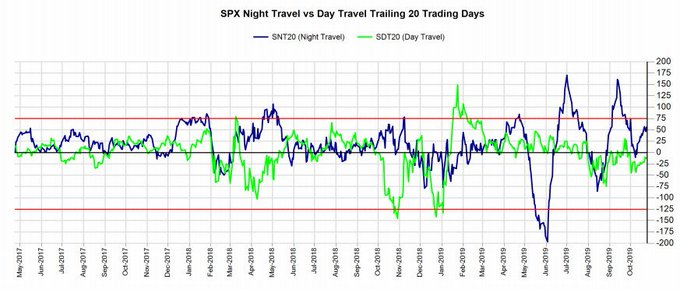

One of the working theories we’ve had is that the out performance of the S&P500 during the overnight session is due to market gamma. The idea is that options dealers gamma hedging keeps the market in check during cash sessions, and overnight the market can move about more.

The chart below shows how much more volatile the overnight session is.

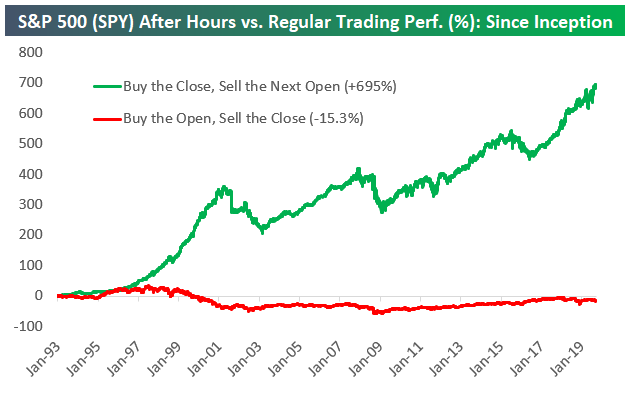

Here is the out performance of the S&P 500 if you just buy the close and sell the open.