$544 Billion In Options Expire Today: Here’s What Will Move

While it’s not quad (or even triple) witching day, today’s a whole lot of weekly options will expire, may of which will be worthless, and others will be providing a supporting “pin” to underlying prices. It’s why, even though we are enjoying a beautiful spring week, Goldman notes that single stock options trading activity is elevated relative to historical levels. To wit, daily options volumes are up 70% in April, up from YTD lows of $2.4bn on 30-Mar.

In total, across single stocks, $544BN of options are set to expiry today, including $305BN calls. As such, today’s expiry could be important for stocks with large open interest in at-the-money(ATM) options, as market makers delta-hedging their unusually large options portfolios will be active. This flow is likely to dampen volatility in some names while exacerbating stock price moves in others.

How to trade this?

As Goldman’s Vishal Vivek writes, at major expirations, options traders track situations where a large amount of open interest is set to expire. In situations where there is a significant amount of expiring open interest in at-the-money strikes (strike prices at or very near the current stockprice), delta-hedging activity can impact the underlying stock’s trading that day. If market makers or other options traders who delta-hedge their positions are net long ATM options, expiration-related flow could have the effect of dampening stock price movements, causing the stock price to settle near the strike with large open interest. This situation is often referred to as a “pin” and can be an ideal situation fora large investor trying to enter/exit a stock position. Alternatively, if delta-hedgers are net short ATM options (have a “negative gamma” position), their hedging activity could exacerbate stock price moves.

What that means it expiration-related trades may cause trading activity to aggressively pick up for stocks with a significant amount of ATM open interest.

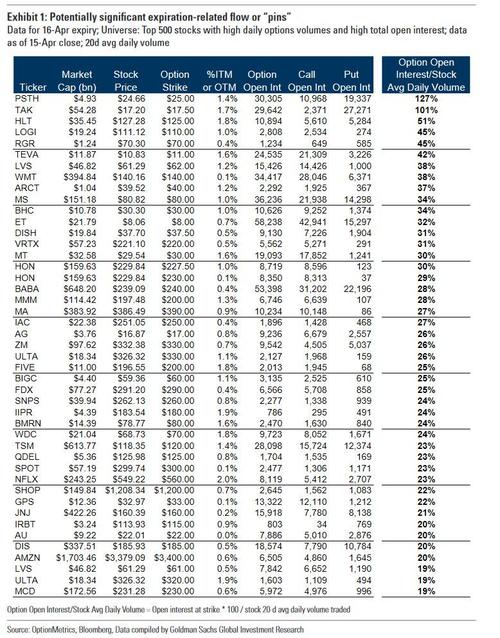

So to help traders looking to hop on for daytrading opportunities, here is a table identifying possible focus stocks with large ATM open interest expiring today, which is compared to the average daily volume of the underlying stocks. As Goldman puts it, “expiration-related activity is likely to have more of an impact if the open interest represents a significant percentage of the stock’s volume.”

Finally, for what it’s worth, this morning our friends at SpotGamma write that this has been a rather strange OPEX cycle, “with a consistent almost mechanical bid pushing markets higher. We’ve not seen the Call Wall “breached” this many times before, but there are other aberrations that we’ve mentioned in previous notes – like net put sales. We’ve got some theories on this we are posting in a longer form piece.”

According to SG, because implied volatility has now compressed (ie VIX at new lows) there is now more potential for “long term” volatility. Recall how as of late any sharp, violent drop in markets was bought so quickly (see chart below). These bursts lower coincided with record VIX spikes, but a reflective snap-back bid would bring a market recovery of equal force as the VIX (i.e. implied volatility) reversed.

And one other curious observation from SpotGamma:

When implied volatility is very high, its very sensitive to market moves and also signaling that markets are expecting more large moves ahead. As soon as markets would pause or catch a support level, that implied volatility would quickly reverse lower. We often think of this analogy that if a shark stops swimming, it sinks ( partially true!). If the market stops dropping then Implied volatility sinks.

With this, as we often talk about, lower implied volatility (ie lower VIX) signals market makers have to buy back short hedges which fuels rallies. SG’s conclusion: this current level of lower implied volatility now gives the market more downside firepower. Starting with a lower implied volatility “slows down” that responsive “snap-back” buying mechanism. Additionally, gamma is higher when IV is lower so gamma flips may have more juice.