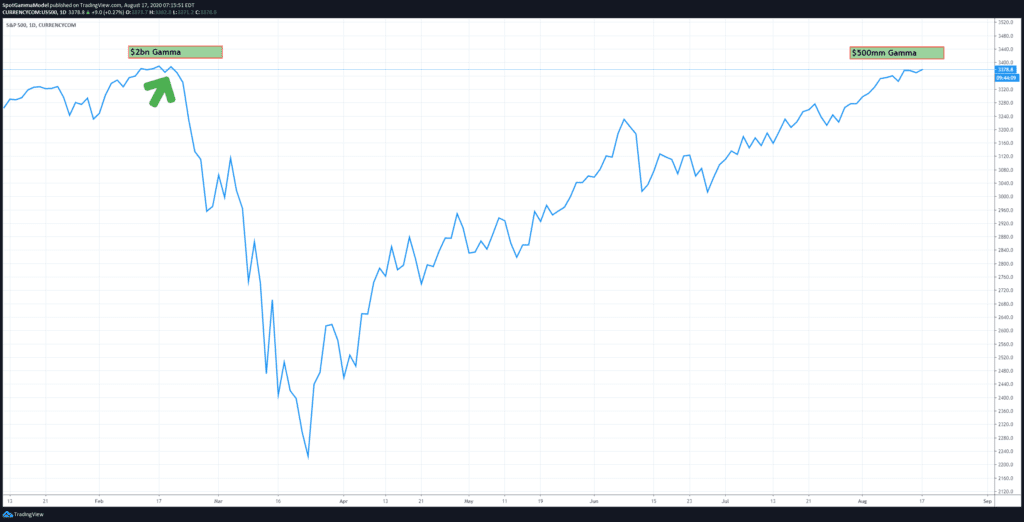

Its interesting too look back at where we were in February ’20 just days before the crash. Clearly things are different now, and we are suggesting a >30% drawdown (for one, the put fuel isn’t there). However its interesting to compare sentiment and data particularly as we have hit a double top just before a monthly SPX expiration which. Recall that the February crash started right on the monthly February expiration.

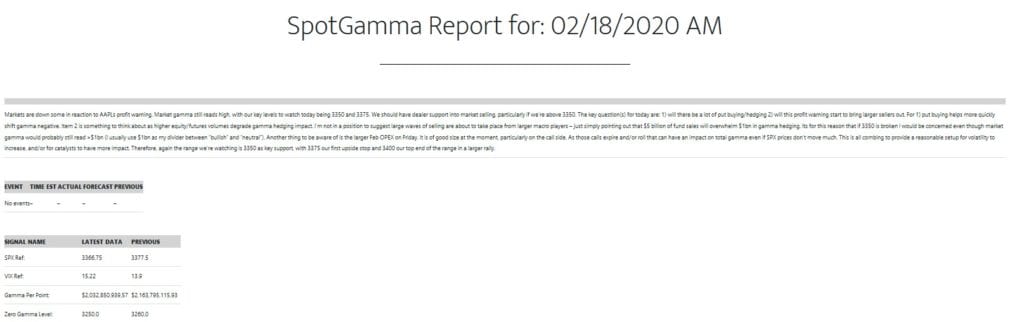

Markets are down some in reaction to AAPLs profit warning. Market gamma still reads high, with our key levels to watch today being 3350 and 3375. We should have dealer support into market selling, particularly if we’re above 3350. The key question(s) for today are: 1) will there be a lot of put buying/hedging 2) will this profit warning start to bring larger sellers out. For 1) put buying helps more quickly shift gamma negative. Item 2 is something to think about as higher equity/futures volumes degrade gamma hedging impact. I’m not in a position to suggest large waves of selling are about to take place from larger macro players – just simply pointing out that $5 billion of fund sales will overwhelm $1bn in gamma hedging. Its for this reason that if 3350 is broken I would be concerned even though market gamma would probably still read >$1bn (I usually use $1bn as my divider between “bullish” and “neutral”). Another thing to be aware of is the larger Feb OPEX on Friday. It is of good size at the moment, particularly on the call side. As those calls expire and/or roll that can have an impact on total gamma even if SPX prices don’t move much. This is all combing to provide a reasonable setup for volatility to increase, and/or for catalysts to have more impact. Therefore, again the range we’re watching is 3350 as key support, with 3375 our first upside stop and 3400 our top end of the range in a larger rally.

SpotGamma subscriber note 2/18/20