as a way to play higher prices in Bitcoin and other crypto currencies. We can tell through reviewing our EquityHub data that these stocks currently have 1.5 call:put ratios. With Crypto prices currently crashing its likely that selling in these crypto-linked names will increase, and with that we look for put options to gain in volume.

Options Gamma Squeeze – Double Whammy

The fact that the call: put ratio is >1 implies that any downside contribution from options hedging was more from call options being unwound, as opposed to put options increasing in value. Recall that options gamma is the highest for at-the-money options, and the bulk of call options for all these names sits at a strike price roughly 10-20% higher.

Take RIOT for example, which is currently trading near $22 (see below). The strike with the largest call open interest is $40. When these calls first trade, its likely that options market makers had to buy long stock to hedge out those call option positions. However, as the stock traded lower and time passed, options market makers can sell out of their long stock hedges.

Market makers removing their long hedge from calls decaying is more of a “gamma unwind” as opposed to a “gamma squeeze”. Conversely, if the stock price was shooting higher then dealers would have to buy stock hedges, and this could create a gamma squeeze to the upside. Many are familiar with this gamma squeeze concept from GME and other “meme stocks” ripping higher earlier this year.

You’ll also notice in the table above that the highest put open interest (OI) level is the $20 strike. Since RIOT is about $22, it could be at current stock prices where a put options gamma squeeze kicks in, as put gamma increases if/when the stock approaches $20. This implies that as the stock moves toward $20 that options market makers must sell increasing amount of RIOT stock to stay hedged. This could significantly impact the volatility of RIOT to the downside.

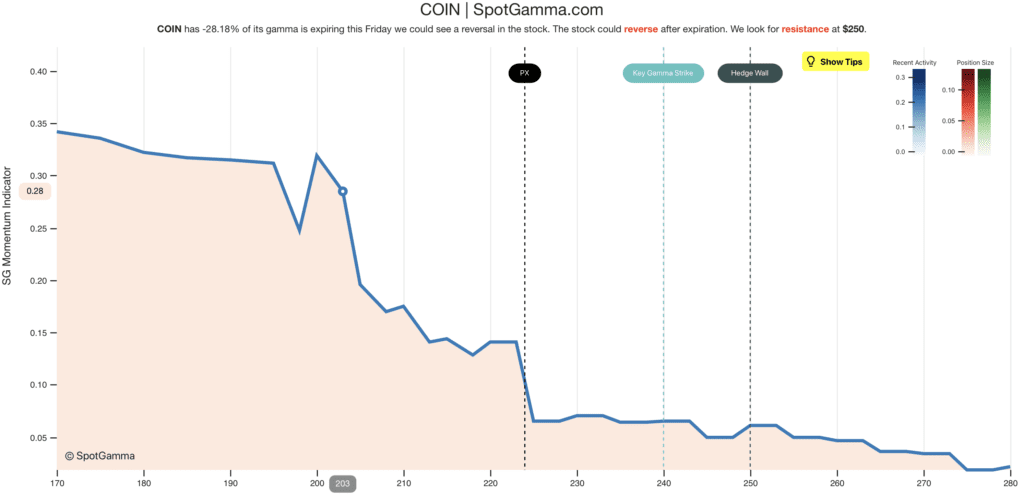

This put-gamma squeeze setup is also in place for MARA and COIN which are both approaching their largest put OI levels ($20 and $200, respectively).

Below is a screenshot of our volatility estimate for COIN. As you can see the SG Momentum (aka volatility) increases sharply as the stock approaches $200. This is because put options positions are larger <=$200, and so the gamma hedging increases which incentivises dealers to start shorting more shares. With crashing prices, more traders look to buy puts which is where the gamma squeeze picks up.

The “Double Whammy” comes in if crypto continues to crash and these stocks drop due to their Bitcoin correlation. With that a gamma squeeze could push dealers to increase their short hedging. This may create a real wash-out in crypto-linked stocks.