A better way to estimate volatility through a Gamma Lens

Here at SpotGamma, our extensive research and testing has led us to develop an improved method for forecasting market volatility. Our new proprietary model, called the SpotGamma Implied Volatility (SIV) Index, is based on our analytics around S&P 500 Gamma activity and related-movements in the underlying S&P 500.

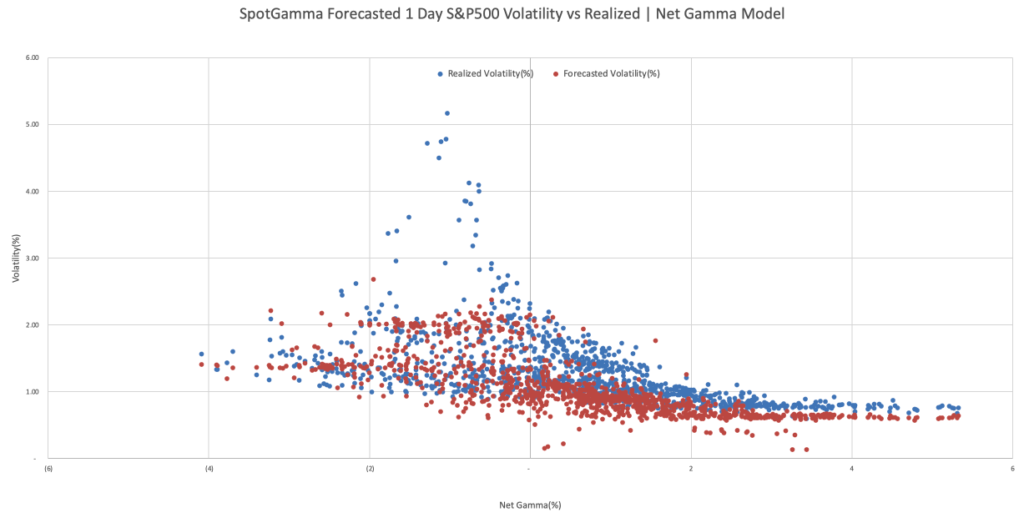

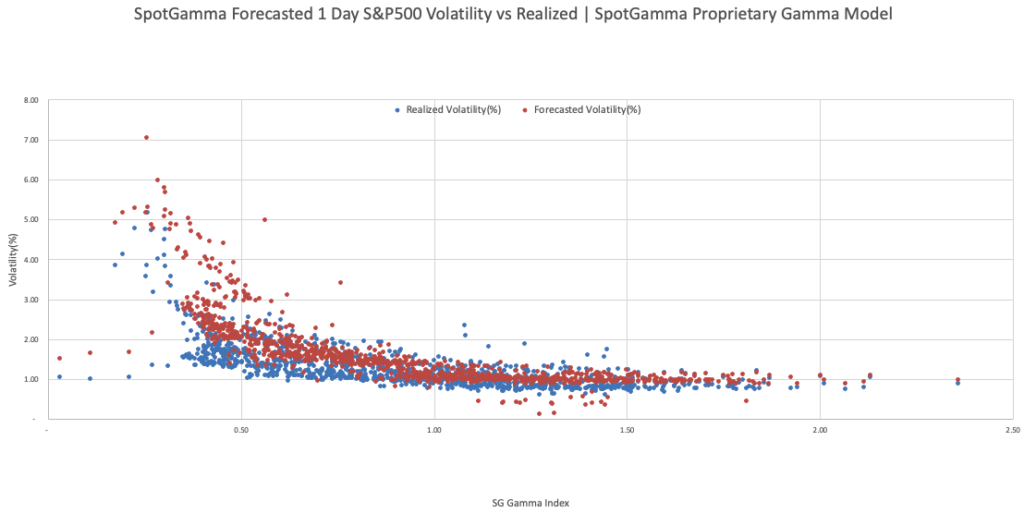

We believe basic Gamma Models need to be improved. Our research team has found a more accurate method to forecast market volatility by adjusting our Gamma models. This model unwinds many of the base assumptions made in those ubiquitous Net Gamma models, resulting in a much clearer picture, as seen below. The resulting correlation of r=82 suggests this new Gamma-derived volatility model is a significant improvement for S&P 500 volatility forecasts.

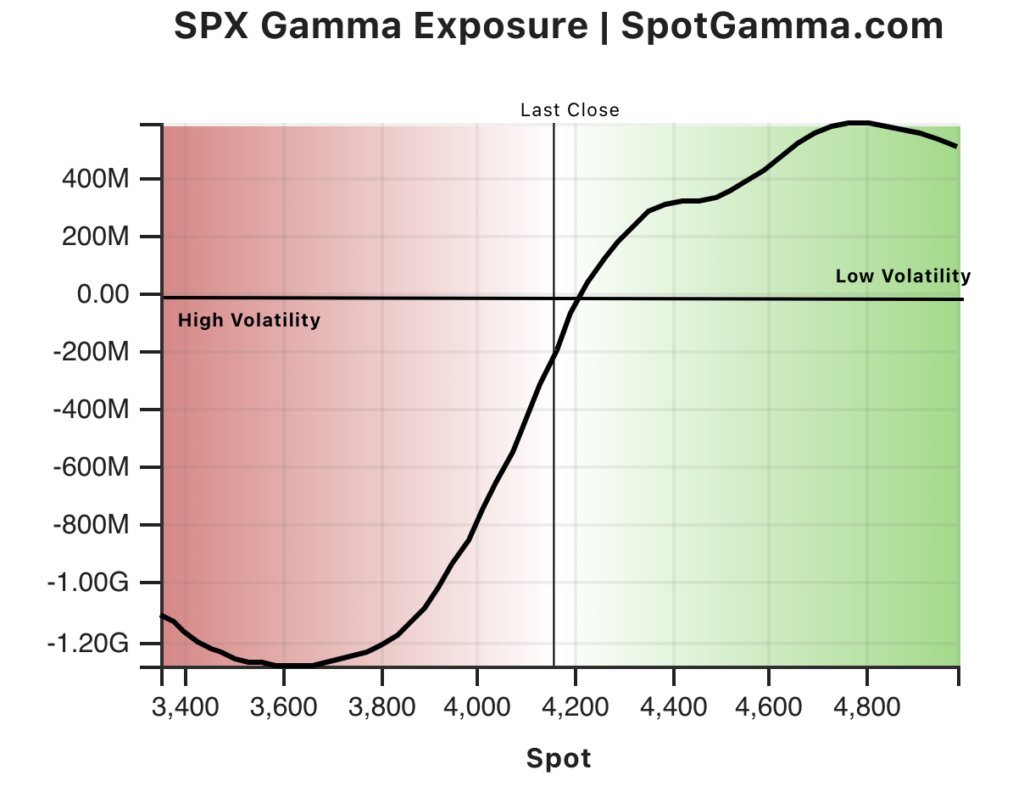

While we will continue to provide simple Gamma charts, they have limitations to how actionable they are without being evaluated within the scope of other market dynamics or combined with other tools.

Correlation of r=60 vs. r=82

Naive Gamma

SpotGamma Implied Volatility (SIV) Index

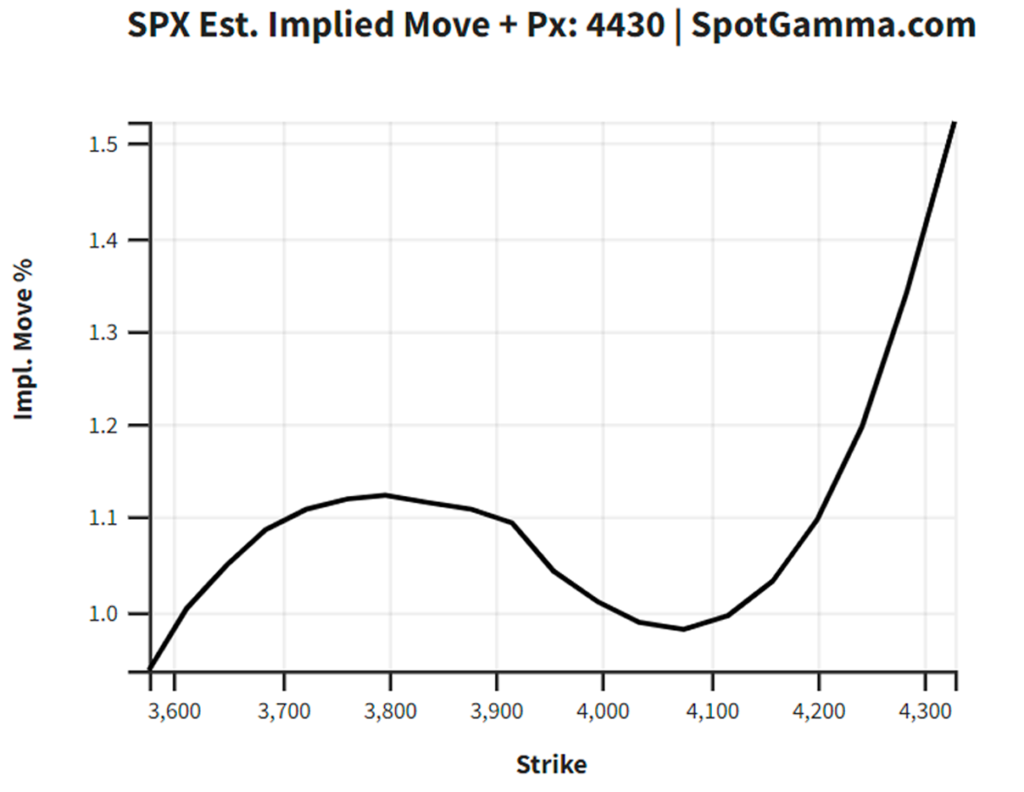

Now, the SpotGamma Implied Volatility (SIV) Index moves past the basic assumptions. We have applied proprietary methods that incorporate how the gamma implied volatility may change as the S&P price changes. This will result in more efficient market forecasts, improved volatility estimates, and highly-actionable trading intelligence.

Naive Gamma Chart

SpotGamma Implied Volatility (SIV) Index Chart

The SIV analysis is only available to paying subscribers. To continue to meet our mission of educating and empowering all investors, we will provide a simplified graphical representation of the naïve gamma curve free to all who may want to use it.