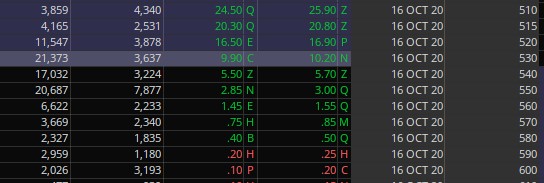

Call buyers are out in full force in ZM. Going into today there was ~250k calls outstanding. Today so far we’ve seen 150k calls trading, with 520-550 strikes in tomorrows expiration particularly active. Note below the 10/16 expiration call volume (left col) is heavily outpacing open interest (2nd from left).

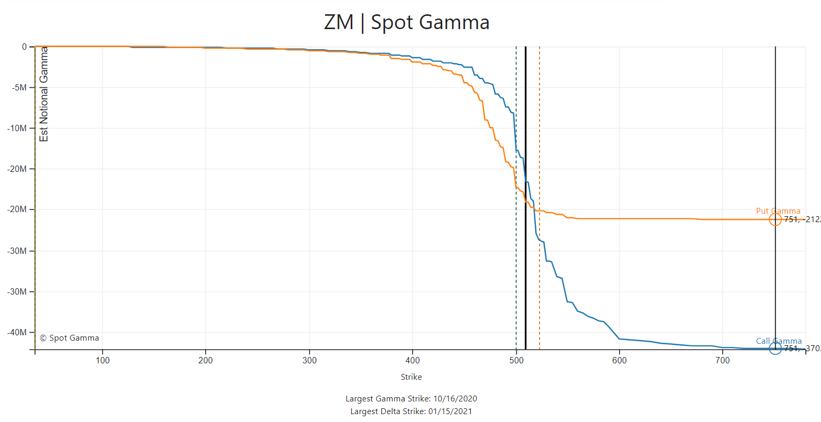

Going into today our EquityHub model showed dealer negative gamma increasing sharply over 500. With the addition of todays call volume it appears that day traders are trying to gas this name higher. As >50% of the gamma expires tomorrow we could see a reversal into next week.