From ZH:

Earlier today we discussed last week’s “very large” options expiration, which as SpotGamma calculated sparked a ~50% reduction in single stock gamma, which on one hand has left markets vulnerable to short-term volatility but on the other – as Nomura’s Charlie McElligott poetically put it – sparked a “gamma unchlenching” as evidenced by Friday morning’s near -1.5% peak-to-trough decline in ESA, a -2% high-to-low move in RTYA and a -1.5% hi-lo move in NQA post Friday’s Op-Ex index settlement, as those previously insulating Dealer hedging flows were reduced as options expired.

So with opex out of the way, dealers are once again roughly Gamma neutral; echoing what we said earlier, McElligott notest that this “means it would not take much of a pullback to pivot towards Short Gamma “accelerant flows” to the downside, especially as now we hit peak “buyback blackout” into EPS, as well as the historically “negative” forward returns that come with “higher” earnings revisions.”

While that is the risk scenario, in the meantime we are enjoying all the benefits of renewed euphoria after last week’s selloff with equity implied vols “again getting hammered into Wednesday’s VIXpiry” with McElligott observing that “UX1 is already down 1vol this morning, while broad cross-asset markets look like resumption of recent thematic trend—USD lower vs Risk FX & Crypto, UST yield curves bear-steepening, Commods generally higher, RTYA (Cyclical Value) > NQA (Sec Growth / Duration-Sensitivity / LT Momentum).”

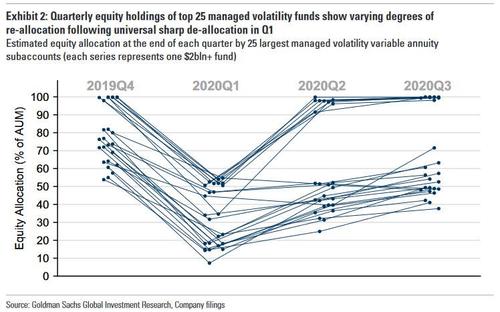

There is one potential caveat here: as Goldman discussed last week, as a result of the decline in VIX, managed volatility and vol control funds are rapidly approaching full equity allocation after the Q1 2020 VIX shock. As a reminder, among systematic macro investors, managed vol funds are large (they account for roughly $200bln ofAUM) and important, since vol itself is the key input to their asset allocation decisions. As such, any renewed spike in VIX could lead to much more aggressive deleveraging and further market downside.

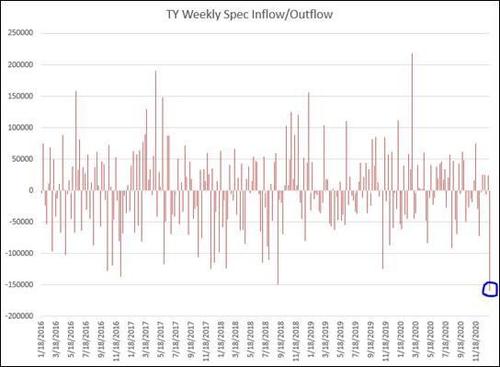

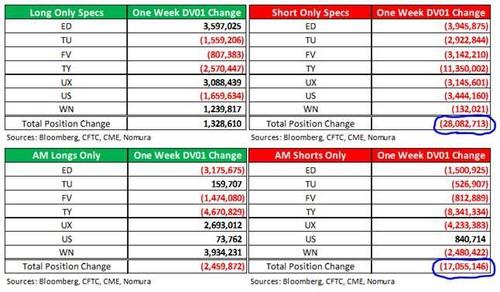

So while we wait to see which way dealers flip now that gamma is no longer a market driver, McElligott points out “some remarkable CFTC data” which confirms the “buy-in” to the fiscal reflation + renormalization theme, with the latest Committment of Traders data showing “the single-largest TY spec sale on record following the GA Senate Blue Wave Lite outcome—but more granularly and highlighting the concentration of the selling, with almost 2/3 of the selling coming via “Top 4” holders of the contract, stating that “…we feel confident that bulk of the selling pressure was driven by either one or a few large money managers who continues to press a growing short interest” off the back of the long-term narrative of inflationary risks + a potentially massive jump in net supply with the new Administration’s aggressive policy agenda.”

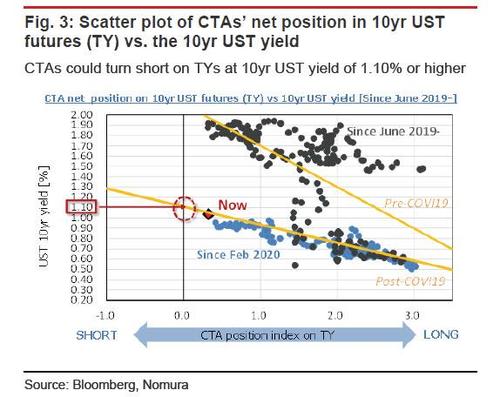

This also confirms what we noted two weeks ago, when we warned that CTAs would start shorting TY when the 10Y yield rose above 1.10%, to wit: “CTAs could turn short on TYs out of a surplus of momentum. In such an event, however, 10yr UST yields would need to remain above 1.10% at least.”

And while none of that is news to regular readers, Charlie points out something that was “potentially lost in the fog of the MLK holiday weekend, with significant implications for Global Rates, Yield Curves and Equities Thematic Factor tie-ins”, was the flurry of BoJ-tied “policy trial balloons” which “effectively hint at a common BoJ desire for higher intermediate and long-end Yields (but done so in a fashion which won’t stoke market fears of “tightening,” lololol good luck with that)“, the Nomura strategist chuckles. Among these are:

- A weekend report from JiJi that the BoJ will pursue a wider trading band for 10Y JGB yields;

- A Reuters sources piece saying that the BoJ too will consider loosening its grip on YCC to allow for super-long interest rates to rise more in an effort to aid pension- and insurer- returns;

- An MNI report that the BoJ is also considering options for longer easing policy…. thus forcing the Central Bank to then pursue measures which could then mitigate the impact of negative rate policy on banks’ profitability—such as boosting the “Macro Add-on Balance,” with a positive interest rate applied to banks meeting appropriate lending criteria, in order to contribute to financial institutions’ profitability and thus, stability.

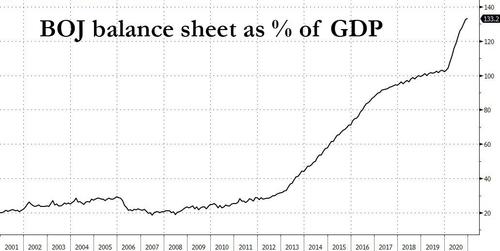

While all these are admirable, the fact is also that none of them are even remotely possible to execute for the central bank whose balance sheet is now a record 133% of Japan’s GDP…

… which means that it is very likely that in the very near future we will have another central bank inspired global coordinated rates tantrum, which will then force central banks to double down with much more QE (as a reminder, the Fed needs a new crisis to double its QE for 2021 which at the current pace will barely monetize half of the upcoming net Treasury issuance).