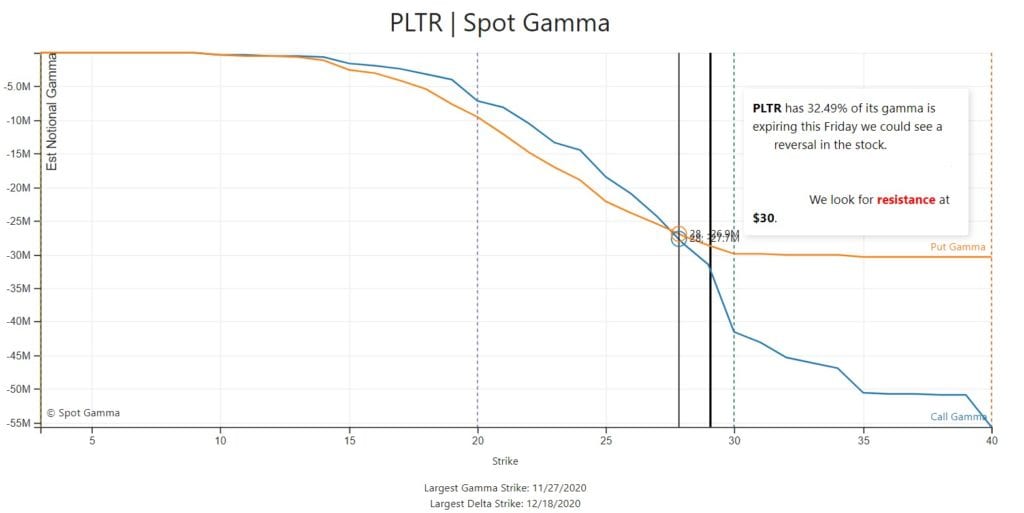

PLTR stock is up 20% today and as much as 80% in a week. While Citron has initiated a short into this rise, bullish Palantir posts are heavy on reddit/WSB. Our options data shows traders have concentrated their bets at the $30 strike, with a lot of that position expiring today, 11/27.

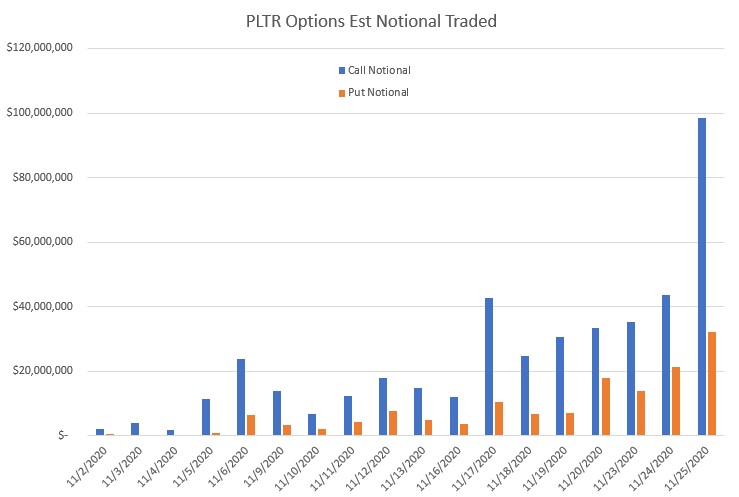

We mention this options position as its clear that calls are a major way traders are expressing their long views. As you can see below the estimated notional call volume* has grown sizably as the stock has soared. This increased call volume implies that dealers are having to buy PLTR stock, and continue buying it as the name increases in price.

Earlier this week our EquityHub data was picking up this surge in options activity. Consider Wednesday, wherein PLTR started with 745k contracts of call open interest. The call volume for Wednesday was 1 million, indicating a surge in new options positions. Buying pressure in the stock is likely to continue until call buying subsides, which which could reduce dealers long hedging position.

We’d mark Fridays as possible turning points in these names with heavy call buying. This is due to the large concentration of options positions expiring, which could lead dealers to unwind long hedges as those call positions roll off.

*notional value based on options mid last * volume