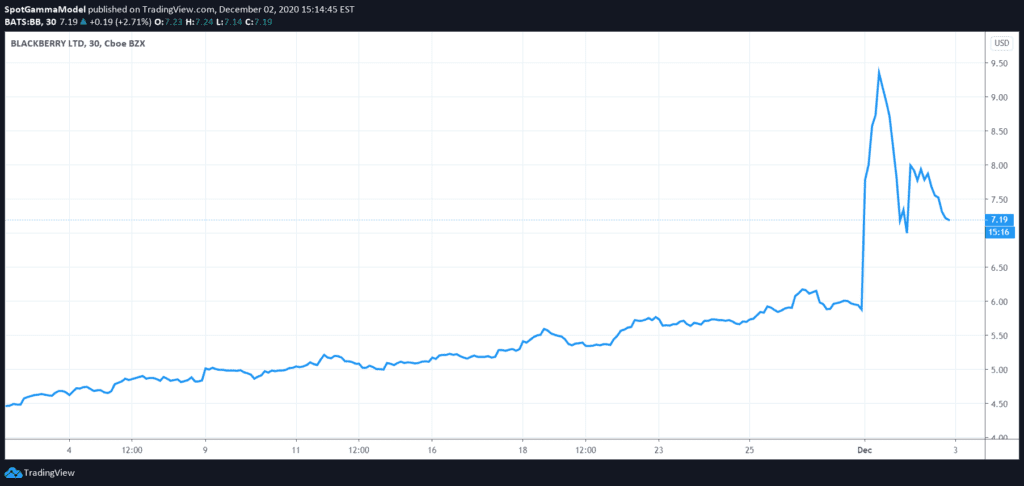

Blackberry stock surged after news it was working with AMZN. This led to massive call buying, which likely helped to push the stock up as dealers must delta hedge. You can see the stock pushed up near 10, and is currently down at $7. As call buyers stopped theta stepped in, and all those calls started to decay. This likely led to some selling in the name.

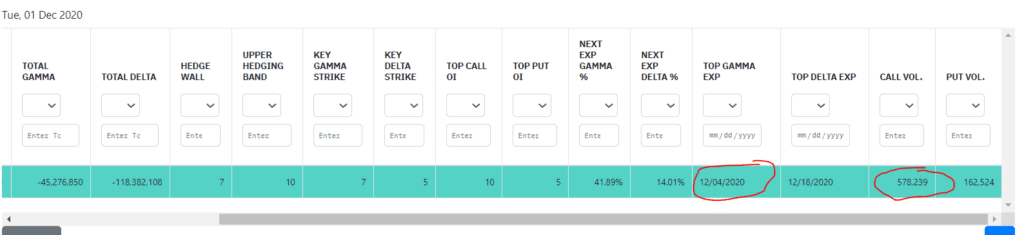

$7 is an interesting level as its the largest options gamma strike on the board. The bulk of these options expire on 12/4, which means we may see BB tied to that $7 figure into expiration. The $5 level may serve as support into 12/18 due to a large amount of deltas tied to that expiration.

Its likely BB remains quite volatile into 12/18, and we think call buyers must step in for any push over $7 to happen again.