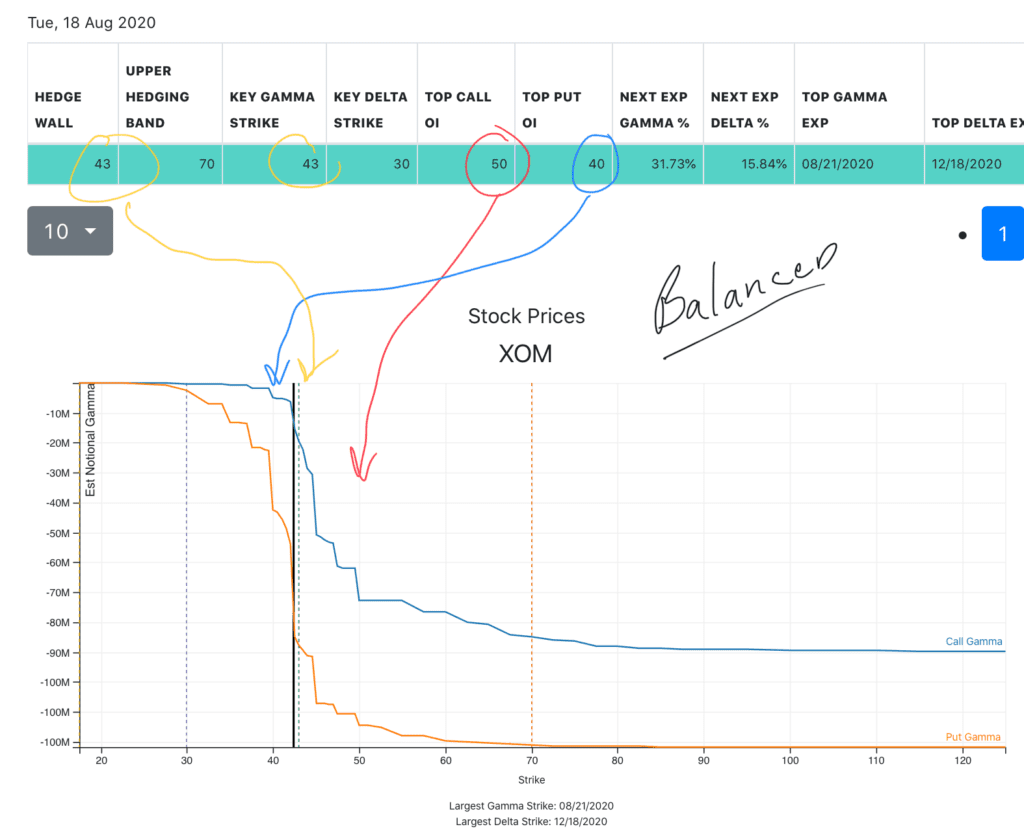

A member requested analysis of XOM which you can see below. It appears the gamma has sort of a “straight jacket” on XOM with large put interest at 40, large call interest at 50. Our Hedge Wall picks up a change in hedging behavior at 43, which indicates that’s a key level in the stock.

You can see for the past month even through earnings (red E on chart) and a dividend (blue D) the stock has mean reverted right around this 43 strike. This may change slightly after this Fridays options expiration as ~30% of the gamma in this name expires.