Much has been made recently of the ominous “options gamma trap” and its potential effects in stock markets.

What is an Options Gamma Trap?

An options gamma trap is when options dealers are positioned “short gamma” and cause large swings in the stock market. To hedge a short gamma position you sell stock when the market is dropping and buy stock when the market is going up. Therefore any move in the market could be compounded because dealers must hedge in the same direction as the market.

It becomes a trap when the selling leads to more put buying – which puts dealers short more puts and hence having to sell more futures. Typically these scenarios also lead to higher implied volatility levels (eg VIX) which increases put values, leading to more dealer selling.

Gamma Trap Example

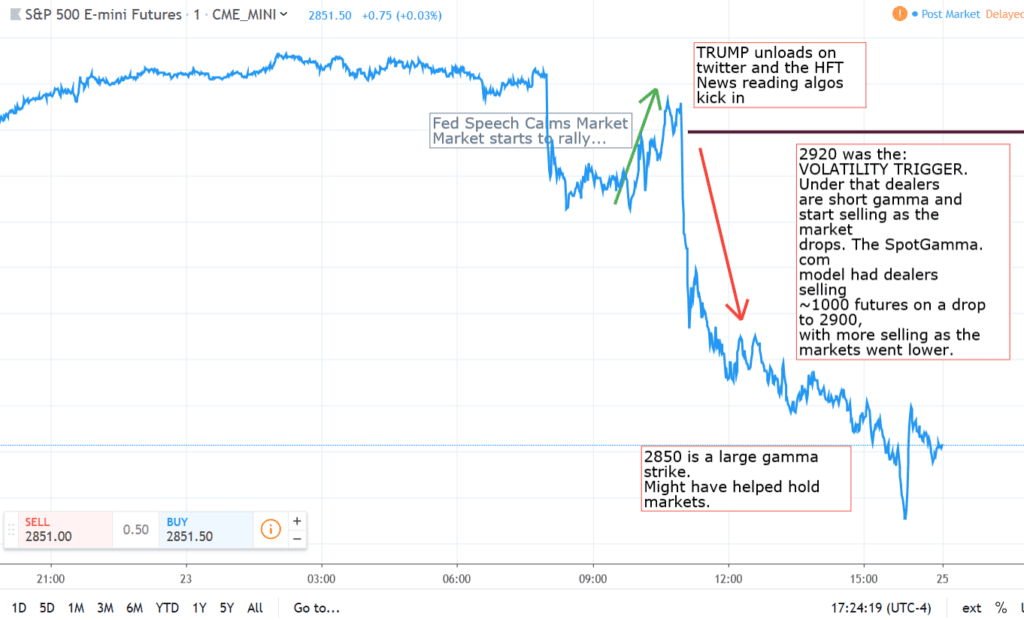

Below is a chart from a recent trading day highlighting the effects of short gamma. On 8/26/19 our model estimated that dealers would go from long gamma to short at the 2920 level in the S&P500. A sudden Trump tweet caused a drop in the markets and “gamma trap” (see more here).

Can You Predict Gamma Traps?

By analyzing the open interest in the underlying index or stock, and making a few assumptions you can estimate how dealers may be positioned. Based on this you can possibly estimate a level at which options dealers go from “long gamma” to “short gamma”. SpotGamma refers to this as the Volatility Trigger.