AMC was up 95% FOR THE DAY yesterday, with a close at 62.50. The big news this morning from AMC is that they plan to sell another 11.5 million shares, following another sale earlier this week.

AMC plans to sell 11.5 million shares and cautions investors:

— Gunjan Banerji (@GunjanJS) June 3, 2021

“Our current market prices reflect market and trading dynamics unrelated to our underlying business, or macro or industry fundamentals, and we do not know how long these dynamics will last” pic.twitter.com/zkBZPVLiy3

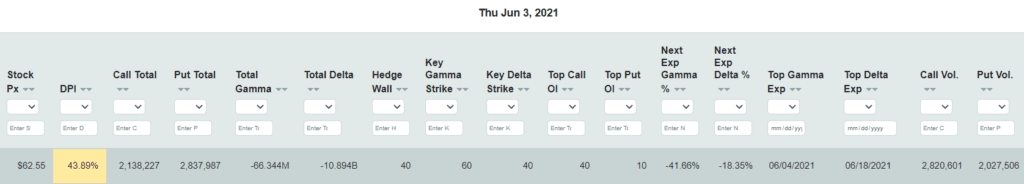

Todays EquityHub snapshot shows call open interest DECREASED day over day, while put interest increased 30%. Based on current options levels we see support at 40 (hedge wall), and the largest amount of gamma at 60. Therefore we consider anything over 60 as “extended” until & unless that key gamma strike shifts higher.

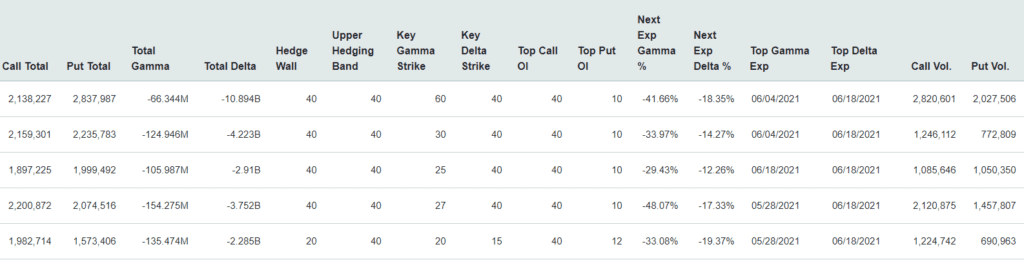

Here are the previous 5 days, with the most recent data (today) listed at the top:

Obviously a lot can take place today, and so watching options volume will be key. If large volume takes place as specific strikes >=60 then that key gamma hedge strike may shift higher. Currently there is a lot of open interest at $70, and so if AMC squeezes another +20% today then that strike could come into play for Friday nights OPEX. This is really a timing issue, and seeing where AMC closes tonight sets up the likely pin/magnet area for tomorrow.

Options Gamma Squeeze Unwind

As we enter a very large OPEX tomorrow for AMC with >40% of total gamma expiring. We think this means a weak trading day and selling for AMC on Friday. This is because all of the short dated AMC calls that led to the gamma squeeze are now going to expire, and market makers can likely sell off their long stock hedges. For today (Thursday) its very difficult to predict price action as the mechanics of this options decay won’t set in until tomorrow.

In the video below we discuss this options expiration/decay dynamic as it appeared last week: