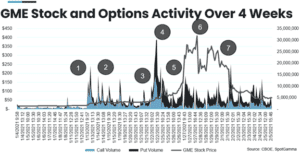

In late January 2021, GameStop experienced a once-in-a-decade squeeze that has captivated the world’s attention. This was a premeditated and programmatic exercise, orchestrated by coordinated stock and option buying across the retail and professional community, that resulted in large institutional entities losing billions of dollars. These investment houses with significant short positions did not expect a stock with […]

options gamma

Silver Has Some Gamma!

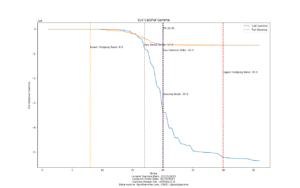

A few days ago we posted the following chart and comment on Twitter about the Silver ETF, SLV: $SLV running and could be gathering momentum. Seems like there are a fair a amount of calls up into 20’s. If those are net long calls that could help keep it running. I do have silver & […]

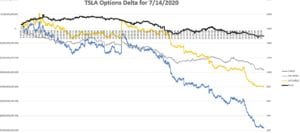

TSLA Options Deltas

We show TSLA having the 1500 as the key options strike going into Friday 7/17. The stock yesterday breached 1750 before pulling back to 1500. Its clear the options flow changed when the stock tagged that 1750 area as you can see in the chart at bottom. Friday will such and interesting date fore the […]

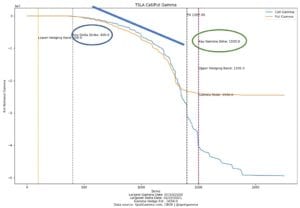

TSLA Convert Bonds Options & Gamma Traps

We think that much of what has pushed TSLA’s massive runup in price has been a “gamma trap“. The idea being that in-the-money long calls and new long call positions force dealers to buy the stock as it goes higher. Our model detects a lot of very deep in the money <=400 strike calls, which […]

The Options Magnet

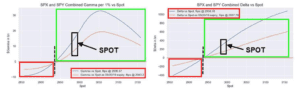

We theorize that strikes with a high amount of options gamma combined with high options volume at that strike(s) can influence the SPX to that level. This something similar to an options “pin” but we think of it more as a “magnet”. You can see in the chart below that the 2800 strike has a […]

Nomuras Options Gamma Update for September

The “Heisenberg Report” posts notes from Charles McElligott and his Nomura Options Gamma update for September. Its posted here to cross reference what our model derives. Now that the extreme long gamma dynamic that was pinning the index has rolled off, it’s possible things can start to move in earnest. On the upside, McElligott flags […]

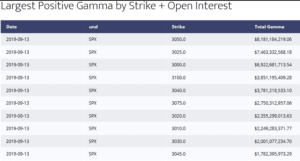

Large Options Gamma Roll 9/20/19

September 20th has a large options gamma roll ahead in the S&P500 (SPX, SPY). There are substantial call and put positions and there was obviously a lot of movement up this month. We also have the Fed which is expected to lower rates by 25 bps. This could provide a market catalyst just as large […]

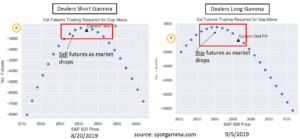

Short Gamma vs Long Gamma

As dealers were short gamma for most of August they have moved to long gamma. Below is a chart comparing their theoretical behavior in each gamma regime. You can see when dealers are short gamma and the market is falling they are trading with the market, fueling the drop. Conversely when long gamma they are […]

Long Gamma Kick Save 8/30/2019

There have been lots of short gamma charts lately but today’s action looked like a long gamma kick save. News about Iranian enrichment pushed the market down at ~11EST and there was a decent drop to ~291 – a dip that was bought. The previous close was 292.5 and we model that because of the […]

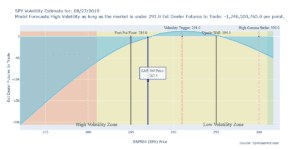

SPY Gamma Market Outlook

TradingView SPY Chart With Gamma Range Based on our options gamma model we see 285 in SPY as a decent support level due to size of put open interest. At the top of the range sits the volatility trigger level aka “zero gamma”. Options dealers will be buyers up to that level, but transition to […]