U.S. equities surged on May 12, 2025, as the S&P 500 closed +3% to 5,848, with intraday action reflecting a more modest 0.23% gain, after the U.S. and China agreed to a significant 90-day reduction in reciprocal tariffs. What did any of this have to do with 0DTE SPX options? Hint: The 0.23% intraday gain. The Anatomy […]

0DTE

TSLA 420: A Temporary High (?) as Charm & Vanna Flows Work Against the Stock

TSLA has been on an incredible +50% move for the month following the 11/6 elections. SpotGamma wrote extensively about the very bullish setup we saw on 11/7 – a setup that was more bullish than general market expectations, and why we thought TSLA stock would reach previous all-time-highs of 400. Along that path, we called […]

The NVIDA Industrial Complex: 0DTE and Deteriorating Liquidity

In two recent media appearances, Brent Kochuba, Founder of SpotGamma, broke down his theory about how impactful NVDA short dated options are to the US stock market. Hint: very. First, this was discussed with Victor Jones of TasyTrade, and then with Jack Forehand of ExcessReturns. In recent market activity, we’ve seen significant movement in NVIDIA […]

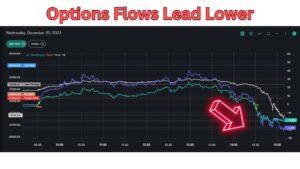

How 0DTE Flows Drove the 12/20 Selloff

On 12/20 the S&P500 experienced its sharpest selling in over 3 months, as the index rapidly declined 1.6% – seemingly out of nowhere. SpotGamma, in real time, flagged 0DTE trading as a likely culprit in a now-viral tweet: Its a 0DTE driven plunge in the S&P. you can see the spread here between bearish 0DTE […]

SpotGamma with the Wall Street Journal on the Rise of 0DTE

Brent, Founder of SpotGamma, was featured in a video presentation with the Wall Street Journal discussing the rise of 0DTE options trading. Watch here.

The 0DTE ETF: Defiance ETF QQQY

Defiance ETFs introduces a new fund, the Defiance Nasdaq 100 Enhanced Options Income ETF (ticker QQQY), tapping into the trend of zero-day-to-expiration contracts (0DTE). Defiance also plans to expand its offerings with derivatives linked to the S&P 500 and Russell 2000. Designed to maximize income, QQQY writes puts on the Nasdaq 100, seeking to offer […]

Analysis: The CBOE 0DTE Report

Everyone’s talking about options flows and how same day (0DTE) trading is impacting market prices. While options flows do not drive stocks *all* of the time, there are critical moments when these flows directly influence stock prices. For 0DTE in particular, it’s the buildup of Delta that can move markets. In September 2023, the CBOE […]

How 0DTE Options Flows Move Stock Markets

What a legendary post! Spot on. $SPX 4400 it is! @spotgamma https://t.co/1dbjB9eo8p — magicavi (@magicavi89) August 25, 2023 The following analysis was revealed in real time both to our SpotGamma members, and posted to our Twitter account, in real time. On Friday August 25th Fed Powell gave a speech at the Jackson Hole symposium. This […]

Noel Smith: Volatility, Correlation and Edge

Below is an automated transcript of our conversation. As it is automated, please forgive any grammatical errors. [00:00:00] Brent Kochuba: Joining me today is Noel Smith of Convex Asset Management. And the reason I want to have Noel on today is because there’s all sorts of interesting things happening in the volatility landscape. [00:00:08] And […]

SpotGamma on Excess Returns

Summary Brent Kochuba, founder of SpotGamma, discusses the impact of the rise of 0DTE options, fixed strike volatility and the implications of options expirations. Highlights Below is the transcript from this conversation: welcome to excess returns where we focus on what works over the long term in the markets join us as we talk about […]