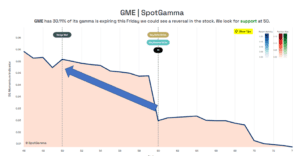

On 2/1 with GME stock at $225 we wrote about how options dealer flows could result in the stock dropping to the $60 strike. We highlighted this strike because it was where the largest concentration of options were placed (from a gamma perspective). You can see that is is precisely what has played out: This […]

options pin

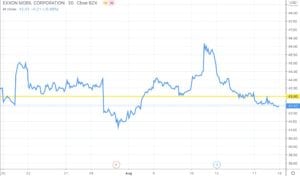

XOM Balanced Options Position

A member requested analysis of XOM which you can see below. It appears the gamma has sort of a “straight jacket” on XOM with large put interest at 40, large call interest at 50. Our Hedge Wall picks up a change in hedging behavior at 43, which indicates that’s a key level in the stock. […]

WKHS Options Pin 8/14/20

WKHS seemed pinned to $15 where we mark a large amount of options gamma.

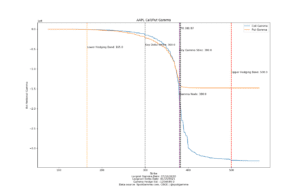

FAANG Options Expiration Gamma Pin

Our equity analysis models are in BETA but as we watch the data come in we pick up on a few interesting things. One of those was today when 4 our of the 5 FAANG (AAPL, AMZN, NFLX, GOOGL) names have their highest “gamma expiration” today: 7/10/20. Whats also interesting is that at the time […]

SPX Same Day OPEX

We ran a detailed analysis of the impact of same day options expiration volume vs open interest and the effect this may have on “pinning” the market into the close. Some may also refer to the idea as “options max pain”. You can read it here but we thought it was worth showing the effect […]

The Options Magnet

We theorize that strikes with a high amount of options gamma combined with high options volume at that strike(s) can influence the SPX to that level. This something similar to an options “pin” but we think of it more as a “magnet”. You can see in the chart below that the 2800 strike has a […]

The Option Pin / Sticky Strike

Friday (4/3/20) was an interesting day in the S&P500 market due to its rotating action around the 2500 strike. We had several data points that led us to believe that this strike would be key to the action on Friday and wanted to highlight those points. Most of these charts are only available to subscribers […]

How an Option Pin Plays Out

The current October options expiration portrays how an options pin can play out. For several days we have seen 3000 as our high gamma strike, with options volume at 3000 strike dominating the market. As the market moves away from this strike options dealers and other options hedgers move the price “back in line” to […]