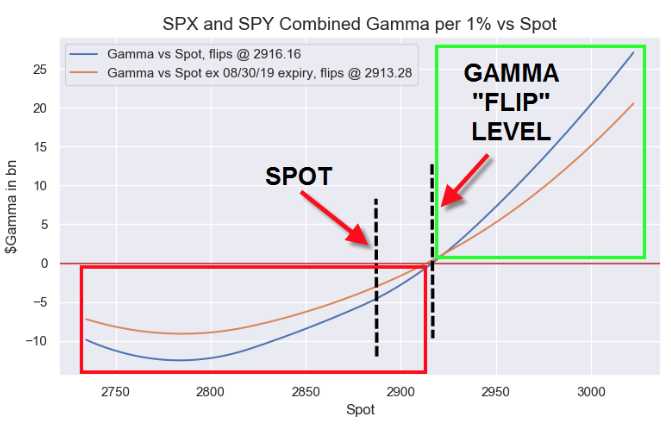

Don’t consider this grandstanding, but it highlights an issue with people bent on constructing a narrative around models. Recently a Nomura analyst put out some great research but seemed to be bent on making it bullish, when the data clearly says neutral. Nomuras latest gamma call shows output similar to our model in that Gamma is short under 2916 (we have 2900). What this data is telling you is this:

- Under 2900 a downdraft can happen quite quickly because dealers are short gamma. That means they will start selling if the market sells.

- Over 2900 dealers are long gamma. So they start to sell into a market rally, not with the rally.

No one can possible know what the next catalyst is and which direction the market is headed. We can all try to make a plan for various scenarios, and that is where the gamma models might help.