Macro Theme: |

Key Levels: |

| Macro Note TBA | Reference Price: 4045 SG Implied 1-Day Move: 0.9% SG Implied 5-Day Move: 2.55% Volatility Trigger: 4020 Absolute Gamma Strike: 4000 Call Wall: 4200 Put Wall: 3900 |

Upcoming Market Events

Tuesday, March 07 (10am EST): Fed Chair Powell speech

Wednesday, March 08 (10am EST): Fed Chair Powell hosts Q&A

Friday, March 10 (Friday at 8:30am EST): Nonfarm Payrolls

Tuesday, March 14 (Tuesday at 8:30am EST): CPI

Wednesday, March 15 (Wednesday at 8:30am EST): PPI

Friday, March 17: Monthly Opex (Quad Witching)

Wednesday, March 22 (Wednesday at 2pm EST): Fed Interest Rate Decision

What’s Happening Today in the Market

We saw liquidity forming at our combo 1 at 4100 combo 2 at 4050. These are our two strongest combo levels, but only combo 1 interacted with the price, as equities sold into the end of the day.

We are still well above the Volatility Trigger

Gamma Spotlight

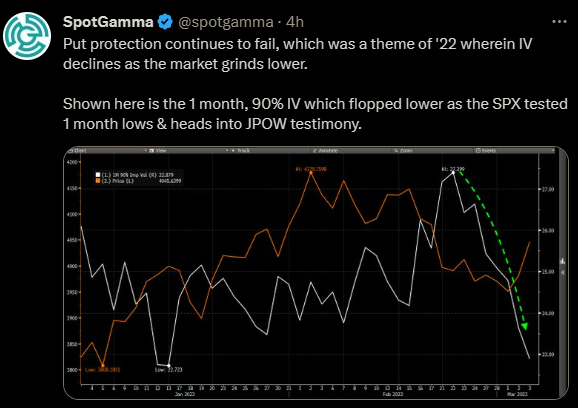

In case you missed it on Twitter today, we shared a visual comparing the relationship of implied volatility (white) to the underlying (orange) on SPX. What the green line shows is how a crushing of IV has connected to at least a relief bounce for equities. But what we can also see is that leading into it, implied volatility bled along with the underlying, which is very hard on puts. If that happens long enough, then it is reasonable to expect an eventual vanna rally—as put holders cannot take the heat any longer and begin closing out their positions. This initiate bullish delta flows in the market since the reflexive action is for dealers to buy shares after their counterparty holdings of short puts are closed.

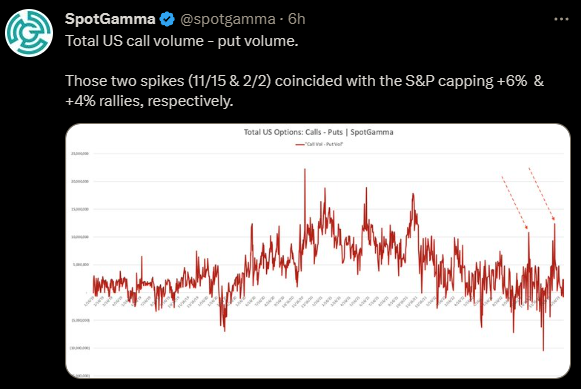

As another observation we highlighted today, the market just recovered from another spike in call volume:

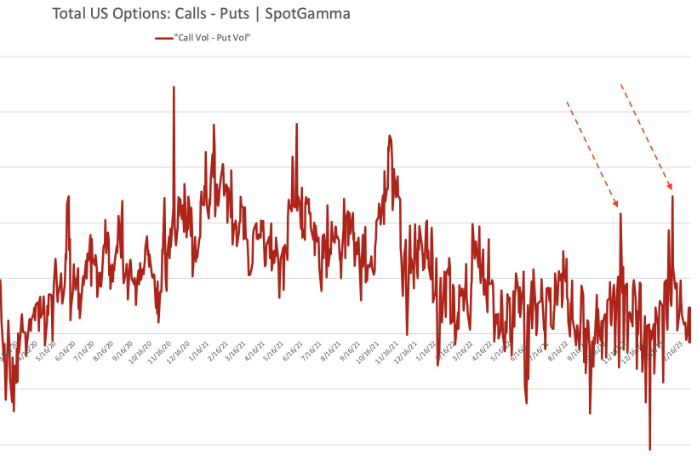

Zooming in, we can see that this spike in call volume happened toward the very beginning of the year, when sentiment had a different tone and we did not yet have the information of the higher (and longer) projected ceiling for interest rates.

In the future, this could potentially serve as a contrarian indicator if we see a spike. Likewise, if call volume gets low enough, and we confirm that call skew has also become low enough, then on mean reversion alone one might be able to frame a trade around that. We will be keeping an eye on this along with the rest of the mix.

Largest Catalysts of the Day

Bearish: In the premarket, a European Central Bank (ECB) policy member expected that they would need 50bp consecutively over their next four announcements. Along those lines, Nomura raises their forecasted rates for the ECB.

Neutral: The Fed Funds rate is unchanged today.

Neutral: US Factor Orders came in today within the range of expectations. This was a slight beat with a low bar at -1.6% actual (-1.8% consensus and 1.8% previous).

Details on the Catalysts

ECB Policy Maker came out this morning to show his support for them using 50bp over the next four announcements.

Source: https://www.reuters.com/business/finance/ecbs-holzmann-calls-four-more-50-bps-rate-hikes-handelsblatt-2023-03-06/

One main concern for is that there would not likely be much divergence (or at least sustained divergence) between the central banks. And so if Europe gets too tight with their monetary policy than the US could follow. There is also a matter of currency competition here, since, for example, if the US dollar gets too strong because of monetary policy, and most of the world’s currencies are pegged to the dollar, then then this can cause relative inflation for non-US currencies.

And then, making this more of a concrete reality than just hawkish banter from officials, Nomura raised their forecast for the ECB terminal rate to 4.25% by July. This was up from 3.50% previous!

What the Models Are Telling Us

From our Equity Hub view of SPY, we can see just how strong the Put Wall is at 390. As Chair Powell speaks over the next couple days, and everything goes off the rails, then this would be a probably target as the reasonable lower bound for wider price action.

This could create a support/resistance setup to go long if the price begins to interact with the Put Wall, but generally when making suppport/resistance trades we want to have stop losses or other checks with risk management in case that level ends up breaking.