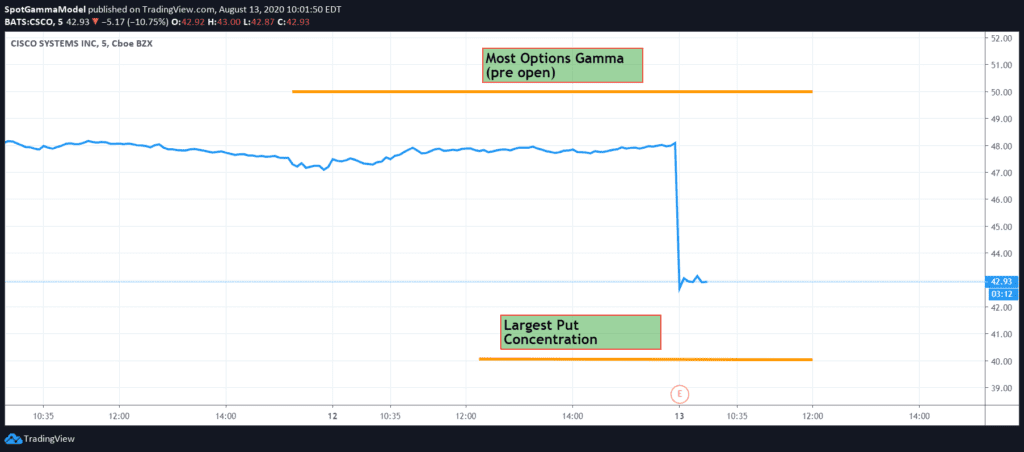

We’re positing up a live example of using our Equity Hub data. CSCO disappointed in earnings today, and is currently down 10%. Here is a snapshot of our data from preopen which shows the largest concentration of options at the 50 strike. The most puts are at 40, which we think might function as a bottom. Its 10AM EST now, we will update this at the close. (NOTE: Updated Chart at Bottom)

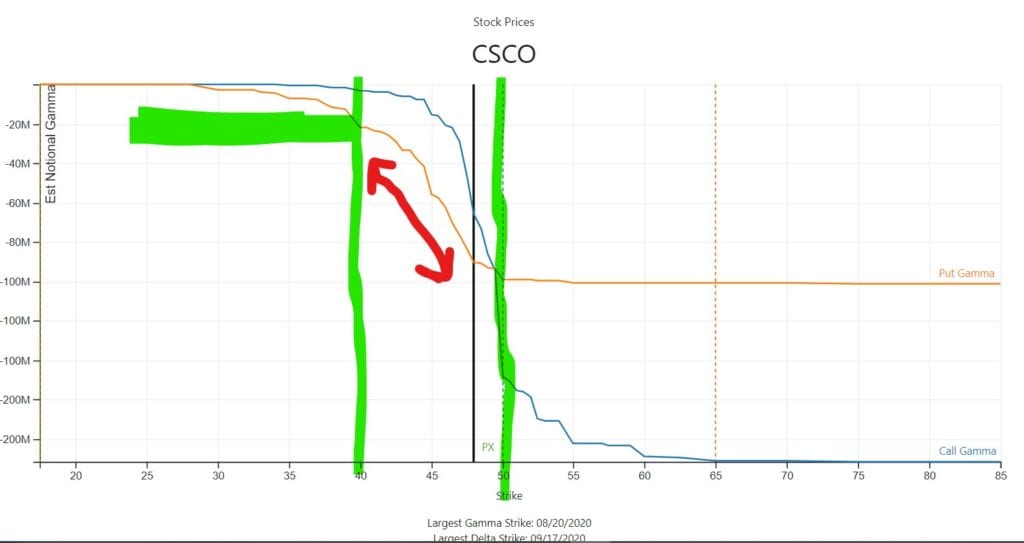

Looking at our Gamma map you can see that there was a lot of fuel for volatility based on the steepness of the call and put gamma (blue and orange lines) – we marked this with red arrow. That gamma flattens out under 40. Because the bulk of this interest doesnt expire until 8/20 (>1 week) we think that there is enough pull in the 50 strike options to possible reel this name back in. We also think that 40 strike put positions would be closed here to take advantage of the ~10% drop.

Based on this we think odds are for CSCO to bottom around this 42.50 level.

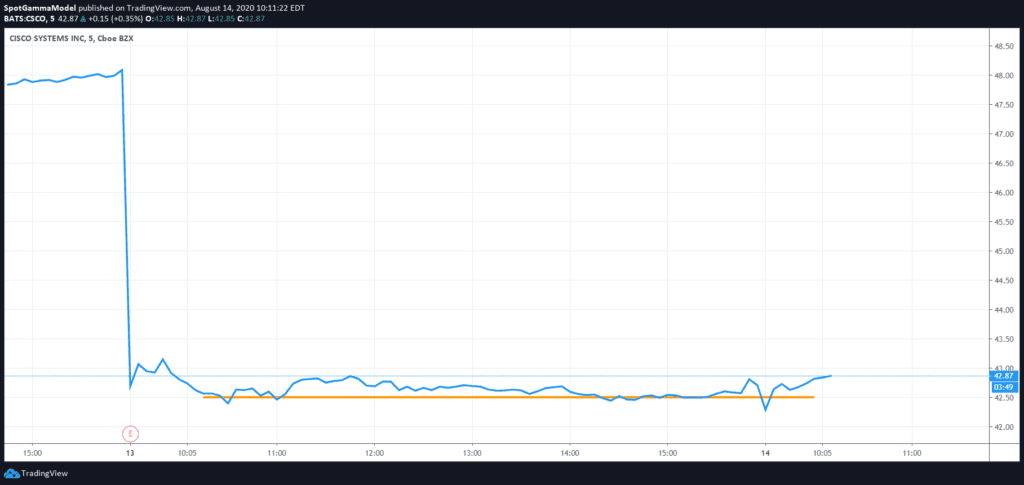

8/14/20 AM Update

Our idea was that CSCO may find a bottom around $42.50 due to how options were positioned, and so far thats been the case. We will update this chart later today, too.

8/25/20 Update

CSCO has been tied to this 42 level since our previous post.