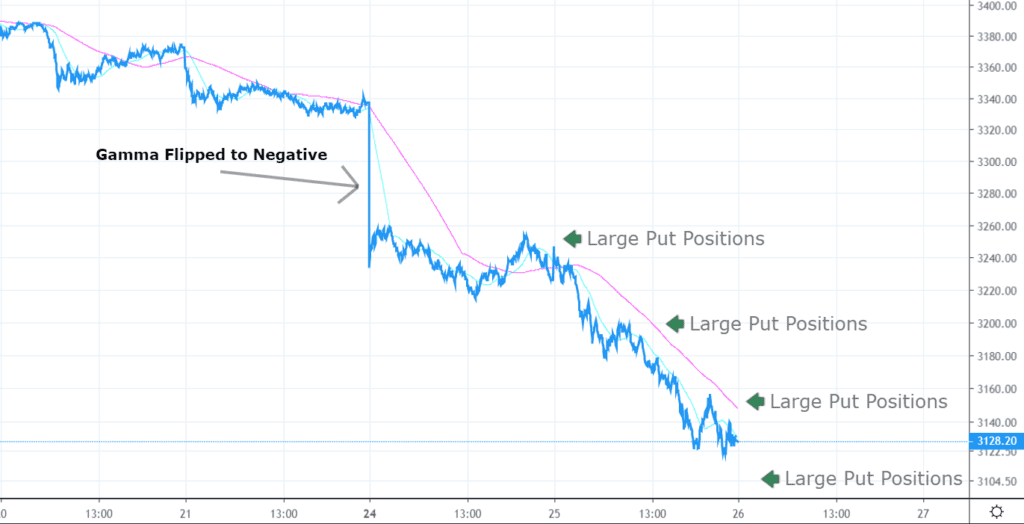

There has been relentless selling during the end of February attributed to Coronavirus fears. There are clearly sellers of all types active in the current market, but much of this selling may be attributed to negative market gamma and the “gamma trap”. As you can see below on over the weekend of Feb 24th futures opened below our key ~3300 level which marked the transition from a positive gamma regime to negative (see here for definitions).

When this transition occurs options dealers move from buying dips to selling as the market goes down. Also noted on the chart are areas in which we saw large put positions. As the market moves closer to these strikes, it pushes them in the money and therefore has larger hedging requirements. In theory this requires more dealer selling, which pushes the market lower. As the market moves lower, more dealer selling is required.

Reflexivity

Soros famously termed this feedback loop “reflexivity“. Put buying creates more dealer selling.

reflexivity refers to the self-reinforcing effect of market sentiment, whereby rising prices attract buyers whose actions drive prices higher still until the process becomes unsustainable. This is an instance of a positive feedback loop. The same process can operate in reverse leading to a catastrophic collapse in prices.

At some point this downward cycle breaks, and the structure unwinds, often in similar velocity to how it declined.