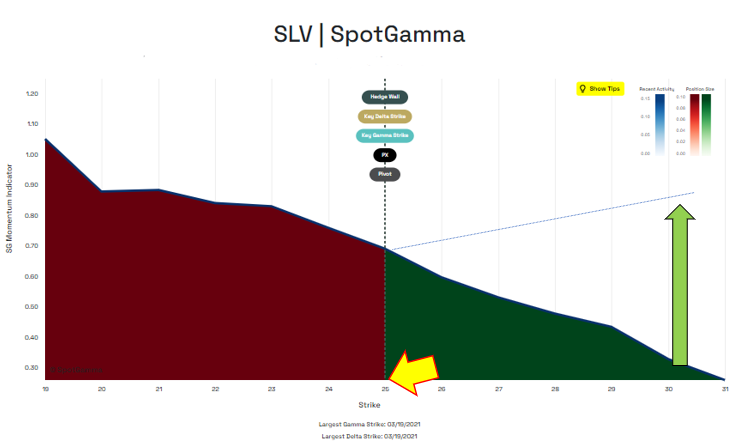

Silver prices were up over 5% last week as WallStreetBets switched its focus from stocks like GME and AMC, to silver and stocks like SLV and PSLV. As you can see in the chart below SLV surged on Thursday directly to the $25 strike, only to pin that level into Fridays close. $25 just happens to be the level at which the overwhelming majority of SLV gamma is placed, and so hedging flows are heavily tied to this price.

The graph below depicts where large options positions are located, and the potential effect on the stock. This data is sourced from our EquityHub tool. As you can see in the graph below, all of our key levels (descriptions) are held at the 25 strike (yellow arrow). The Y axis “SG Momentum Index” infers how much stock volatility may be induced due to options hedging. You can see that our model suggests volatility increases as the SLV price moves lower because the SG Momentum indicator moves higher as the stock price declines. This momentum is the effect of hedging into the concentrated put positions in and around the $20 strike.

If traders were interested in a “weaponized gamma” type move, they would want to see an addition of call options at strikes >25 which would shift the Momentum indicator higher as indicated by the green arrow and dashed line. The unique thing about buying an option is that it may induce a counterparty (who is short that option) to hedge their exposure in stock. Therefore many traders each purchasing a few hundred dollars of call options at the same time incents options dealers to buy thousands of dollars in stock.

The other metric which signals increased upward momentum would be a shift higher in the key gamma strike. This is the main strike level to which dealer hedging is tied, and so if that level moves to a higher SLV strike it implies dealer hedging will support a stock move up.

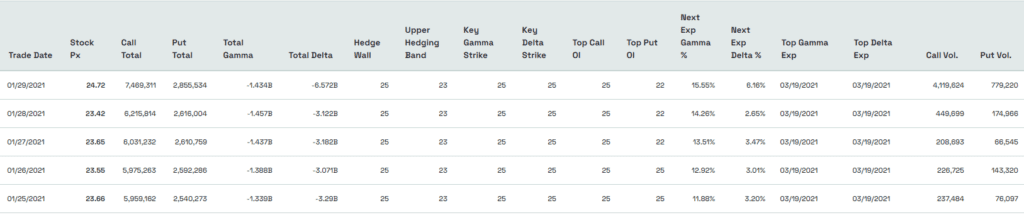

Below is a 5 day history of various options metrics in SLV. You can see that total call open interest (“Call Total”) steadily increased, implying an increase in bullish bets. Despite this, the “key gamma strike” did not move higher from 25 throughout the course of the week.

The SLV ETF has a massive amount of options tied to it and this is likely because the ETF can be arbitraged against silver futures. This means that if the price of SLV shifts higher(lower), traders may able to short(buy) the silver futures contract to arbitrage any price differences. This also means that it would take a large amount of options to shift that key gamma strike higher.

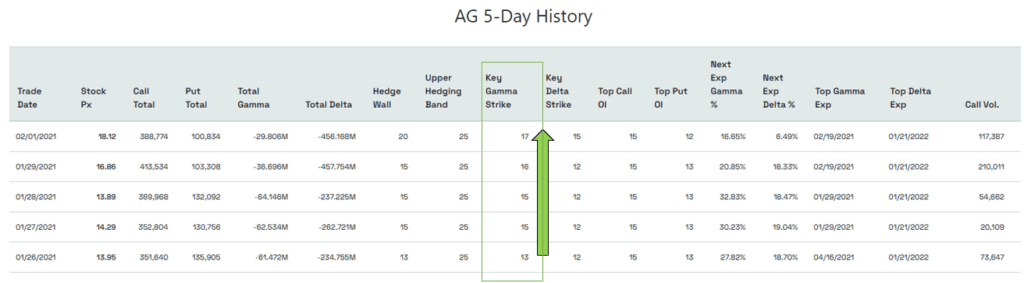

One of the reasons that the GME squeeze was so successful was that GME has a low stock float (small number of shares outstanding). Therefore each call option had a bit more pressure relative to a call option in SLV which has a massive number of shares outstanding. However, many of the mining stocks like AG and HL have small floats and could therefore be relatively more impacted by call buying.

Below we list the 5 day history for AG (First Majestic Silver). The key gamma strike column (green box) reveals that level shifted higher nearly every day this past week. This was in sync with the stock price which trended higher (second chart below).

As tailwind for SLV, AG and all metals stocks is that silver bullion demand is surging. We checked many popular bullion dealers to find nearly all silver coins “sold out” (1/31/21). Demand for the physical metal may feed back into silver futures prices which means that both silver futures and the SLV ETF could pressure the metal price higher.