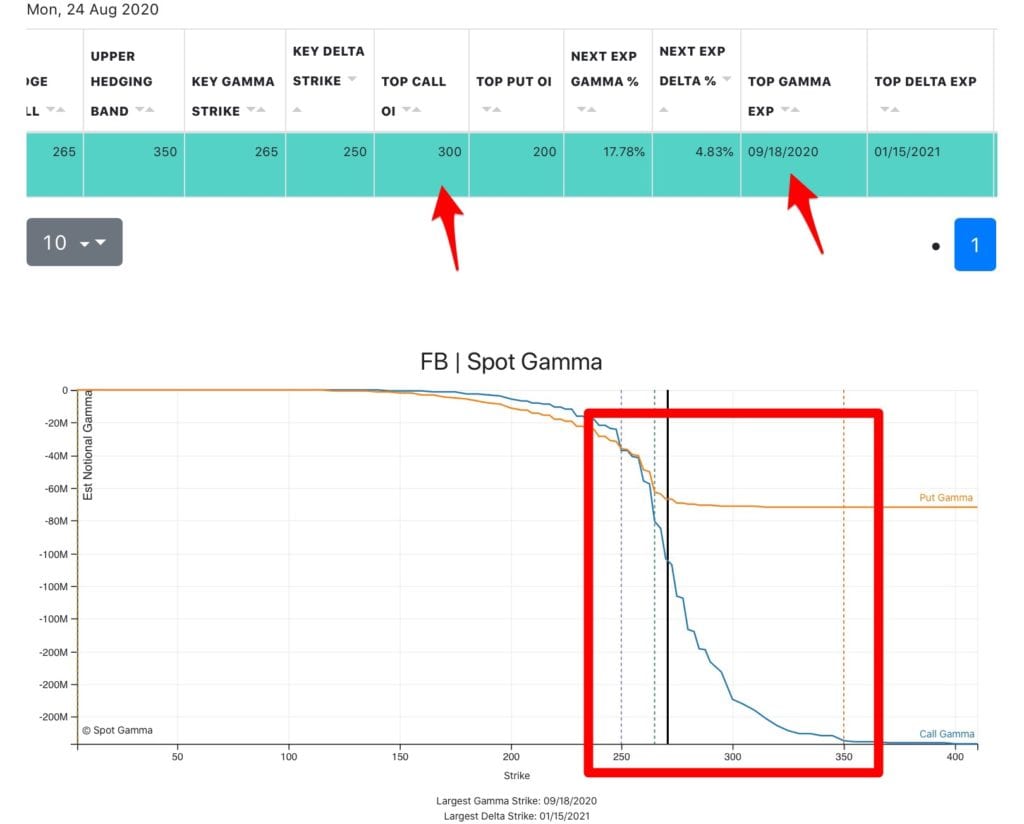

FB has an interesting setup here as call gamma is consolidating around 265 and call open interest is building up around the 300 strike. If this call building trend continues it may cause increased volatility in the name. Volatility infers movement, which could be a rapid move higher OR lower.

In this case we give some edge to higher prices because our view is that call buyers force options market makers to buy the stock which creates a tailwind. Much of this options position doesn’t expire for several weeks which infers to us that it is a stable options position which may be held into September expiration.

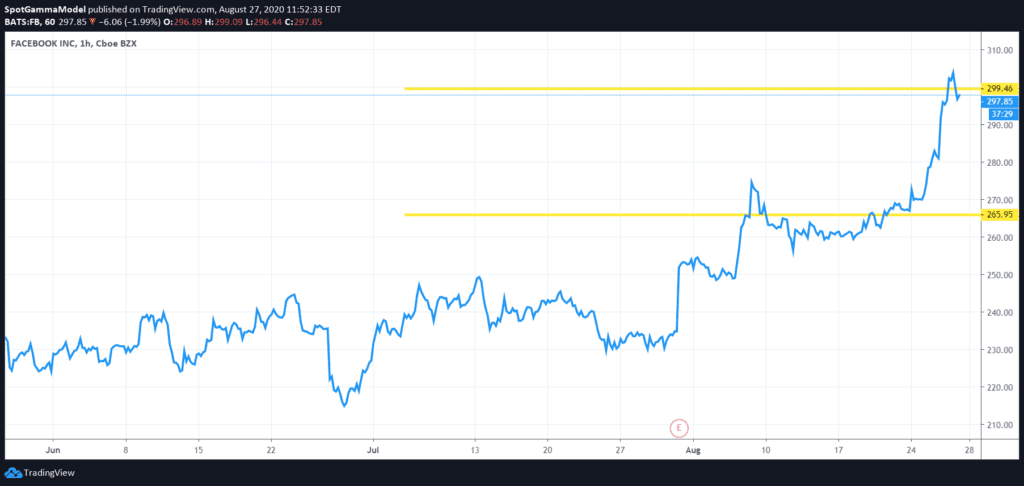

You can see in the price chart below that the stock is making a move higher so far today despite the general FAANG index being up only 0.14%.

8/27/20 – Update – FB has closed at the key 300 level.