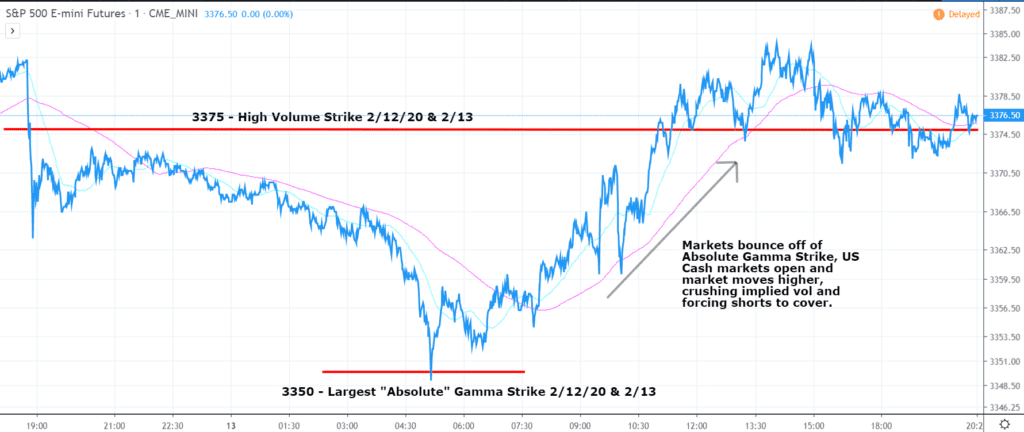

ES Futures moved sharply lower overnight on 2/12-2/13 as fears of the Coronavirus moved higher. This created selling pressure which went unchecked until markets hit the key 3350 level. Its at this level which we measured the highest level of “Absolute Gamma” which the absolute value of call gamma + put gamma. We also calculated that the market was long roughly $1.5 billion in gamma at the 3350 lows – a number which generally supports a “bounce” in markets after a selloff.

We think the Absolute Gamma level is notable because it is a level at which many large positions exist, and there should be both large hedging activity and high option volumes tied to that strike. This may cause this level to function as support or resistance as seen in the chart above.

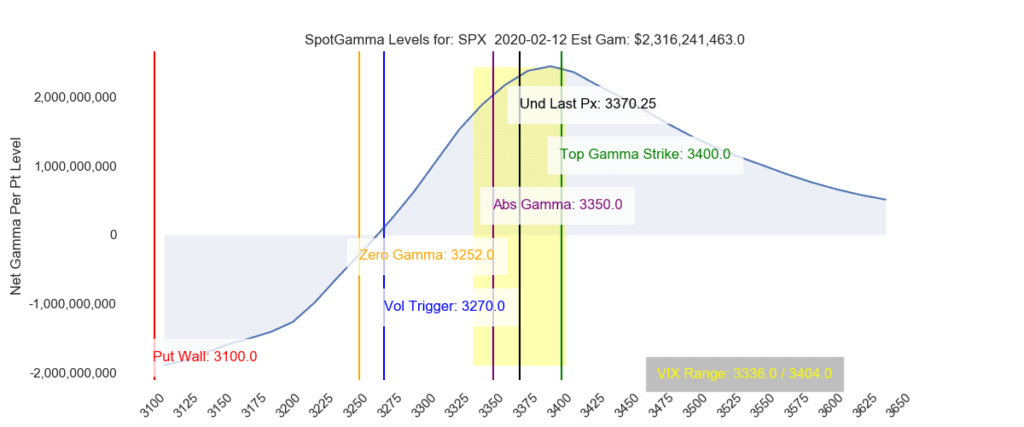

Below is our subscriber chart which outlines stock market gamma exposure and key trading levels. You can see that 3350 was highlighted as a key level heading into the overnight session.