Airbnb (ABNB) was crushed after some disappointing earnings. We have picked up some Dark Pool readings and options flows which may indicate a bottom is in for the stock.

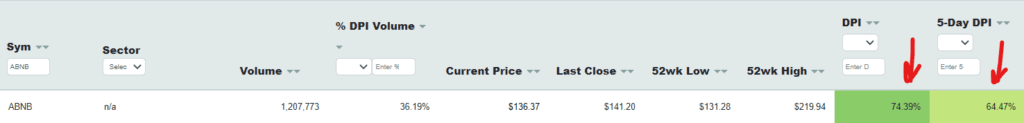

As you can see below the stock is well off recent highs >$200, and is currently trading near $136/share.

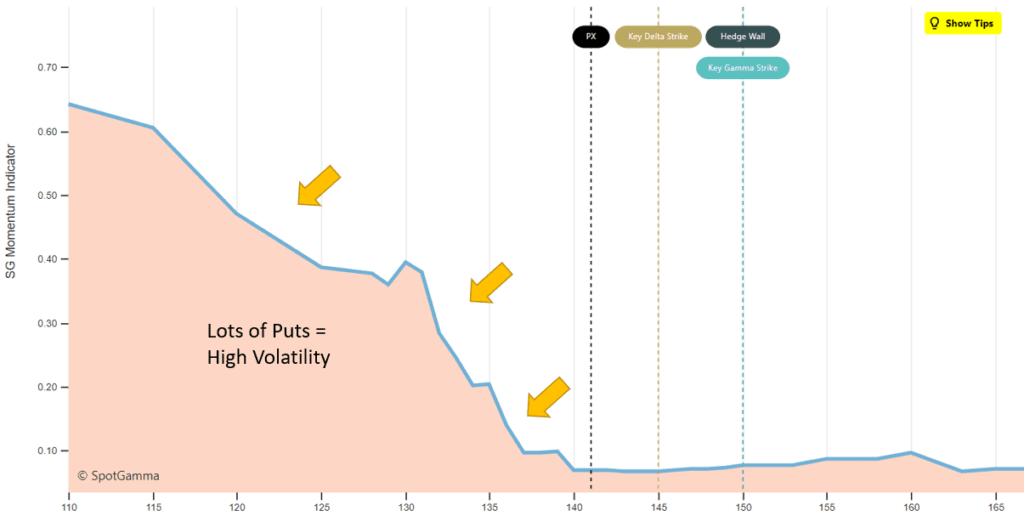

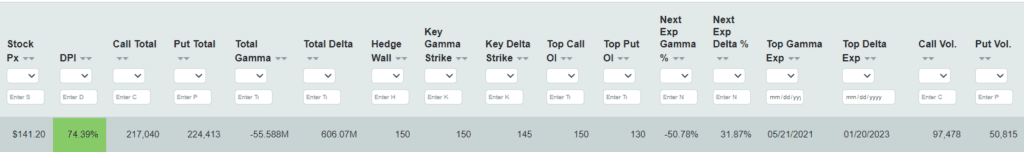

While options are not particularly active in ABNB stock, there are a lot of put contracts down below the $135 strike. The graph here is an estimate of volatility in ABNB stock, with a a higher SG Momentum Indicator suggesting increased volatility if the stock trades under ~$135. This expanded volatility is due to put option gamma increasing.

However, our models show that roughly 50% of total ANBN options gamma expires this Friday. If traders are long put options, market makers may be short put options, and hedged with short stock. If these put options expire, options market makers may be able to buy back those short hedges, creating a bounce in the stock.

Finally, our Dark Pool Indicators (DPI) are showing a very high DPI 1 day reading of 75%, and 5 day reading over 54%. Stats show that a stock may have strong performance over the next +20 days when the DPI reading is over 45%.

All of this data is available with a SpotGamma Pro subscription. Try a FREE 5 day trial, now.