From Bloomberg:

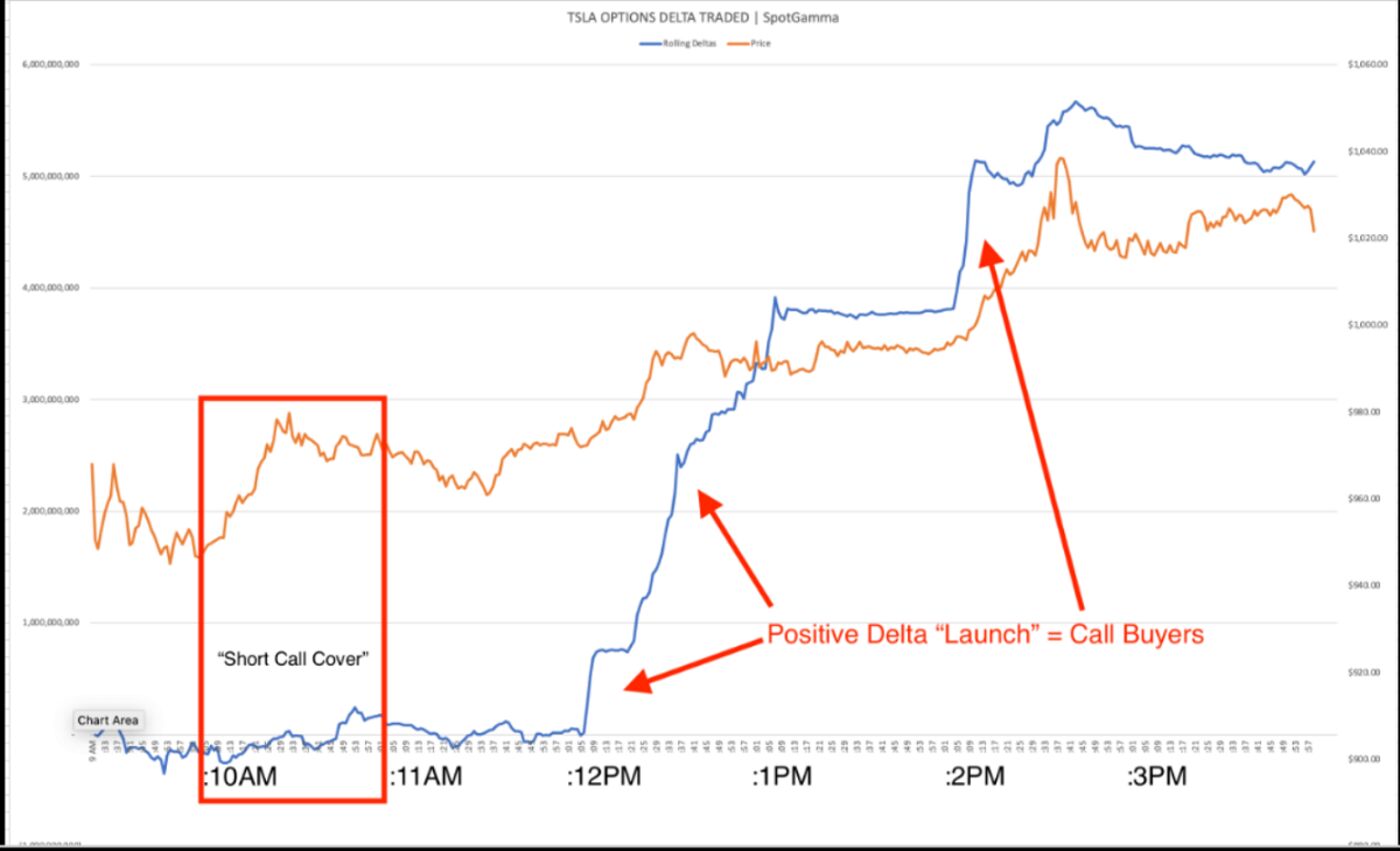

The interplay between the equity and options markets can be complex. To illustrate the dynamics, Brent Kochuba, founder of analytic service SpotGamma, plotted Tesla’s stock against delta, or the theoretical value of stock required for market makers to hedge the directional exposure resulting from all options activity.

In the simplest form, when someone buys calls, a dealer must buy Tesla’s stock to hedge the delta exposure generated by those options trades. If the stock keeps rising, it forces dealers to buy more shares, a process know as gamma hedging.

According to Kochuba’s analysis, Monday started with traders selling calls, which led to a slight negative delta reading. As the stock started to lift off around 10 a.m. in New York, these call sellers were forced to cover their positions. That coincided with Tesla’s share advance toward $980.

Around noon, traders began flooding in to purchase calls, sparking a surge in delta hedging that accompanied Tesla’s ascent toward $1,000. Then two hours later, another wave of call buying hit the market. The stock peaked near $1,045, right before the estimated delta hedging started to taper off.