This podcast episode features a conversation with Charlie McElligott, a cross-asset macro strategist at Nomura. The discussion revolves around recent market volatility, particularly the significant selloff and shifts in volatility dynamics. McElligott explains how the flattening of the skew, a measure of demand for downside versus upside protection, and the bid on volatility of volatility […]

nomura

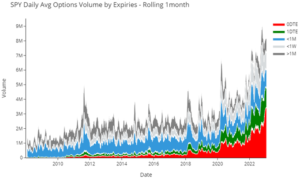

Nomura on 0DTE Options Volumes

From Eric Wallerstein @WSJ: “Nomura’s Charlie McElligott on 0DTE options: Volumes aren’t inherently a sign of apocalypse: flow can exacerbate intraday moves, BUT much of the volume likely electronic market makers trading for risk positioning, creating noise that can ‘net out’.” “However, potentially an arbitrage opp because no need to post margin with prime brokerages […]

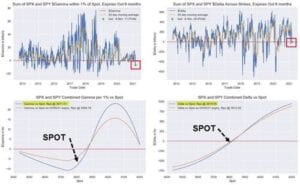

Nomura: US Stock Markets Are “Stuffed To Death On Options Gamma”

BY TYLER DURDENWEDNESDAY, MAY 26, 2021 – 11:55 AM It may not feel like it, but the market is pretty much dead: as we noted last night, Tuesday’s consolidated volume just tumbled to the lowest of 2021, while total options volume yesterday was 540,000, which was less than Christmas Eve and also the lowest volume […]

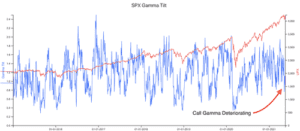

‘Gamma Tilt’ Suggests More Downside In Stocks As “Bigly” Op-Ex Looms

From ZH: BY TYLER DURDENTHURSDAY, MAY 20, 2021 – 11:15 AM Nomura’s Charlie McElligott summarized things heading into the weekend perfectly for traders: “Op-Ex tomorow matters ‘bigly’ for Equities.“ Critically, he explains, there remains likelihood of continued “chase-y” moves in both directions on dealer delta hedging due to the magnitude of the positioning out there: Latest estimates show […]

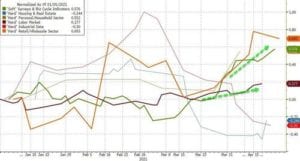

ARKK Gamma & What’s Really Behind The QQQrash? Nomura Gamma

From ZH: Nomura’s “futures imbalance” monitor showed enormous sell pressure all day in NQ futs across all lots sizes (the largest in at least 1m), but particularly in our medium- and large- lot buckets, proxies for large HFs and Asset Managers aggressively selling / shorting… Two things were behind the QQQcrash – ARKK’s vicious circle and CTA Deleveraging. […]

Nomura’s McElligott Talks Gamma on Macrovoices

Charlie McElligott talks several macro themes, and digs into deal gamma around the 44:30 mark. Topics include gamma flips, CTA deleveraging levels, and the large gamma dynamic.

“Banging Between Big Strikes” – Levels To Watch Ahead Of FOMC Statement

BY TYLER DURDENWEDNESDAY, APR 28, 2021 – 01:25 PM As we detailed overnight, today’s FOMC is widely expected to be “steady as she goes” with Biden conveying that the FOMC is not yet thinking about shifting its dovish stance. The only “risk” associated with today could be a “semantics” acknowledgement of better data (though we note the […]

Nomura Gamma Update

A “Fairly Rare Phenomenon” Occurs In Equity Options Land BY TYLER DURDENMONDAY, APR 12, 2021 – 10:15 AM US equity futures have traded the high to low range of Friday’s late-day meltup mania since they opened last night as a modest Asian derisking (following disappointing Chinese credit data, particularly with concerns surrounding the sharp decline of […]

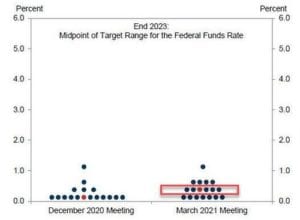

Pre FOMC Nomura Gamma Update

From ZH: With less than 24 hours to go until one of the most closely watch Fed announcements in a long time, the VIX finds itself hanging just below 20, the gamma gravity in the S&P is at 4,000 while dealers remains short Nasdaq/QQQ gamma (which however is shrinking by the day). In short, depending […]

Nomura: “Max Short Gamma” Pain… But Relief Is Coming

Via ZH: Earlier this week we pointed out a bizarre divergence in the “greeks” – while the Nasdaq had slumped into negative gamma territory, which is where dealers are forced to sell more as the Nasdaq slides lower creating a feedback loop where selling begets selling, even as the S&P still remained in positive gamma […]