After the market close on August 1st, the Fitch rating agency downgraded US debt. This brought a bit of volatility to US stock markets on August 2nd.

The downgrade was the first such occurrence since Standard & Poor’s downgraded the U.S.’s long-term sovereign credit rating from AAA to AA+ on August 5, 2011. Markets were already unstable into that downgrade, which triggered the VIX to jump to 48, and the S&P500 Index to decline ~10%.

Here, the reaction was initially more muted. The SPX closed -1.3% to 4,513, with the VIX jumping 2 points to 16.1 (+15% move). We also saw the VVIX, or “volatility of VIX” index increase by nearly 10%, to 96.2, as shown below.

Jumps in the VVIX are not historically a strong indication of future declines in stock markets.

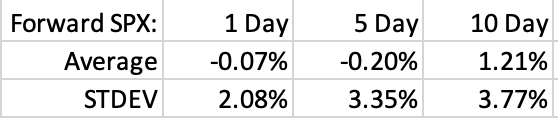

In the past 5 years there have been 57 times when the VVIX had a 1 day move >=10%, and the average forward 1 & 5 day S&P500 returns from these large VVIX moves are -0.07% and -0.2%, respectively.

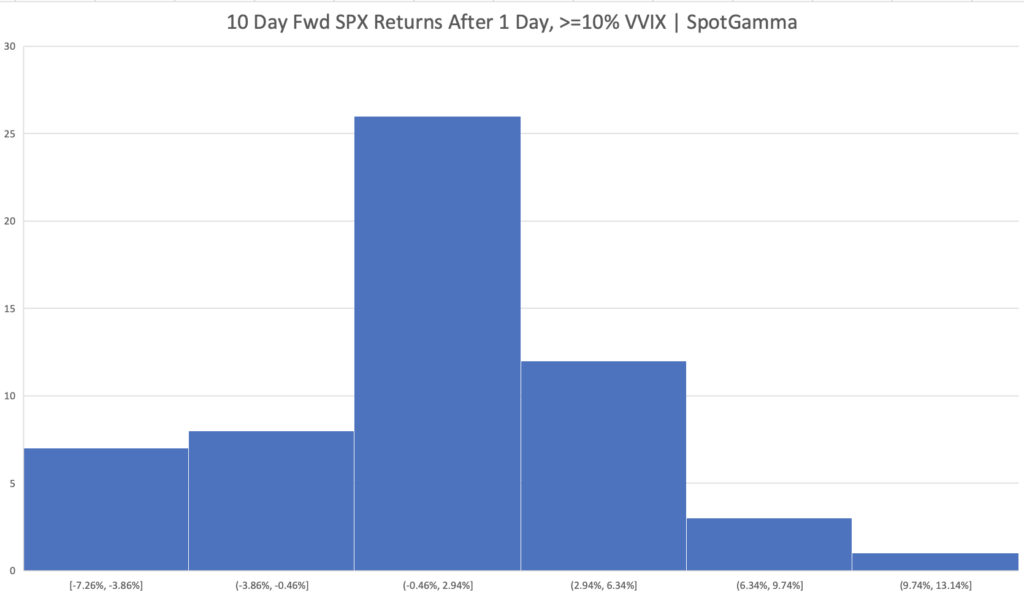

Further the average 10 day forward S&P return is +1.2%.

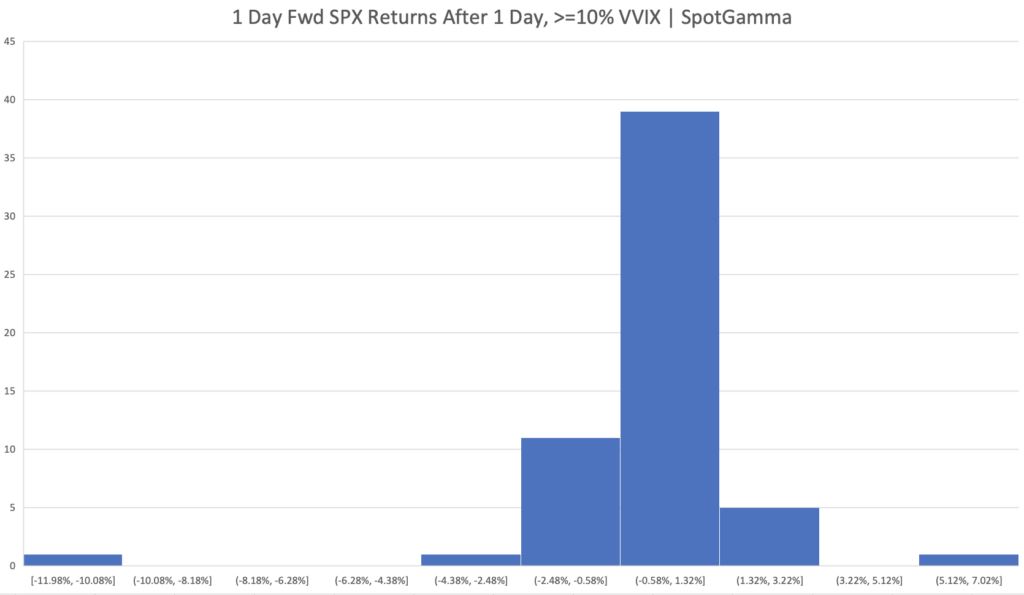

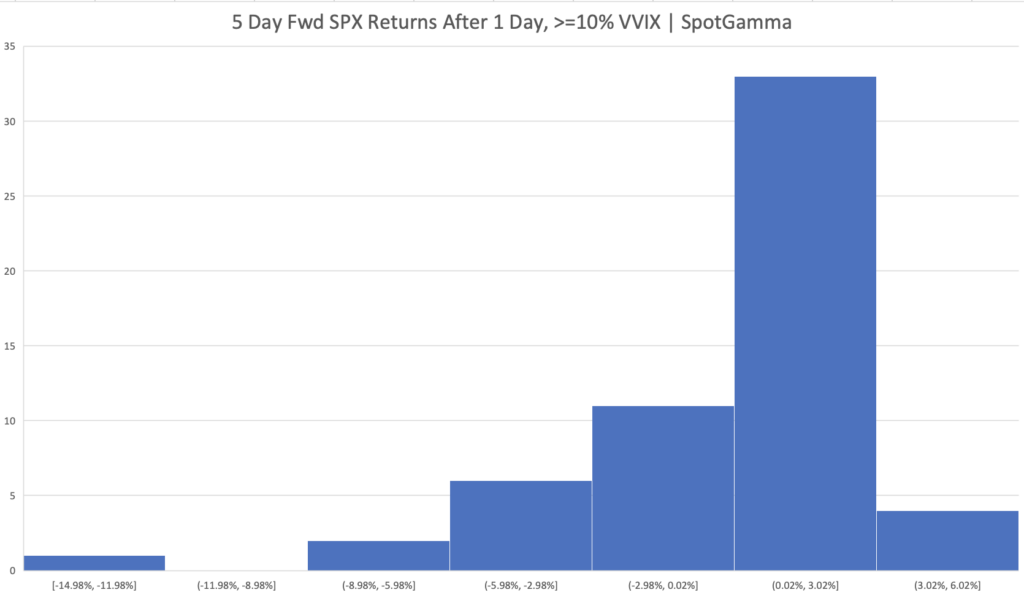

Digging in a bit further, we find a 50/50 chance of negative 1 day returns after a +10% VVIX move, but the odds of having a positive stock market return are quite strong over 5 & 10 day periods.

5 days ahead, the SPX is positive 37/57 times. 10 days ahead odds shift to 41/57.

Here is a histogram of the forward 1 day SPX return after a one day >=10% VVIX increase:

Here is a histogram of the forward 5 day SPX return after a one day >=10% VVIX increase:

Here is a histogram of the forward 10 day SPX return after a one day >=10% VVIX increase: