Much talk focuses on options market gamma and changes in gamma around expiration. But what may be the real catalyst around OPEX is a change in deltas, not gammas. When options expiration occurs (especially a large one like December) options are closed, expire or rolled. You therefore can have large positions change, which can cause large changes in deltas for dealers. In our opinion this is what can spur the market moves that can occur after options expiration.

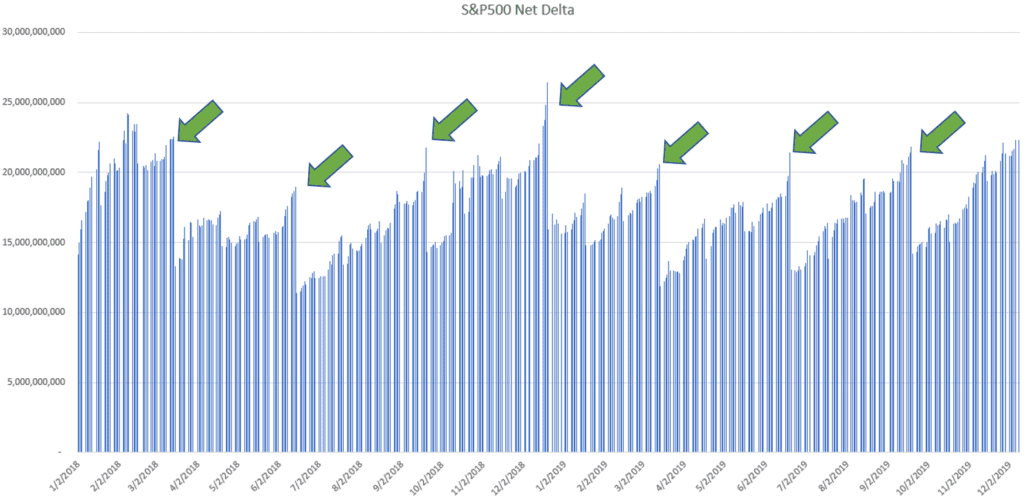

The chart below shows how large some of these delta changes can be after OPEX.

For example if you had large in the money short call positions (dealers are therefore long calls) which were rolled up in strike and out in time, that would in theory create a delta imbalance in which dealers would have to buy back short hedges.

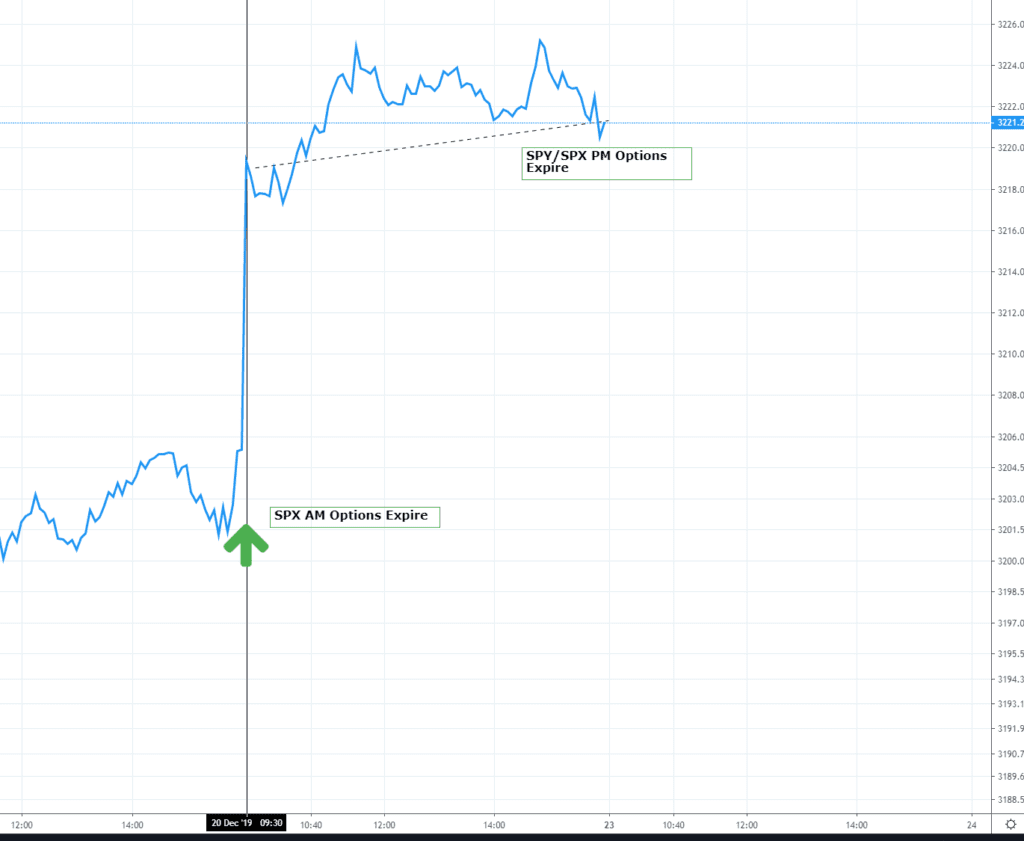

You can see in the market gap up before Fridays open as the large SPX AM December OPEX took place. Its our view we have the gap higher due to delta adjustment, then we trade more or less sideways for the rest of the day as the market is locked in a high gamma environment.

As SPY and SPX PM options expire on Friday night we may see another gap move on Monday morning 12/23 as dealers hedge their deltas.