BY TYLER DURDENWEDNESDAY, JUN 09, 2021 – 12:31 PM

In the ‘old normal’ – when dinosaurs roamed the earth – history suggested that when retail investors piled into stocks with both hands and feet, a major top in prices was usually not far behind.

But, in the ‘new normal’ of Reddit Rebels and Meme Stock Manias, it is the ‘little guy’ that is making the “Smart” money look “Dumb” as stock after stock is lifted out of obscurity – or from the brink of bankruptcy – by a wave of WSB-buyers, crushing the well-reasoned theses of asset-gatherers and commission-takers everywhere as ‘worthless’ stonks go to the moon.

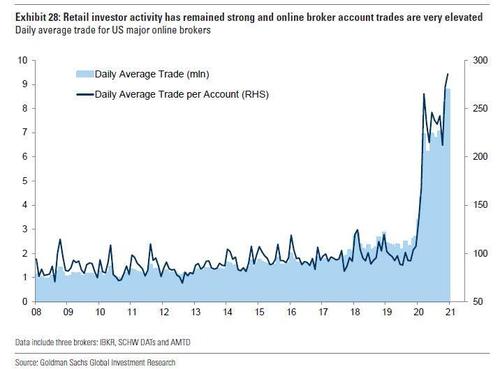

Retail piling in…

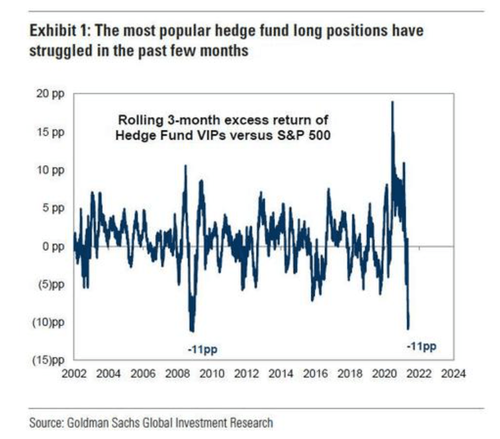

…and hedgies hammered…

In fact, what has been only anecdotally observed, is now confirmed by Goldman Sachs’ latest research note that suggests retail trading activity continues to be a leading indicator (rather than contrarian).

Specifically Goldman’s Derivatives Research group believe retail trading activity is an indication of a large number of traders “paying attention” to a stock.

When a retail investor pays attention to a stock, they generally choose between “buying” or “not-buying” the stock (retail investors are generally not short sellers).

This results in temporary net-buying flow from retail investors and pushes the stock up temporarily.

Volatile stocks then attract the attention of institutional investors as they see opportunities to use their understanding of option market positioning, delta hedging requirements of market makers and fundamental valuation to position for outsized profits.

At some point, retail traders become a smaller percentage of overall volume and the tailwind inherent in this “attention” signal fades.

This is the point where institutional investors position for a (partial) mean reversion.

In fact, many of the high profile retail trading names show a significant drop in retail trading as a percentage of total volume in the days ahead of the ultimate peak and subsequent decline.

Translation:

1) Retail investors ignite the momentum, squeezing shorts out;

2) …which grabs the attention of institutional/hedge funds, who then deploy leverage to spark the gamma squeeze meltup…

3) …which further squeezes the shorts out…

4) …enabling hedgies to implement shorts at much higher prices, slamming the stock lower…

5) …setting the stage for the next retail-ignited squeeze.

Rinse… Repeat.

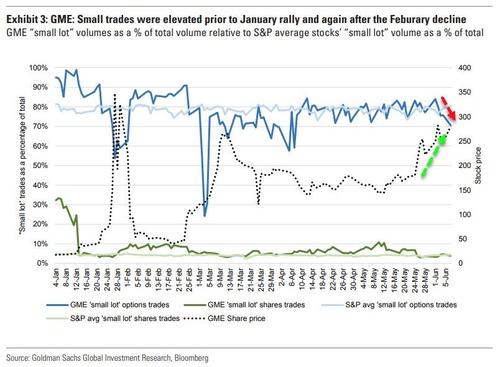

The charts below show the outsized retail investor participation in the past month…

Here is the retail stock investor fading as the stock explodes higher (and hedge funds take over)…

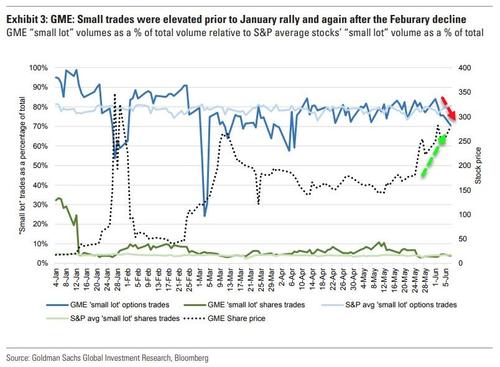

And here are retail option investors doing the same…

So, with all that said, the question is will it end badly…

…again?