SpotGamma sees evidence that we are at an interim high due to implied volatility compressing at levels which are near long term rates of realized volatility.

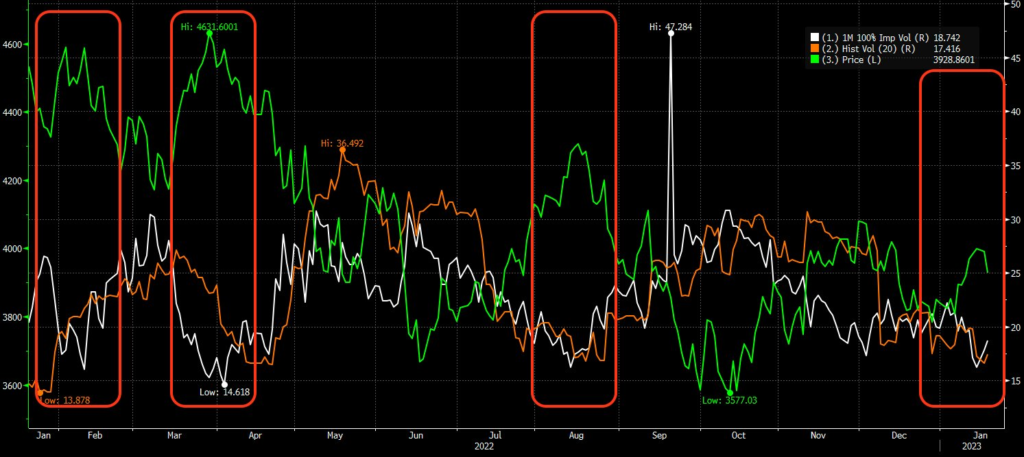

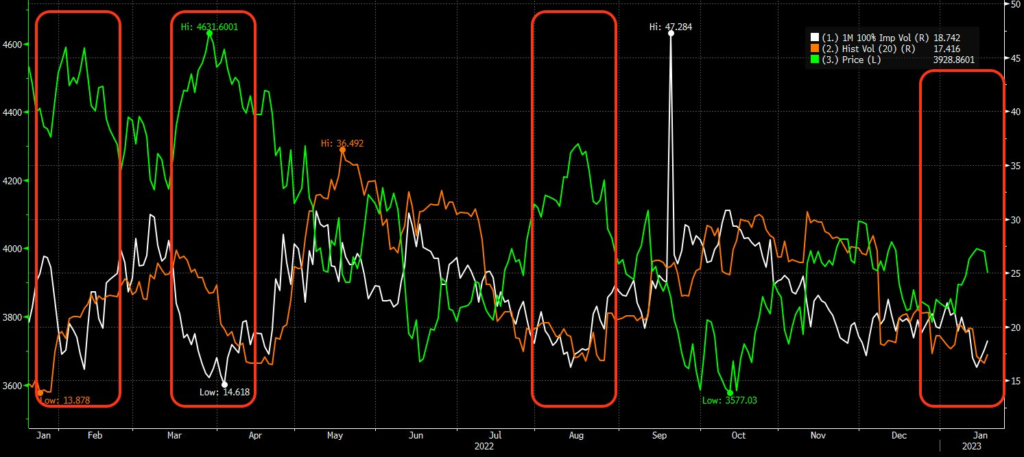

In the chart below we have the SPX (green), 1 month realized volatility (RV), or, how much the SPX has been moving (orange), and 1 month implied volatility[IV], which tells us how much volatility traders expect in the future (white).

In the red boxes above you can see that the spread between IV and RV compress as the market peaks. In other words, traders expectations about volatility in the future shifts under the rate of volatility we’ve been seeing. Its a signal that IV is too cheap, or risk(s) have cleared.

IV<RV is most common after a crisis & recovery Ex: the Covid Crash, people scrambled for hedges into Mar ’20 & then the Fed came with a bailout. After that, traders anxiety eased leading to a very sharp IV decline. RV is slower to decline, b/c its a rolling historical window

Recently there hasn’t been a huge IV increase, but there hasn’t been a true resolution to whats causing market volatility: namely interest rates. Plotted here is 10Y yields (purple) vs SPX (green). Of late there seems to be a clear inverse relationship.

We’ll leave it to macro folks to argue this: but as a base case rate uncertainly isn’t likely resolved until Powell says so. The risk isn’t officially cleared. Therefore we think IV <18 is too cheap/oversold because volatility (RV) should remain high due to these uncertainties.

Further, as rates increase ( + recession arguments) you can make a case that “fair value” on the SPX is lower. Consider this, per Citi: “The S&P 500’s trailing [PE] ratio is back to 18.2x, “dangerously close to the upper end of our fair value range,””

To this point, here is SPX (white) vs SPX P/E ratio (blue). As you can see PE ratios are now back to where they were going into March ’20. While this is down sharply from 2020 highs, it is still well above long term averages near 15.

Often short covering & right tail (i.e. call buying) hedging leads to violent rallies. Eventually big buying demand meets big selling demand leading to IV/RV spread compression: an impasse in price. Lower valuations infer large sellers come out at increasingly lower SPX prices

Eventually when the Fed pauses, equity prices may stabilize which leads to lower levels of volatility and IV/RV levels closer to 15. Or, valuations get undeniably cheap.