SpotGamma recently began investigating a link between 0DTE options volumes and treasury auctions. The first research was posted in our Founder’s Note, and picked up by ZeroHedge:

From ZeroHedge:

Bonds and stocks were nicely correlated after the US cash open and traded in sync before decoupling around the European close…

However, zooming in on the upper chart, we see that around the 5Y Treasury Auction (which saw record-breaking demand), equity markets immediately accelerated higher and then never looked back on their way to close at the highs of the day (while the 5Y yield basically closed unchanged from the auction)…

So what, we hear you screaming?

Well, as SpotGamma details, yesterday was the 5th highest SPX 0DTE % reading over the past year.

Specifically, the volume at SPX 4000 yesterday was very large: 95k puts and 150k calls. Total open interest changes at the 4000 strike: +26k puts and just +8k calls. It was a similar thing in SPY wherein 780k SPY 400 calls traded, and 650k SPY 395 puts traded. Open interest changes to those strikes were: 29k & 23k respectively. This ultra low open interest change for huge volume is a surefire sign of large 0DTE.

This 0DTE comes in to help establish the daily low, and then turns into the momentum trade that pushes markets back higher. It stopped early weak sellers, and then created an afternoon chase. The point here is that we should likely treat price action with a grain of salt until the 2/1 FOMC.

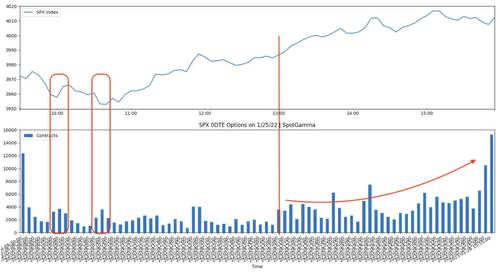

The evidence for this can be seen below, wherein we plotted the 0DTE contract volume (bottom) vs SPX index price (top) in 5 minute buckets (apologies for the crude chart).

What you can see is waves of 0DTE options volumes as SPX was testing 3950 lows.

We monitored this in real time as put volumes concentrated in the 3925-3950 area.

More interestingly, 0DTE volume appears to pick up substantially at 1pm ET. This was when the 5 year treasury auction fired off, and there was “stellar” demand. Based on this there is some evidence that the bond auction cleared the way for higher S&P prices, with 0DTE driving the ramp (the justification being that the bond market doesn’t read much higher rates going forward).

We, like SpotGamma, had heard chatter of this link between the auctions and 0DTE before, and while evidence is only anecdotal for now, it is something we will be monitoring closely going forward.

Finally, we note that when you look at the overall “non-0DTE” picture of what changed yesterday the answer is “not much”, strongly suggesting that this ultra-short-term options trading activity is just that – pure day-trading (or manipulation) – and represents very little in the way of actual positioning.

Whether the relationship between Treasury auction’s ‘strength’ and heavy 0DTE action is reflexive is unclear – but what is clear, whatever equity market momentum is ignited by the Treasury Auction (up or down), 0DTE instantly amplifies it like a beast and that equity flow feeds back to the bond market.

As one veteran equity trader put it, “0DTE is to modern momentum ignition as HFT was ten years ago when people traded stocks.”