Monday August 24th 2015 was a memorable day and it seemed like a good idea for a quick review given how much the current market seems to be trading. This is not a prediction for a market crash. There were a litany of reasons credited with causing the crash ( go here to see). Markets were ugly the week leading into that Monday. What I recall the most were massive SPX options prints going off into the close that Friday. That made it pretty clear Monday was going to be wild.

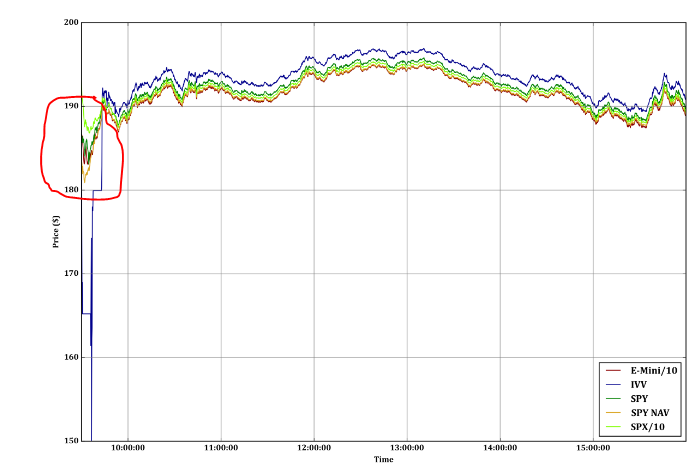

Futures went limit down (down >5%) at 9:25 on Monday and were therefore halted until 9:30. At 9:30 SPY opened and crashed down -7.8% by 9:35, then ripped up to be down only -4.2% by 9:40. The NYSE halted several names at the open because of volatility. This always creates problems because the S&P500 Index cant officially price until its components are open. So, you had SPY down -7% but SPX never registered more than -5% off.

The SPX had to be down more that -7% to cause a market halt. See the big gap in the chart where SPX (lime green) is several points above ES, SPY, etc. Note this breakdown between SPY/ES and the SPX price also happened in ’87 crash, and probably others.

If you were sitting in front of a trading screen that Monday the first 15 minutes you would have basically been lost. Options quotes were spotty to nonexistent (that’s if your software was able to publish) but also pricing anything was somewhat impossible because the SPX had not officially opened. By lunch things had “calmed down” meaning quotes were flowing and you could get your bearings.

A full SEC Report is here