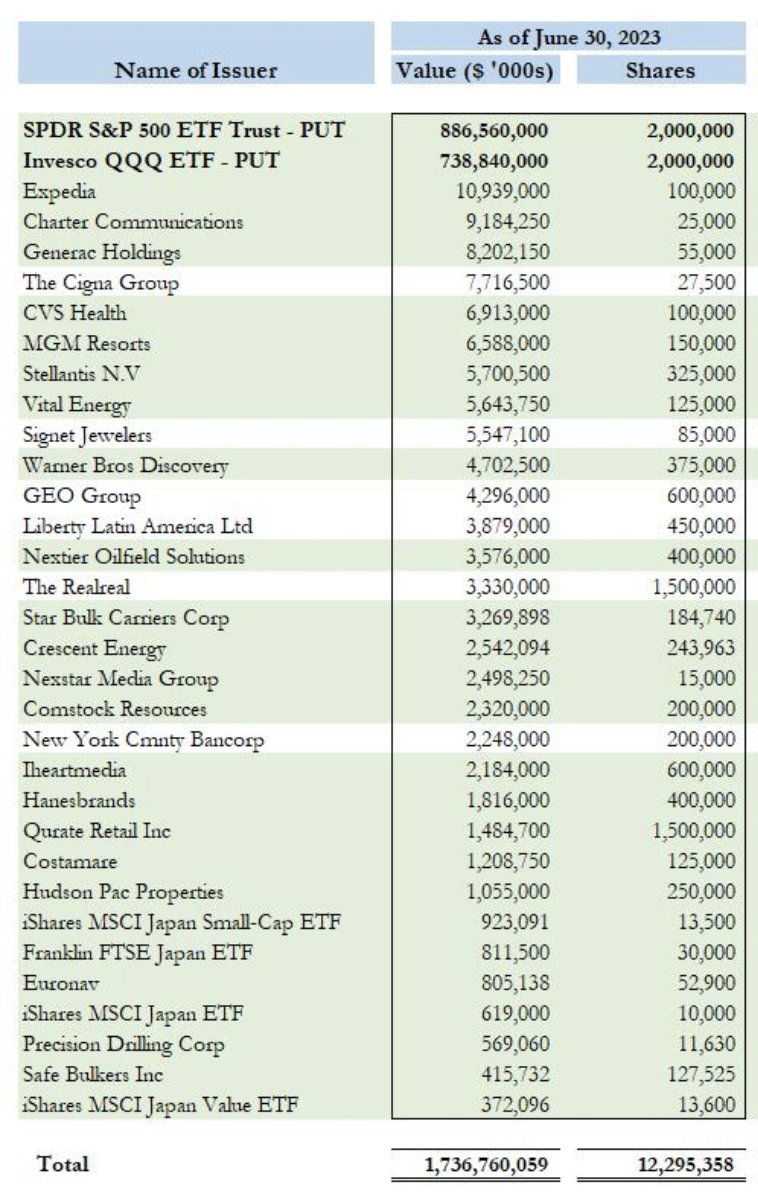

The media is excited about the recent 13F filing from Michael Burry, which suggests that he owns a large put position in the SPY & QQQ ETFs. However, the actually position is not that big.

This is due to the strange way that the regulators value options.

The dollar amount listed on 13F (middle column) is NOT the options premium value, but rather the value of shares the position represents.

Nearly all listed US options represent 100 shares of the underlying stock (100x multiplier), but the are not valued at 100 shares of stock. Therefore 13F filings grossly overstate the relative position size & value of options in a funds portfolio.

To illustrate this, we can back out the 13F SPY value in Burry’s quarterly report:

$886mm/2mm(top right column) = ~$443 which is roughly where the SPY ETF is trading on 8/14.

The reality is we owns 20k SPY puts (2mm/100), and 20k QQQ puts.

He likely spend in the $10’s of millions on these positions, which is a small fraction of Scion Capital’s $230mm AUM.