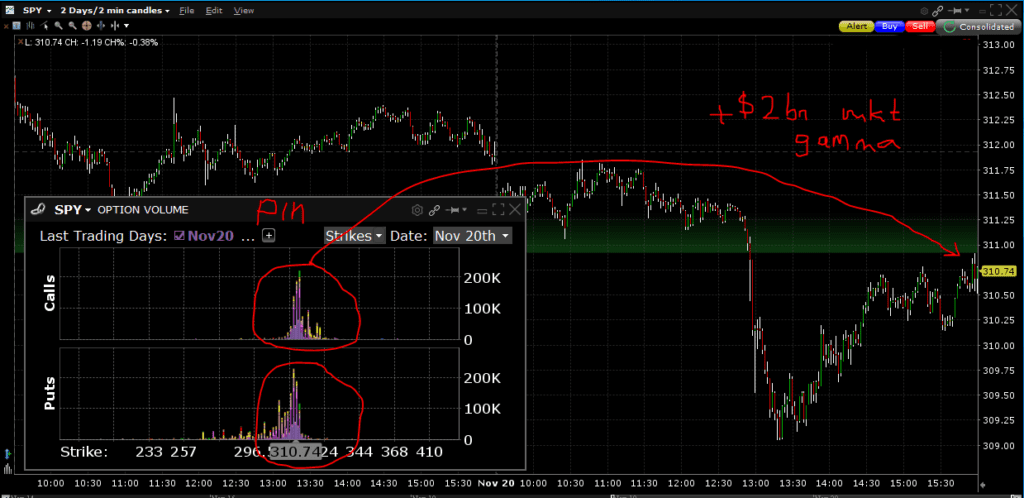

Here is our view of the trading day today. The market started off the day long abut $2bn in gamma and at the lows of the day it was down to ~$1.75 bn. Despite the reduction that is still a hefty amount of gamma that supports a mean reverting market. On top of that we had very concentrated options volume around the 310/311 strike in SPY and 3100/3115 in SPX. You can see this inset in the chart below. Therefore we see the combination of overall market gamma plus the gamma around the active options volume strikes pulled the market back up today.